- Japan

- /

- Industrials

- /

- TSE:9470

3 Stocks Estimated To Be Trading Below Fair Value In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, investors are optimistic about potential economic growth fueled by anticipated tax cuts and deregulation, pushing major indices like the S&P 500 to record highs. Amidst this surge, identifying undervalued stocks becomes crucial for investors looking to capitalize on opportunities that may be trading below their intrinsic value in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| UMB Financial (NasdaqGS:UMBF) | US$122.86 | US$245.13 | 49.9% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.14 | 49.9% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.695 | MYR1.39 | 49.8% |

| TBC Bank Group (LSE:TBCG) | £31.35 | £62.68 | 50% |

| Afya (NasdaqGS:AFYA) | US$16.16 | US$32.25 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.06 | 49.8% |

| XPEL (NasdaqCM:XPEL) | US$45.46 | US$90.91 | 50% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.39 | MX$38.77 | 50% |

| S-Pool (TSE:2471) | ¥344.00 | ¥686.71 | 49.9% |

| BuySell TechnologiesLtd (TSE:7685) | ¥3890.00 | ¥7757.36 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Japan Investment Adviser (TSE:7172)

Overview: Japan Investment Adviser Co., Ltd. offers a range of financial solutions in Japan and has a market cap of ¥69.13 billion.

Operations: The company's revenue is primarily derived from its Finance Solution segment, which generated ¥28.10 billion.

Estimated Discount To Fair Value: 36.9%

Japan Investment Adviser appears undervalued, trading at ¥1,143 against a fair value estimate of ¥1,810.97. Despite recent volatility and shareholder dilution, its revenue is projected to grow 27.9% annually, outpacing the market's 4.2%. Earnings are expected to rise significantly at 56.22% per year over the next three years. However, debt coverage by operating cash flow remains weak and recent guidance revisions indicate exchange losses impacting net income forecasts due to yen appreciation.

- The analysis detailed in our Japan Investment Adviser growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Japan Investment Adviser stock in this financial health report.

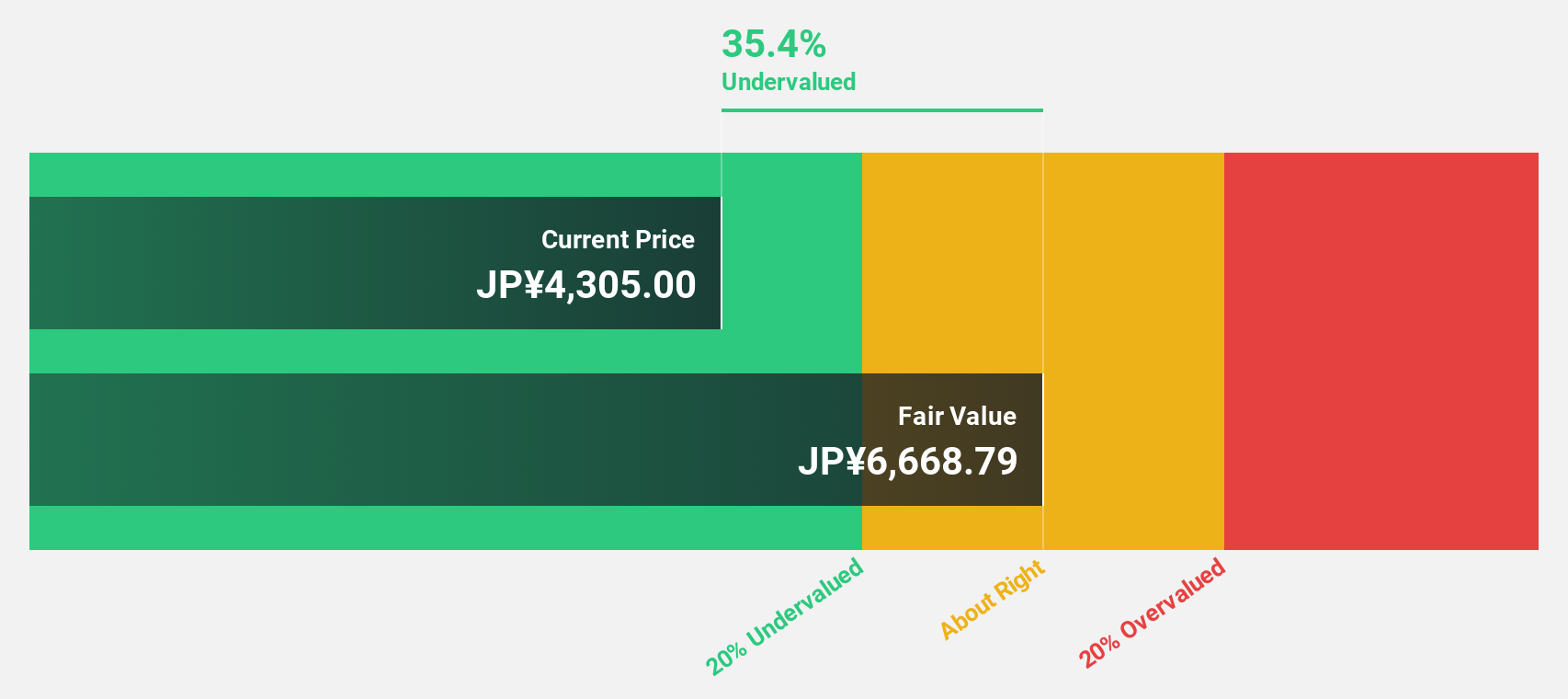

BuySell TechnologiesLtd (TSE:7685)

Overview: BuySell Technologies Co., Ltd. operates in the kimono and branded goods reuse business in Japan with a market capitalization of approximately ¥55.25 billion.

Operations: The company generates revenue of ¥51.73 billion from its reuse business for kimonos and branded products in Japan.

Estimated Discount To Fair Value: 49.9%

BuySell Technologies Ltd. is trading at ¥3,890, significantly below its estimated fair value of ¥7,757.36. Despite high share price volatility and debt not fully covered by operating cash flow, the company shows promising growth potential with earnings expected to increase 28.9% annually over the next three years—outpacing Japan's market average of 8%. Recent amendments to double authorized shares and a ¥10 billion syndicated loan for acquisitions highlight strategic expansion efforts.

- According our earnings growth report, there's an indication that BuySell TechnologiesLtd might be ready to expand.

- Click to explore a detailed breakdown of our findings in BuySell TechnologiesLtd's balance sheet health report.

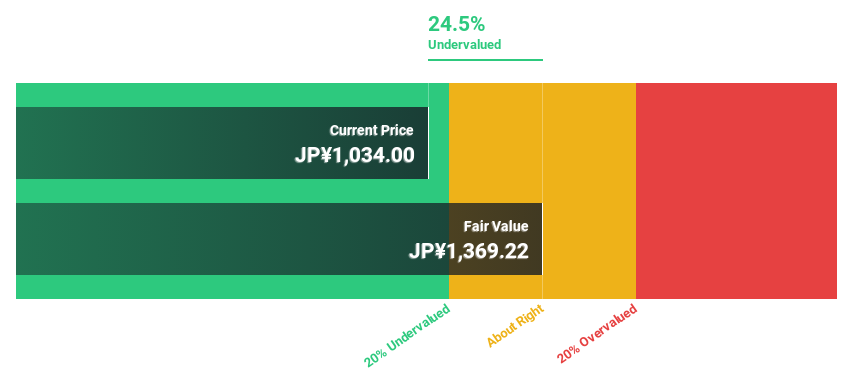

Gakken Holdings (TSE:9470)

Overview: Gakken Holdings Co., Ltd. operates in the educational and healthcare and nursing sectors both in Japan and internationally, with a market cap of ¥43.01 billion.

Operations: The company's revenue is derived from the Educational Domain, which accounts for ¥92.15 billion, and the Healthcare and Nursing Domain, contributing ¥87.60 billion.

Estimated Discount To Fair Value: 24.4%

Gakken Holdings is trading at ¥1,019, significantly below its estimated fair value of ¥1,348.42. The company has initiated a share buyback program worth ¥1 billion to enhance shareholder returns and announced stable dividends of JPY 12.50 per share for the past year with plans to increase them slightly next year. Despite a recent decline in profit margins, earnings are forecasted to grow significantly by 33.6% annually over the next three years, surpassing Japan's market average growth rate.

- Our expertly prepared growth report on Gakken Holdings implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Gakken Holdings with our comprehensive financial health report here.

Summing It All Up

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 897 more companies for you to explore.Click here to unveil our expertly curated list of 900 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9470

Gakken Holdings

Engages in educational, and healthcare and nursing business in Japan and internationally.

Excellent balance sheet established dividend payer.