- Japan

- /

- Retail Distributors

- /

- TSE:8117

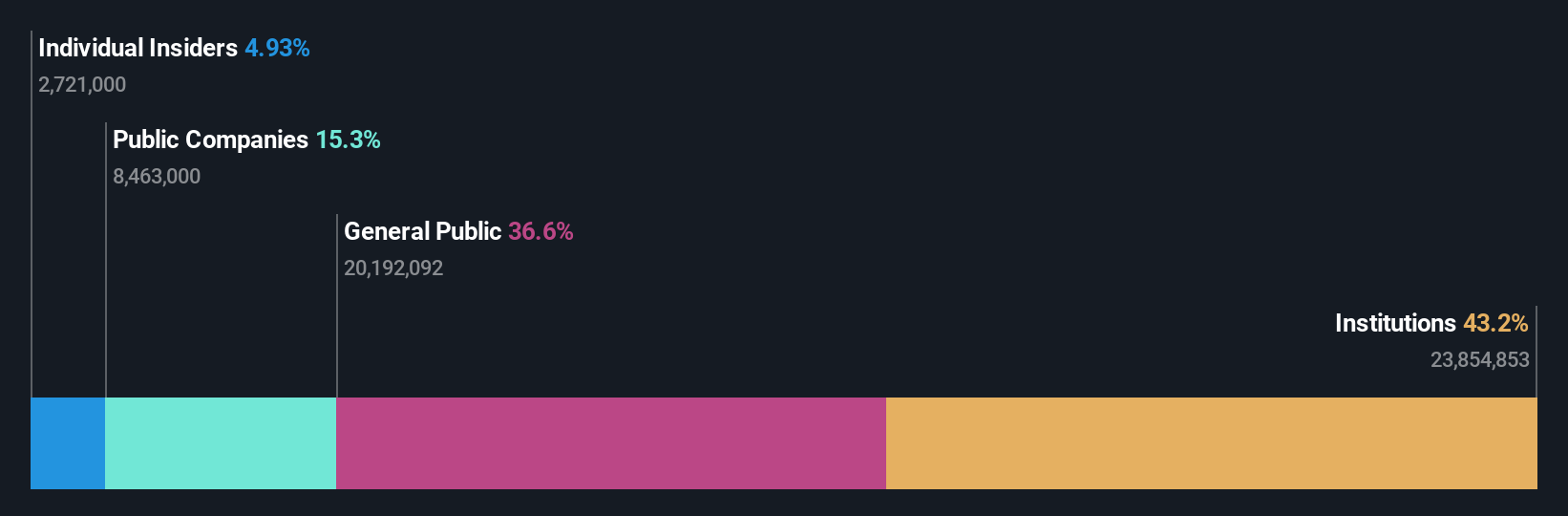

Institutional investors have a lot riding on Central Automotive Products Ltd. (TSE:8117) with 43% ownership

Key Insights

- Institutions' substantial holdings in Central Automotive Products implies that they have significant influence over the company's share price

- The top 11 shareholders own 52% of the company

- Past performance of a company along with ownership data serve to give a strong idea about prospects for a business

If you want to know who really controls Central Automotive Products Ltd. (TSE:8117), then you'll have to look at the makeup of its share registry. With 43% stake, institutions possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

Last week’s 8.5% gain means that institutional investors were on the positive end of the spectrum even as the company has shown strong longer-term trends. One-year return to shareholders is currently 26% and last week’s gain was the icing on the cake.

In the chart below, we zoom in on the different ownership groups of Central Automotive Products.

See our latest analysis for Central Automotive Products

What Does The Institutional Ownership Tell Us About Central Automotive Products?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

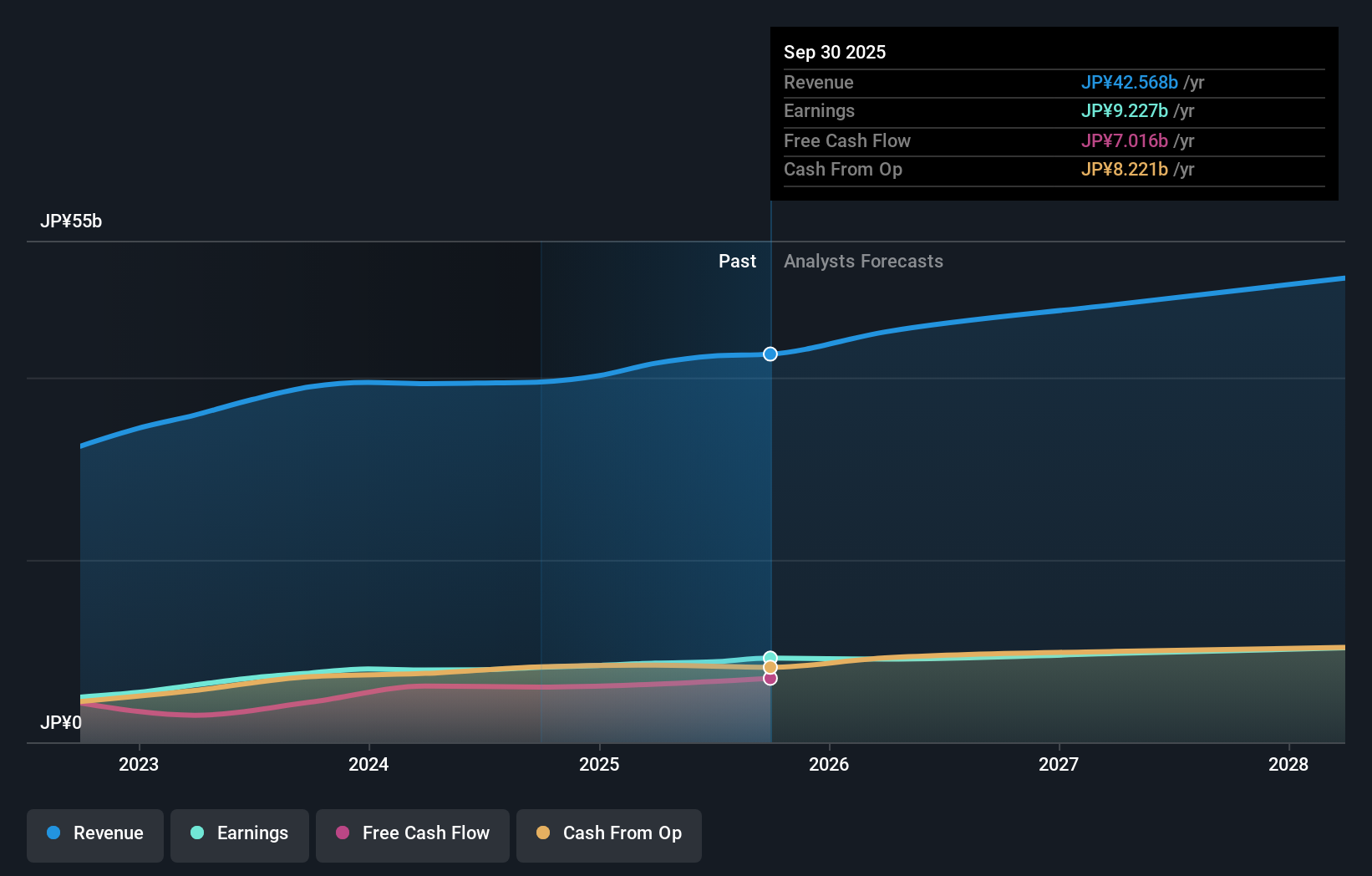

We can see that Central Automotive Products does have institutional investors; and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Central Automotive Products' earnings history below. Of course, the future is what really matters.

Central Automotive Products is not owned by hedge funds. FMR LLC is currently the largest shareholder, with 11% of shares outstanding. Nissan Tokyo Sales Holdings Co., Ltd. is the second largest shareholder owning 5.8% of common stock, and Mitsubishi UFJ Asset Management Co., Ltd. holds about 5.0% of the company stock.

Looking at the shareholder registry, we can see that 52% of the ownership is controlled by the top 11 shareholders, meaning that no single shareholder has a majority interest in the ownership.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. While there is some analyst coverage, the company is probably not widely covered. So it could gain more attention, down the track.

Insider Ownership Of Central Automotive Products

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Shareholders would probably be interested to learn that insiders own shares in Central Automotive Products Ltd.. As individuals, the insiders collectively own JP¥5.1b worth of the JP¥104b company. Some would say this shows alignment of interests between shareholders and the board. But it might be worth checking if those insiders have been selling.

General Public Ownership

The general public, who are usually individual investors, hold a 37% stake in Central Automotive Products. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Public Company Ownership

It appears to us that public companies own 15% of Central Automotive Products. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Central Automotive Products better, we need to consider many other factors.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:8117

Central Automotive Products

Engages in the development, import and export, and sale of automotive parts and related services.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.