- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3132

Top Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by record highs in U.S. indexes and geopolitical uncertainties, investors are increasingly seeking stability amid broad-based gains and economic optimism. With the Federal Reserve hinting at potential interest rate cuts and strong labor market data boosting sentiment, dividend stocks emerge as an attractive option for those looking to balance growth with income generation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.10% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Air Arabia PJSC (DFM:AIRARABIA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Air Arabia PJSC, along with its subsidiaries, offers air travel services and has a market capitalization of AED13.86 billion.

Operations: Air Arabia PJSC generates revenue primarily from its airline operations, amounting to AED6.14 billion.

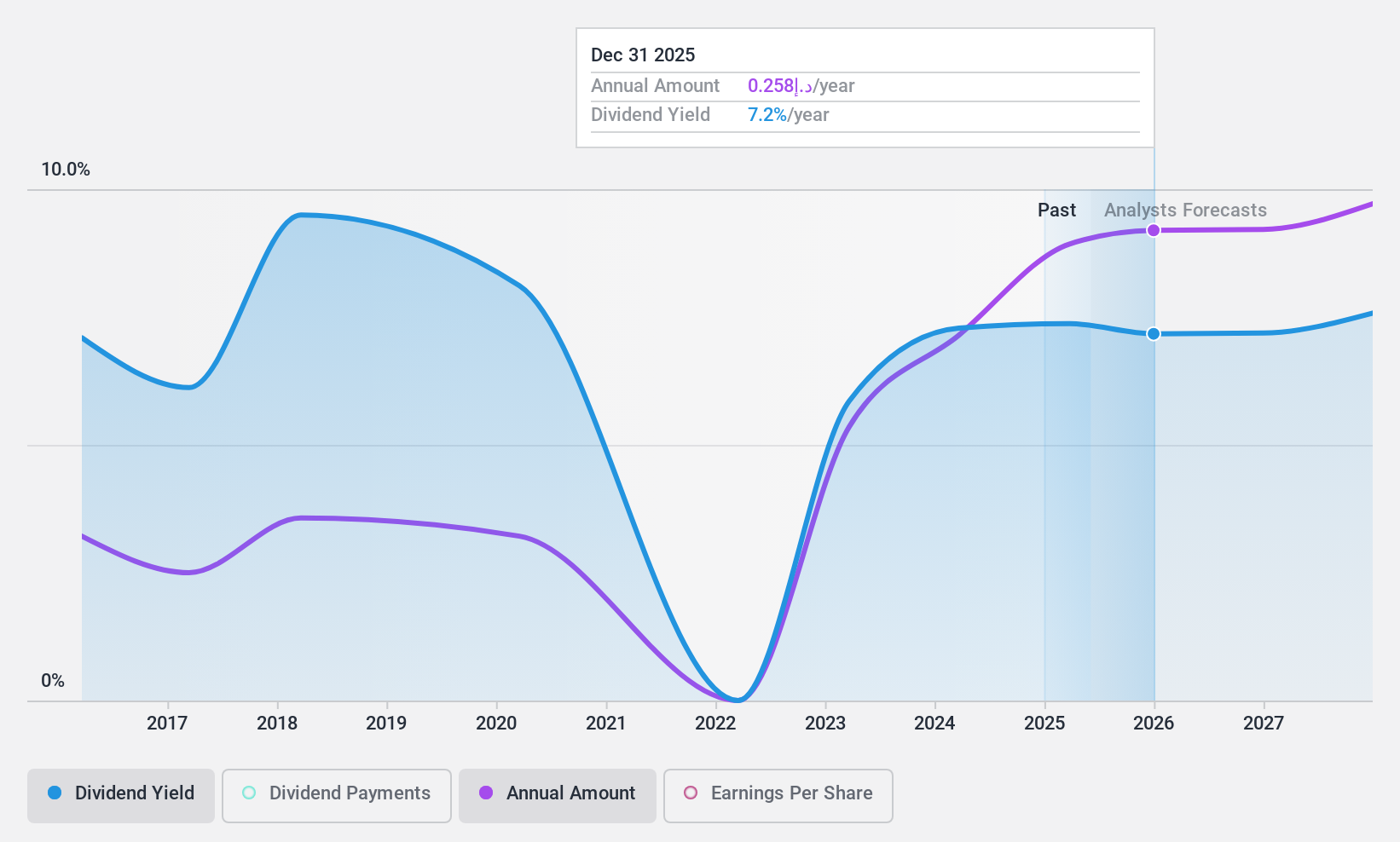

Dividend Yield: 6.8%

Air Arabia PJSC's dividend payments are covered by earnings and cash flows, with payout ratios of 67.6% and 54.1%, respectively, indicating sustainability. The company offers a competitive dividend yield in the top 25% of the AE market. However, its dividends have been volatile over the past decade, impacting reliability. Recent earnings show stable sales growth but a slight decrease in net income for nine months ending September 2024, which may influence future dividends.

- Click to explore a detailed breakdown of our findings in Air Arabia PJSC's dividend report.

- Our comprehensive valuation report raises the possibility that Air Arabia PJSC is priced lower than what may be justified by its financials.

Macnica Holdings (TSE:3132)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Macnica Holdings, Inc. imports, sells, and exports electronic components in Japan and has a market cap of ¥308.30 billion.

Operations: Macnica Holdings, Inc. generates revenue from its Network Business segment amounting to ¥139.96 billion and its Integrated Circuits, Electronic Devices, and Other Businesses segment totaling ¥860.76 billion.

