Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Takachiho Co.,Ltd. (TSE:8225) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for TakachihoLtd

What Is TakachihoLtd's Debt?

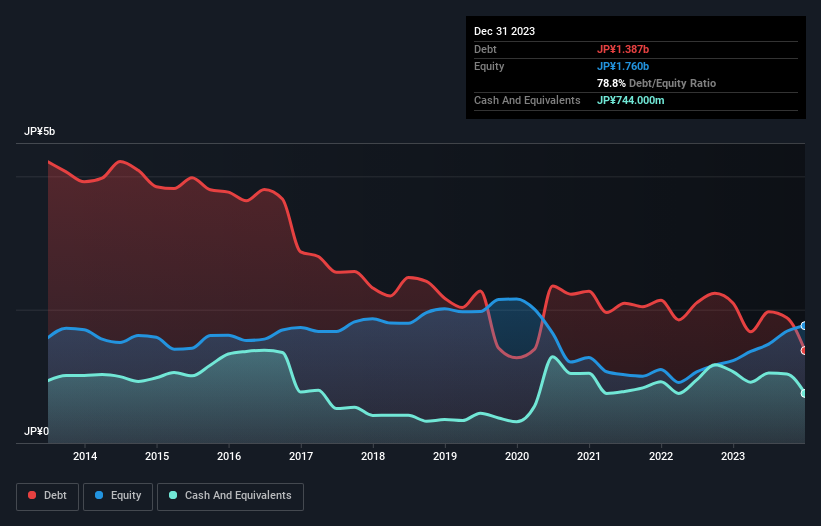

As you can see below, TakachihoLtd had JP¥1.39b of debt at December 2023, down from JP¥2.10b a year prior. However, it also had JP¥744.0m in cash, and so its net debt is JP¥643.0m.

How Healthy Is TakachihoLtd's Balance Sheet?

We can see from the most recent balance sheet that TakachihoLtd had liabilities of JP¥1.30b falling due within a year, and liabilities of JP¥1.38b due beyond that. On the other hand, it had cash of JP¥744.0m and JP¥851.0m worth of receivables due within a year. So it has liabilities totalling JP¥1.08b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of JP¥1.71b, so it does suggest shareholders should keep an eye on TakachihoLtd's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

TakachihoLtd's net debt is only 1.3 times its EBITDA. And its EBIT covers its interest expense a whopping 48.1 times over. So we're pretty relaxed about its super-conservative use of debt. In addition to that, we're happy to report that TakachihoLtd has boosted its EBIT by 80%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But it is TakachihoLtd's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last two years, TakachihoLtd produced sturdy free cash flow equating to 64% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, TakachihoLtd's impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its level of total liabilities does undermine this impression a bit. Taking all this data into account, it seems to us that TakachihoLtd takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for TakachihoLtd you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if TakachihoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8225

TakachihoLtd

Engages in the manufacture, wholesale, and retail of tourism souvenirs in Japan.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026