- Japan

- /

- Specialty Stores

- /

- TSE:8136

Could Sanrio (TSE:8136) and MGA's Bratz Partnership Reveal a Shift in Brand Expansion Strategy?

Reviewed by Sasha Jovanovic

- MGA Entertainment recently announced a partnership with Sanrio to launch the first-ever Bratz x Hello Kitty Collector Dolls, debuting on September 30, 2025.

- This collaboration brings together two iconic brands and coincides with Hello Kitty's milestone birthday season, appealing to collectors and expanding cross-brand appeal.

- We'll explore how this high-profile partnership and its potential to attract new fan demographics could impact Sanrio's investment story.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

What Is Sanrio Company's Investment Narrative?

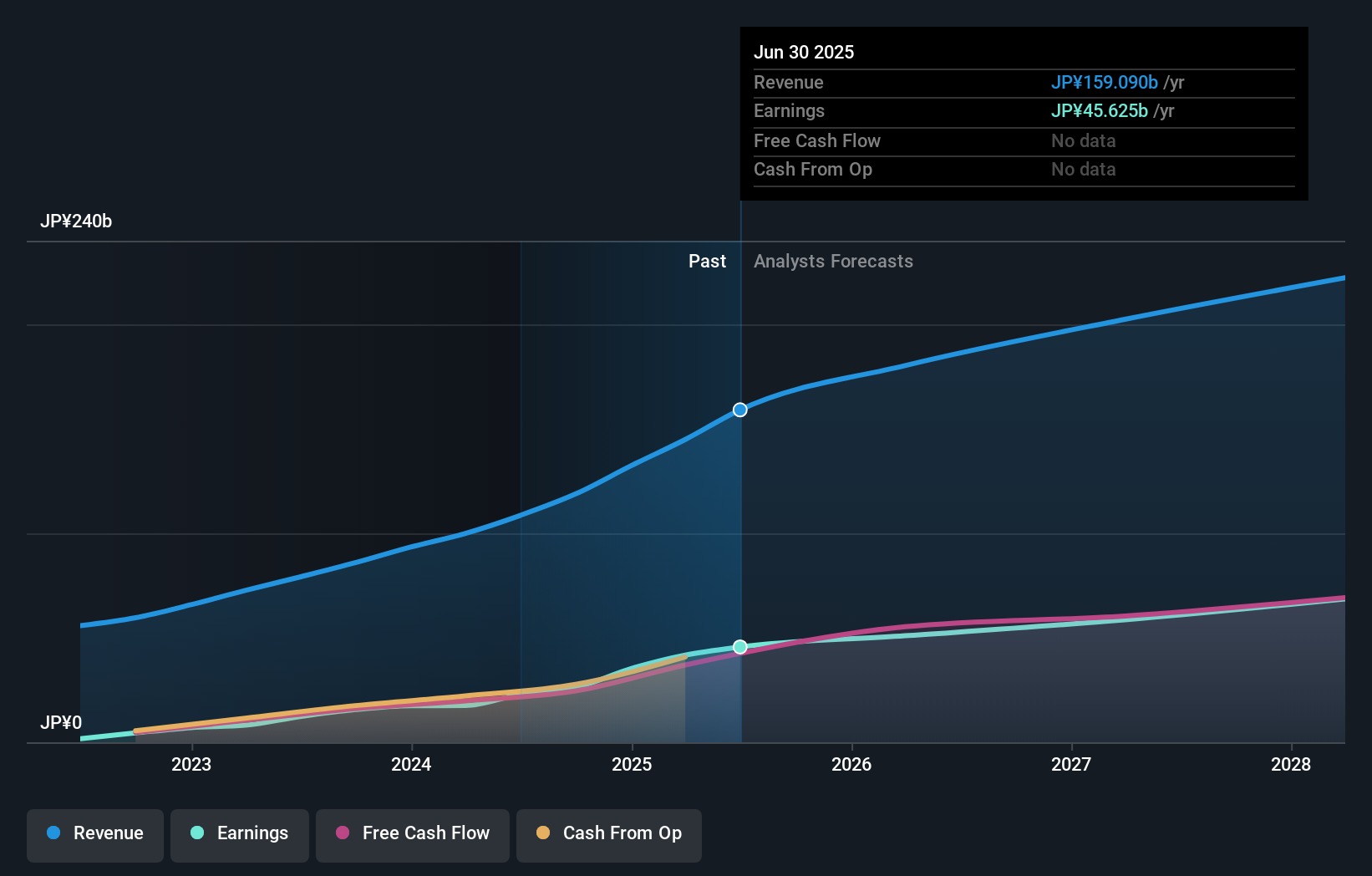

When weighing the big picture for Sanrio, you have to believe in the brand’s global appeal, the company’s ability to leverage intellectual property, and its resilience despite a premium valuation and recent dividend reductions. The Bratz x Hello Kitty collaboration adds a fresh catalyst by targeting new, potentially younger demographics, expanding Sanrio’s cross-brand reach just as Hello Kitty enters a milestone moment. Given that this partnership could drive incremental merchandise demand, there’s potential upside to earnings projections not yet captured in earlier analysis or consensus price targets. However, Sanrio already trades at a significant premium to both its peers and estimated fair value, with recent share price volatility signaling that investors are sensitive to expectations. The company’s long-term growth still largely depends on broadening its licensing opportunities while managing operational risks and governance transitions. But while brand momentum is strong, heightened valuation and unpredictable earnings pose real risks investors should be aware of.

Sanrio Company's shares are on the way up, but they could be overextended by 34%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Sanrio Company - why the stock might be worth 25% less than the current price!

Build Your Own Sanrio Company Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sanrio Company research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sanrio Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sanrio Company's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8136

Sanrio Company

Plans and sells social communication gifts, greeting cards, and books in Japan and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives