- Japan

- /

- Electrical

- /

- TSE:5659

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with major indices like the Nasdaq Composite reaching new highs while others face declines, investors are keenly observing economic indicators and central bank rate decisions. In this environment of fluctuating market sentiment and potential interest rate cuts, dividend stocks can offer stability and income potential, making them an attractive component for enhancing a diversified portfolio.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Nippon SeisenLtd (TSE:5659)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Seisen Co., Ltd. is a company that manufactures and sells stainless steel wires both in Japan and internationally, with a market cap of ¥39.29 billion.

Operations: Nippon Seisen Co., Ltd.'s revenue is primarily derived from its operations in Japan (¥41.34 billion), followed by Thailand (¥5.44 billion) and China and South Korea (¥1.59 billion).

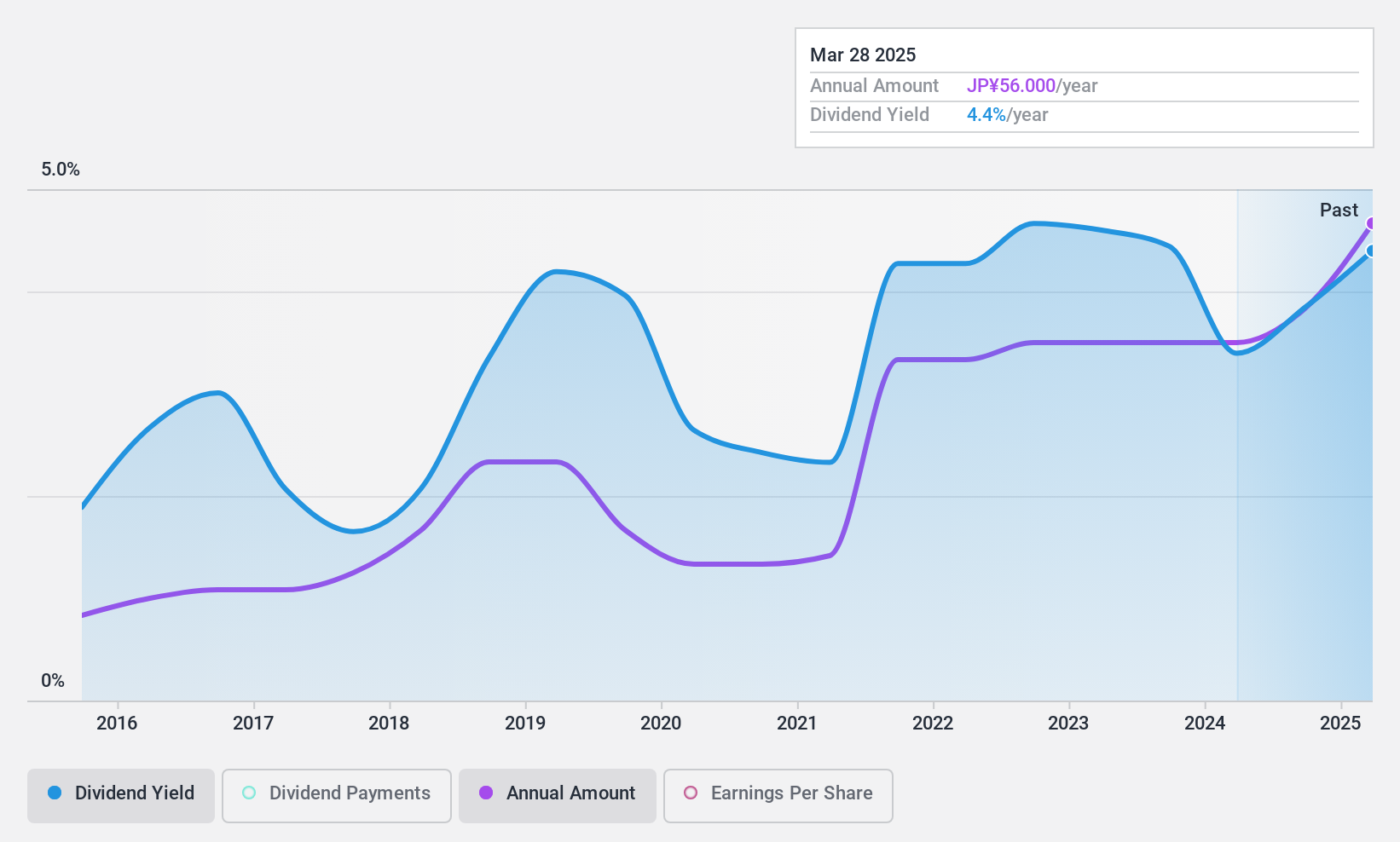

Dividend Yield: 4.4%

Nippon Seisen Ltd.'s dividend appeal is mixed. Despite a top-tier yield of 4.37% in Japan, the high payout ratio of 223.3% indicates dividends aren't well covered by earnings, though cash flows are sufficient with a 54.2% cash payout ratio. Dividend stability is questionable due to volatility and recent cuts from ¥105 to ¥28 per share for fiscal year ending March 2025, reflecting challenges in maintaining consistent payouts despite earnings growth over the past five years.

- Take a closer look at Nippon SeisenLtd's potential here in our dividend report.

- The analysis detailed in our Nippon SeisenLtd valuation report hints at an inflated share price compared to its estimated value.

Scroll (TSE:8005)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Scroll Corporation primarily operates in the mail-order and e-commerce sectors in Japan, with a market cap of ¥37.58 billion.

Operations: Scroll Corporation's revenue is derived from its Solution Business at ¥41.60 billion, E-Commerce Business at ¥14.74 billion, Mail Order Business at ¥25.17 billion, and Group-Controlled Business at ¥3.43 billion.

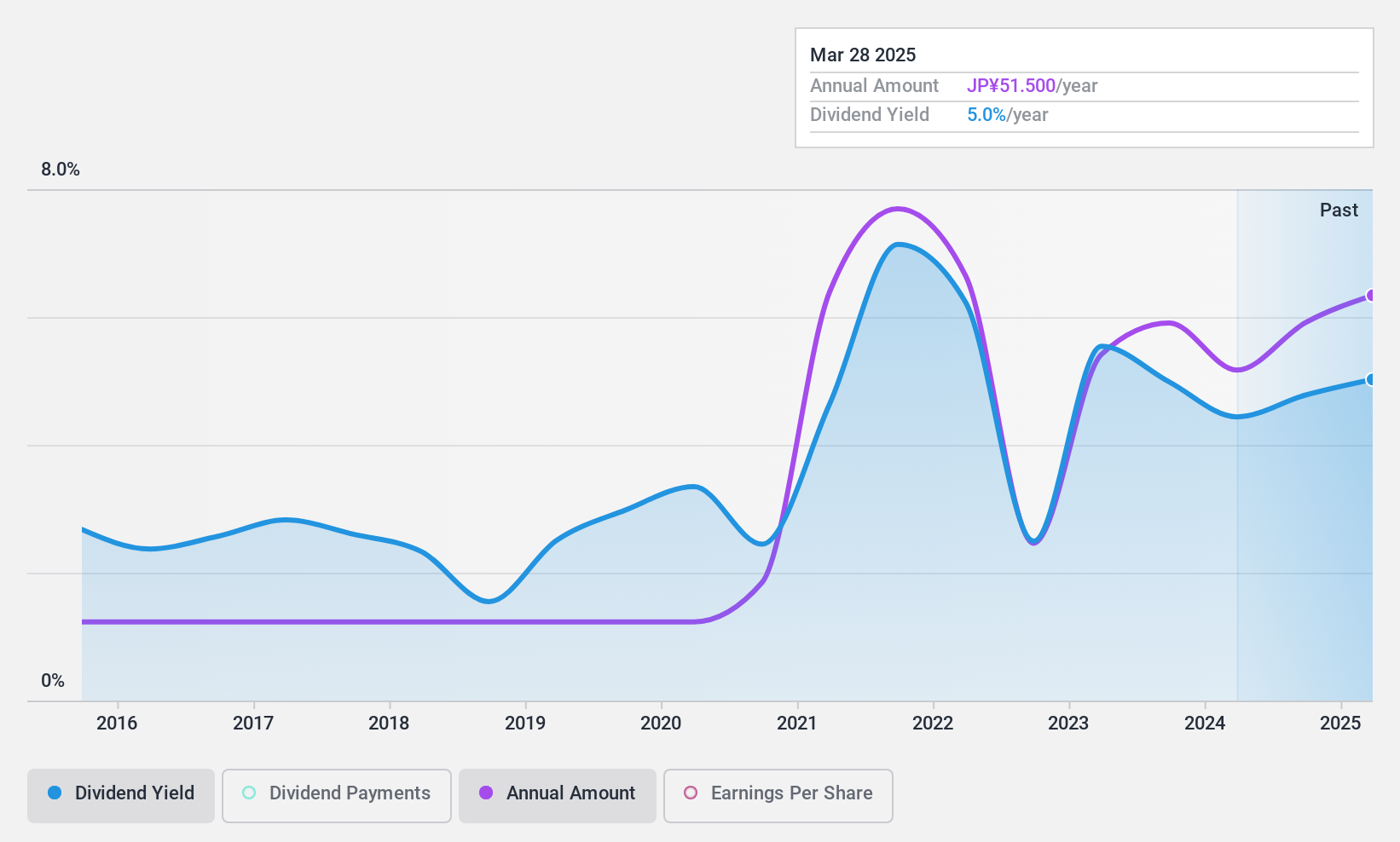

Dividend Yield: 4.4%

Scroll Corporation's dividend profile shows both strengths and weaknesses. The company maintains a top-tier dividend yield of 4.4% in Japan, supported by a low payout ratio of 35.6% and cash payout ratio of 29.9%, indicating dividends are well covered by earnings and cash flows. However, the reliability is questionable due to volatility over the past decade despite recent affirmations of JPY 24 per share for Q2 2024, with long-term growth noted but stability lacking.

- Click to explore a detailed breakdown of our findings in Scroll's dividend report.

- Upon reviewing our latest valuation report, Scroll's share price might be too pessimistic.

Parker (TSE:9845)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parker Corporation engages in product development, manufacturing, sales, and technical services across various industries including automobiles, electrical machinery, chemicals, steel, electronics, and food with a market cap of approximately ¥19.64 billion.

