As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical tensions, investors are closely watching central bank actions and inflation trends. With the Federal Reserve holding rates steady amid solid economic growth in the U.S., and the European Central Bank reducing rates to support investor sentiment, dividend stocks continue to be an attractive option for those seeking stability and income in uncertain times. In this environment, identifying dividend stocks with strong fundamentals can provide a reliable income stream while potentially offering some cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.80% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.56% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.93% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

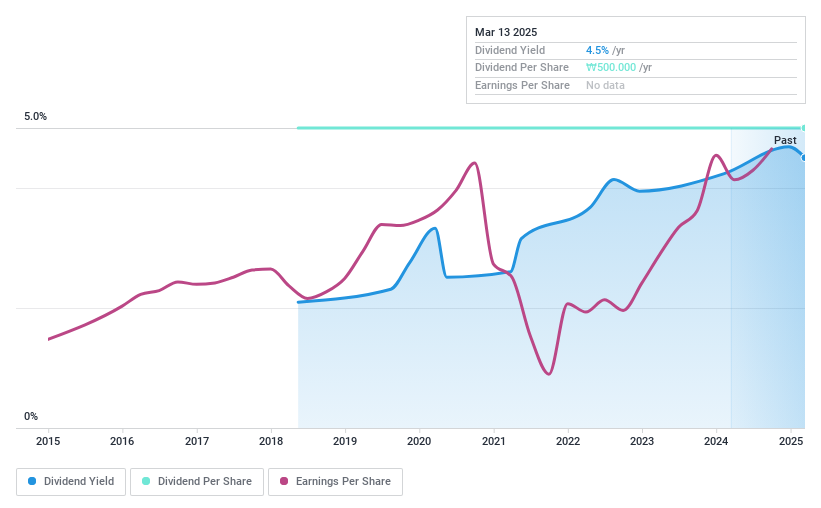

JW Lifescience (KOSE:A234080)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JW Lifescience Corporation specializes in providing infusion solutions both in South Korea and internationally, with a market cap of ₩164.60 billion.

Operations: JW Lifescience Corporation's revenue is primarily derived from its Pharmaceuticals segment, amounting to ₩221.32 million.

Dividend Yield: 4.7%

JW Lifescience's dividend, with a yield of 4.7%, ranks in the top 25% in the Korean market. Despite stable payments over its 7-year history, dividends have not grown and have been unreliable. However, they are well-covered by earnings and cash flows with payout ratios of 26.9% and 16.3%, respectively. The stock trades at a significant discount to its estimated fair value, potentially offering value to investors seeking income stability despite past volatility concerns.

- Click here to discover the nuances of JW Lifescience with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that JW Lifescience is trading behind its estimated value.