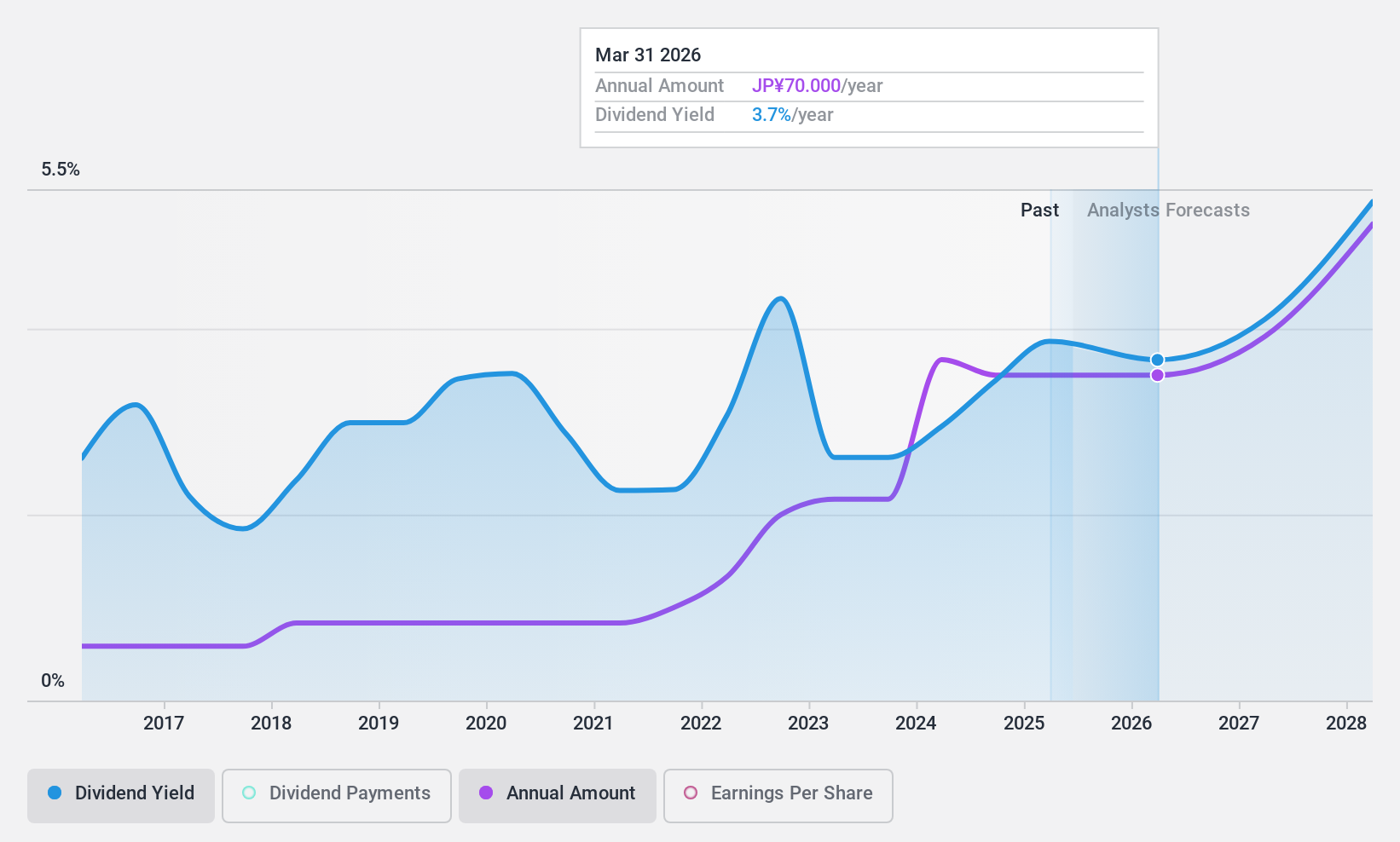

Dividend Yield: 3.9%

Macnica Holdings offers a dividend yield in the top 25% of the JP market, with dividends well-covered by a low payout ratio of 12.9%. Despite this, its dividend history has been unstable and volatile over the past decade. Recent buyback activities aimed at enhancing shareholder returns may support future payouts. However, revised earnings guidance reflects challenges in key markets, potentially impacting dividend stability moving forward.

- Delve into the full analysis dividend report here for a deeper understanding of Macnica Holdings.

- According our valuation report, there's an indication that Macnica Holdings' share price might be on the cheaper side.

Happinet (TSE:7552)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Happinet Corporation operates as an entertainment trading company in Japan with a market cap of ¥88.56 billion.

Operations: Happinet Corporation generates revenue through its entertainment trading operations in Japan.