Operations: Parker Corporation's revenue is primarily derived from its Chemicals Department at ¥20.27 billion, Chemical Products Department at ¥20.56 billion, Industrial Materials at ¥17.30 billion, Chemicals Division at ¥6.63 billion, and Machinery Department at ¥2.65 billion.

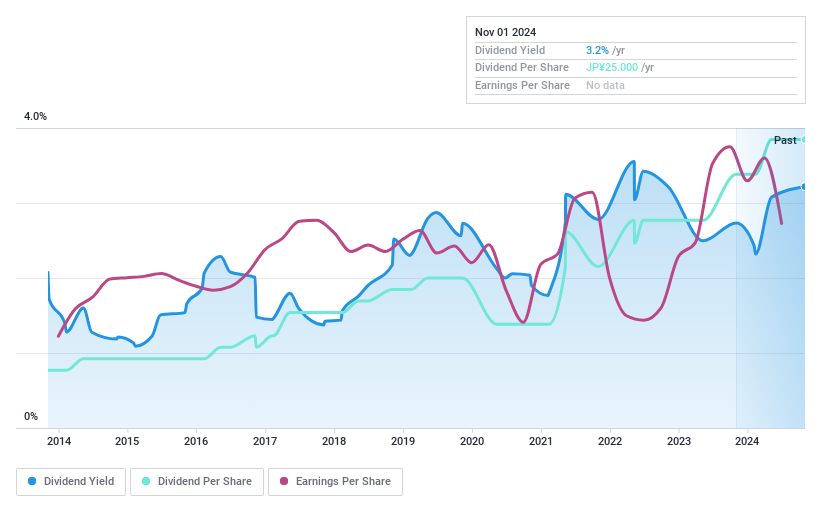

Dividend Yield: 3.2%

Parker's dividend profile highlights a mixed picture. Despite a low payout ratio of 22.6% and cash payout ratio of 23.9%, indicating strong coverage by earnings and cash flows, the dividends have been volatile over the past decade, impacting reliability. The dividend yield stands at 3.18%, below Japan's top quartile for dividend payers, with recent profit margins declining from last year (6.1% to 3.7%), affecting overall financial stability for consistent dividends.

- Navigate through the intricacies of Parker with our comprehensive dividend report here.

- The analysis detailed in our Parker valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Investigate our full lineup of 1972 Top Dividend Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon SeisenLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5659

Nippon SeisenLtd

Manufactures and sells stainless steel wires in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives