- China

- /

- Gas Utilities

- /

- SHSE:600803

3 Reliable Dividend Stocks Yielding Up To 5.8%

Reviewed by Simply Wall St

As global markets respond to easing inflation and robust bank earnings, major U.S. stock indexes have rebounded, with value stocks notably outperforming growth shares. Amid these dynamic conditions, investors often turn to dividend stocks for their potential to provide consistent income streams, especially when seeking stability in a fluctuating market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.17% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.16% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.92% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ENN Natural GasLtd (SHSE:600803)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ENN Natural Gas Co., Ltd. operates in natural gas distribution, trading, storage, transportation, production, and engineering in China with a market cap of CN¥63.29 billion.

Operations: ENN Natural Gas Co., Ltd. generates revenue through its activities in the distribution, trading, storage, transportation, production, and engineering of natural gas within China.

Dividend Yield: 3.2%

ENN Natural Gas Ltd. recently joined the SSE 180 and Shanghai Stock Exchange 180 Value Index, reflecting its growing market presence. The company reported CNY 3.49 billion in net income for the first nine months of 2024, up from CNY 3.10 billion a year earlier. Despite a volatile dividend history over nine years, ENN's dividends are well covered by earnings (27.3% payout ratio) and cash flows (38.5% cash payout ratio), offering a competitive yield in China's market.

- Delve into the full analysis dividend report here for a deeper understanding of ENN Natural GasLtd.

- According our valuation report, there's an indication that ENN Natural GasLtd's share price might be on the cheaper side.

Wah Hong Industrial (TPEX:8240)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wah Hong Industrial Corp. develops, produces, and sells composite materials and advanced plastic compounds both in Taiwan and internationally, with a market cap of NT$4.13 billion.

Operations: Wah Hong Industrial Corp.'s revenue is primarily derived from its operations in East China (NT$4.06 billion), Taiwan (NT$3.78 billion), and South China (NT$1.40 billion).

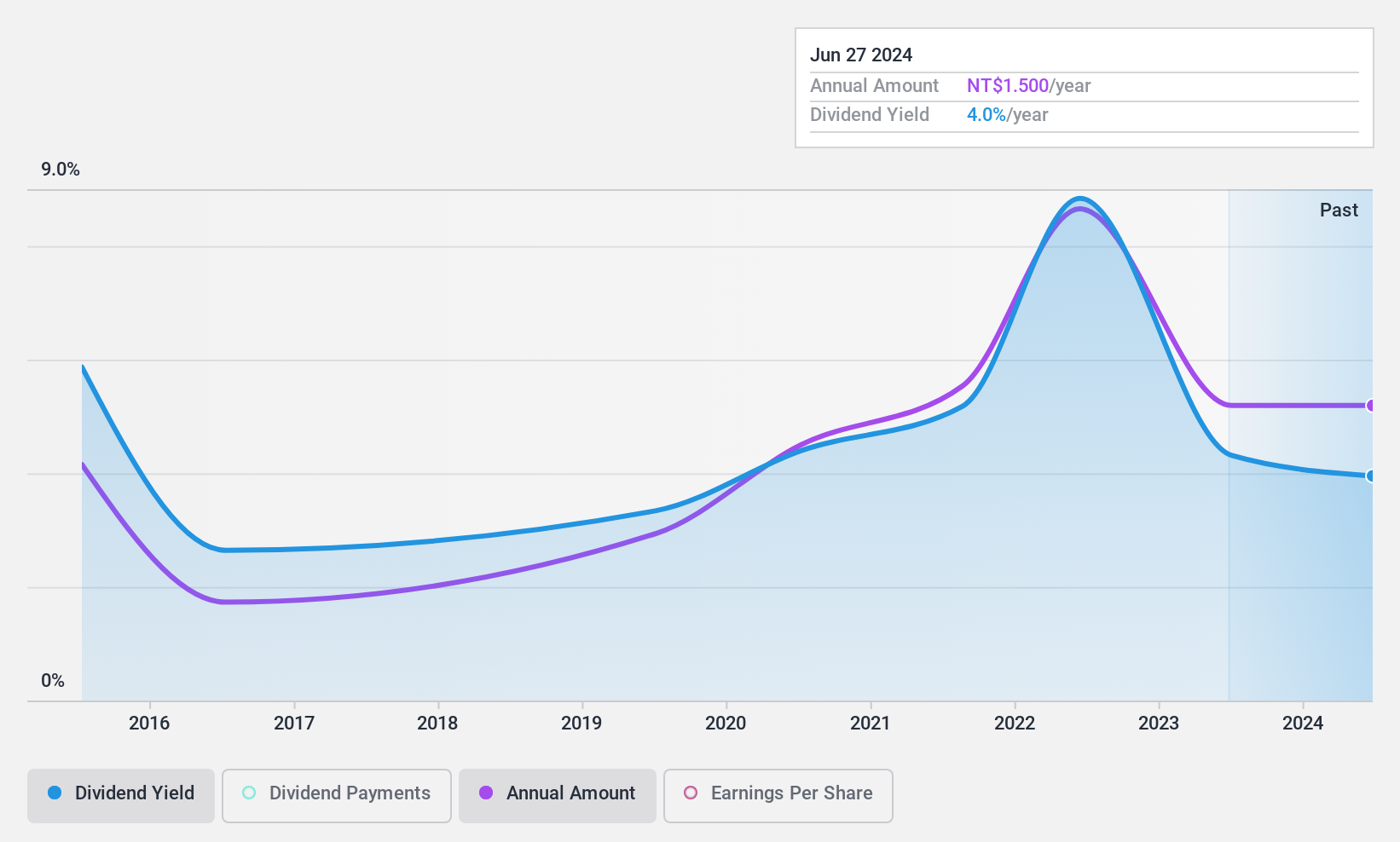

Dividend Yield: 3.6%

Wah Hong Industrial has shown a volatile dividend history, with payments increasing over the past decade but remaining unstable. Despite this, dividends are well covered by earnings (46.2% payout ratio) and cash flows (66.5% cash payout ratio). The company reported improved net income for Q3 2024 at TWD 170.45 million compared to TWD 58.95 million a year ago, although sales slightly declined. Its dividend yield of 3.64% is below Taiwan's top-tier payers, but its P/E ratio of 12.9x suggests relative value in the market.

- Click to explore a detailed breakdown of our findings in Wah Hong Industrial's dividend report.

- Our comprehensive valuation report raises the possibility that Wah Hong Industrial is priced higher than what may be justified by its financials.

Aoyama Trading (TSE:8219)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aoyama Trading Co., Ltd. operates in business wear, credit card services, printing and media, sundry sales, repair services, and franchise operations in Japan with a market cap of ¥107.54 billion.

Operations: Aoyama Trading Co., Ltd.'s revenue segments include Business Wear Business at ¥133.02 billion, Miscellaneous Goods Sales Business at ¥15.21 billion, Franchisee Business at ¥15.67 billion, Comprehensive Repair Service Business at ¥14.11 billion, Printing/Media Business at ¥11.42 billion, Card Business at ¥5.07 billion, and Real Estate Business at ¥3.05 billion.

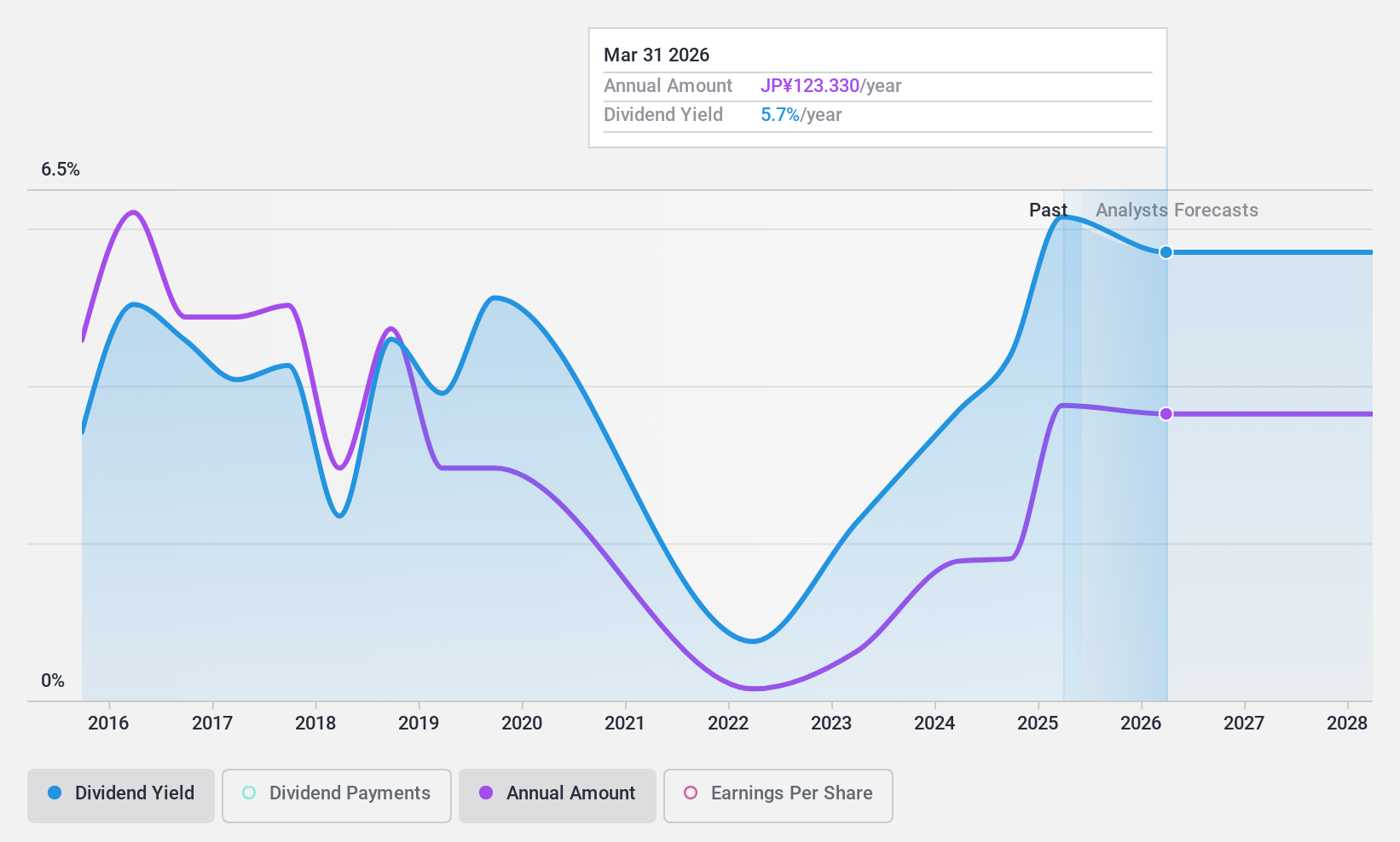

Dividend Yield: 5.8%

Aoyama Trading's dividend yield of 5.83% ranks in the top 25% of JP market payers, yet its dividends have been volatile and not well-covered by cash flows, with a high cash payout ratio of 99.8%. Despite recent earnings growth and a favorable P/E ratio of 12x compared to the JP market, share price volatility persists. The company announced increased dividends for FY2025 and completed a buyback program to enhance shareholder returns.

- Get an in-depth perspective on Aoyama Trading's performance by reading our dividend report here.

- Our valuation report unveils the possibility Aoyama Trading's shares may be trading at a discount.

Make It Happen

- Reveal the 1976 hidden gems among our Top Dividend Stocks screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ENN Natural GasLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600803

ENN Natural GasLtd

Engages in natural gas distribution, trading, storage, transportation, production, and engineering in China.

Outstanding track record, undervalued and pays a dividend.

Market Insights

Community Narratives