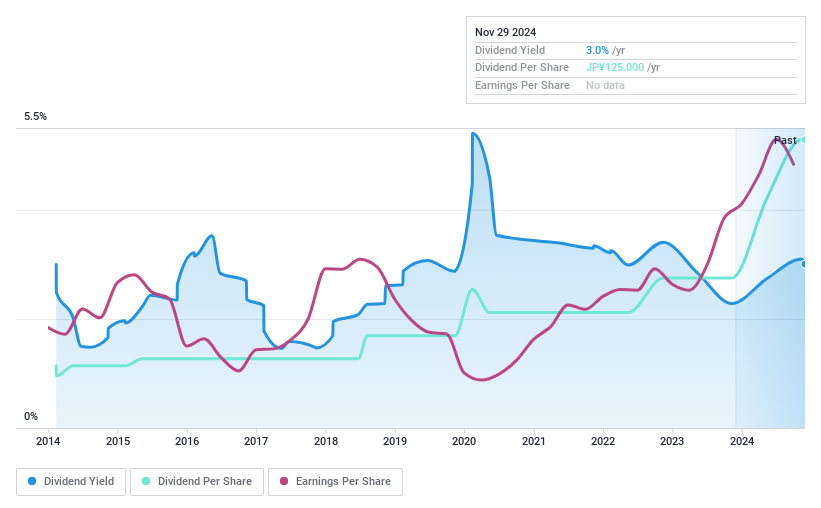

Dividend Yield: 3.1%

Happinet's dividend payments, while covered by a low payout ratio of 32.5% and cash payout ratio of 24.9%, have been volatile over the past decade, indicating an unstable track record despite recent growth in earnings by 25.8%. The dividend yield is below the top quartile in Japan, at 3.07%. Recent share buybacks totaling ¥1.14 billion could signal efforts to enhance shareholder value amidst ongoing earnings developments.

- Click here to discover the nuances of Happinet with our detailed analytical dividend report.

- The analysis detailed in our Happinet valuation report hints at an inflated share price compared to its estimated value.

Seize The Opportunity

- Explore the 1976 names from our Top Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3132

Macnica Holdings

Imports, sells, and exports electronic components in Japan.

Flawless balance sheet, undervalued and pays a dividend.