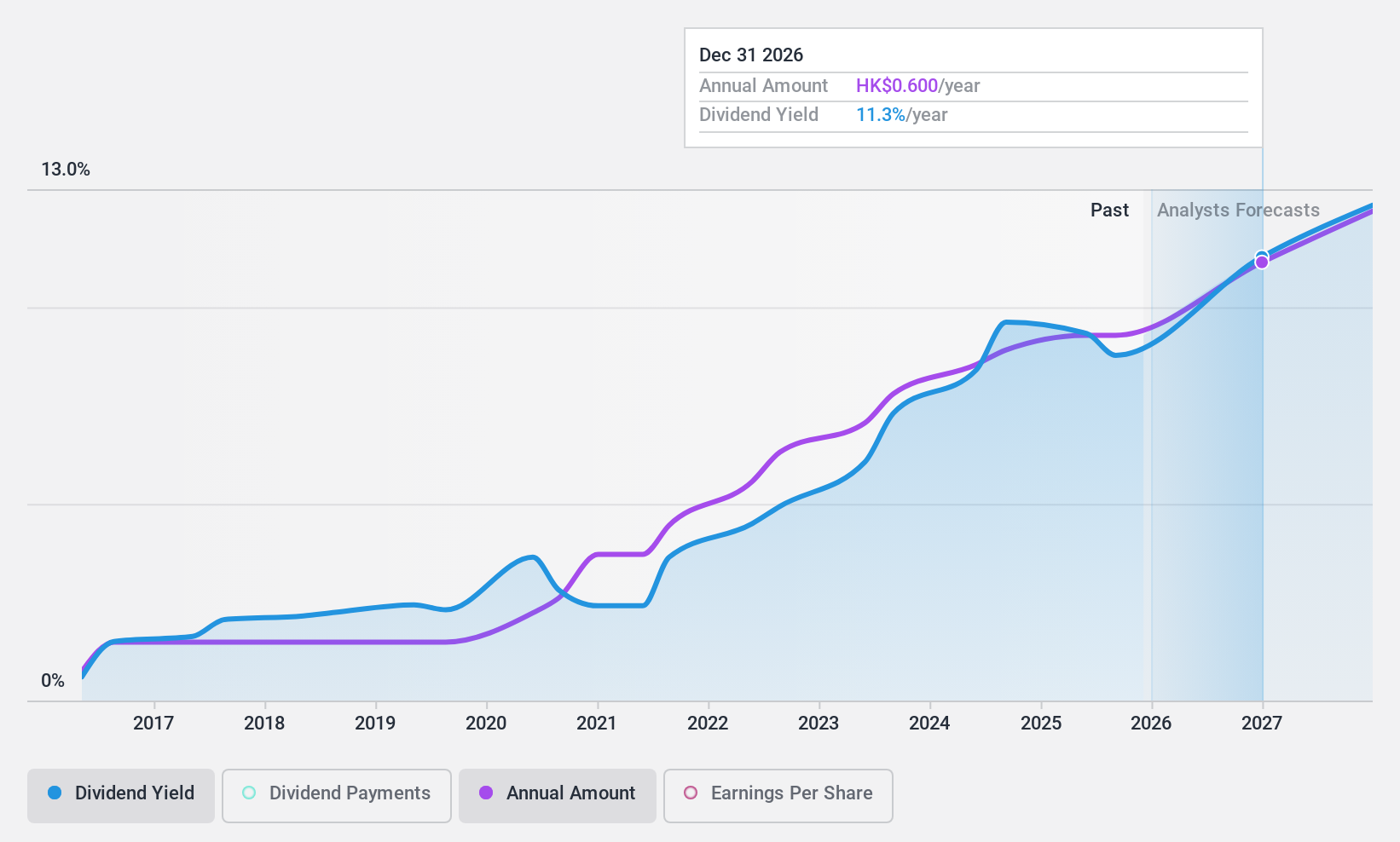

PAX Global Technology (SEHK:327)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PAX Global Technology Limited is an investment holding company that develops and sells electronic funds transfer point-of-sale products in Hong Kong, the People’s Republic of China, the United States, and Italy, with a market cap of HK$5.17 billion.

Operations: The company's revenue from e-Payment Terminal Solutions Business is HK$6.15 billion.

Dividend Yield: 9.9%

PAX Global Technology's dividend yield of 9.86% ranks in the top 25% of Hong Kong payers, supported by a payout ratio of 52.5% and cash coverage at 84.5%. Despite stable dividends over nine years, recent guidance indicates a potential net profit decline due to reduced revenues and one-off expenses. Trading below estimated fair value suggests good relative value, but investors should consider the impact of anticipated earnings decrease on future payouts.

- Dive into the specifics of PAX Global Technology here with our thorough dividend report.

- Our valuation report here indicates PAX Global Technology may be undervalued.

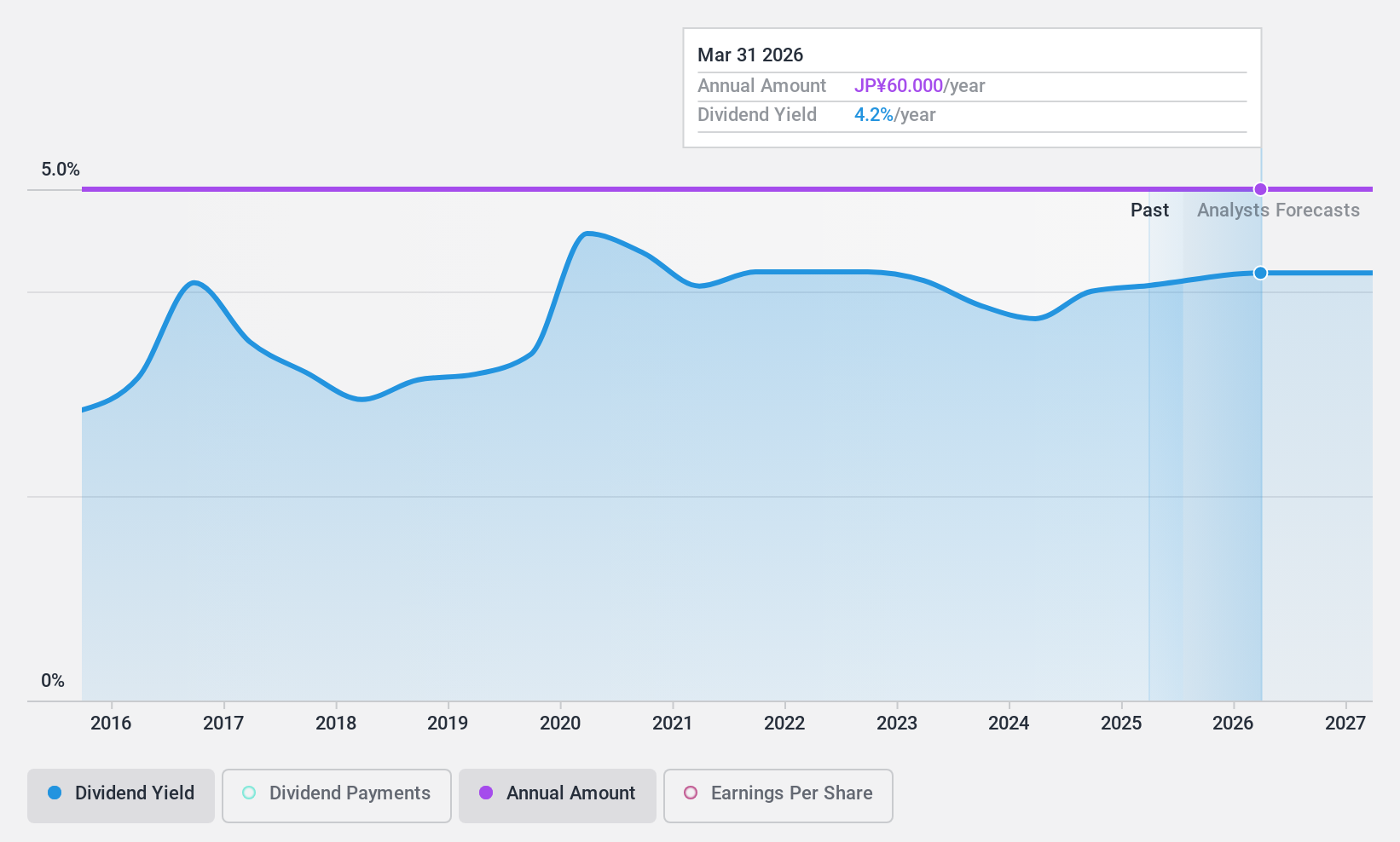

Autobacs Seven (TSE:9832)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Autobacs Seven Co., Ltd. operates a chain of retail stores offering automotive goods and services in Japan and internationally, with a market cap of ¥118.05 billion.

Operations: Autobacs Seven Co., Ltd. generates revenue through its chain of retail outlets that provide a variety of automotive goods and services across Japan and other international markets.

Dividend Yield: 4%

Autobacs Seven's dividend yield of 3.98% is among the top 25% in Japan, with a payout ratio of 48%, suggesting dividends are well covered by earnings but not by free cash flow. Despite stable and growing dividends over the past decade, recent profit margin decline from 3.9% to 2.1% raises concerns about sustainability. The company's delisting from OTC Equity due to inactivity may impact liquidity for investors seeking consistent dividend returns.

- Get an in-depth perspective on Autobacs Seven's performance by reading our dividend report here.

- Our valuation report here indicates Autobacs Seven may be overvalued.

Key Takeaways

- Navigate through the entire inventory of 1960 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:327

PAX Global Technology

An investment holding company, develops and sells electronic funds transfer point-of-sale products in Hong Kong, the People’s Republic of China, the United States, and Italy.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives