- Japan

- /

- Specialty Stores

- /

- TSE:8281

Investors Appear Satisfied With Xebio Holdings Co., Ltd.'s (TSE:8281) Prospects As Shares Rocket 25%

Xebio Holdings Co., Ltd. (TSE:8281) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 5.7% isn't as impressive.

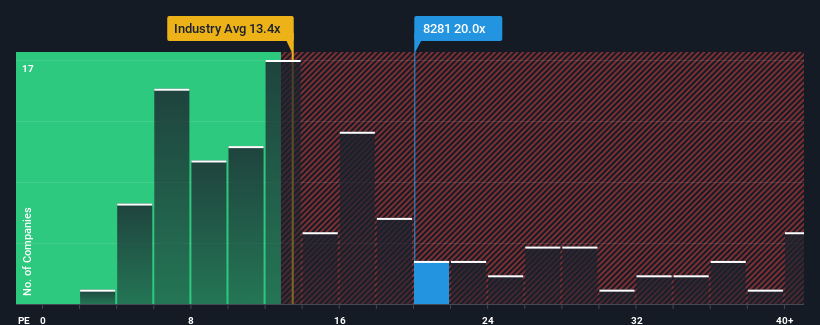

Since its price has surged higher, given around half the companies in Japan have price-to-earnings ratios (or "P/E's") below 14x, you may consider Xebio Holdings as a stock to potentially avoid with its 20x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

As an illustration, earnings have deteriorated at Xebio Holdings over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Xebio Holdings

Is There Enough Growth For Xebio Holdings?

In order to justify its P/E ratio, Xebio Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a frustrating 52% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 533% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 9.9% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Xebio Holdings is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From Xebio Holdings' P/E?

Xebio Holdings' P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Xebio Holdings maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Xebio Holdings is showing 2 warning signs in our investment analysis, you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8281

Xebio Holdings

Through its subsidiaries, operates in the sporting goods business in Japan.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives