- Japan

- /

- Retail Distributors

- /

- TSE:7552

Happinet And 2 Additional Small Caps With Solid Foundations

Reviewed by Simply Wall St

In the current market landscape, small-cap stocks have faced challenges as evidenced by the Russell 2000 Index's continued underperformance against larger indices like the S&P 500. Despite this, opportunities remain for investors to uncover potential gems among smaller companies with solid foundations, particularly those that can navigate economic shifts and leverage growth prospects effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Elite Color Environmental Resources Science & Technology | 30.80% | 12.99% | 1.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Happinet (TSE:7552)

Simply Wall St Value Rating: ★★★★★★

Overview: Happinet Corporation is an entertainment trading company in Japan with a market cap of ¥103.91 billion.

Operations: Happinet generates revenue primarily through its entertainment trading activities in Japan. The company's financial performance is highlighted by a market capitalization of ¥103.91 billion.

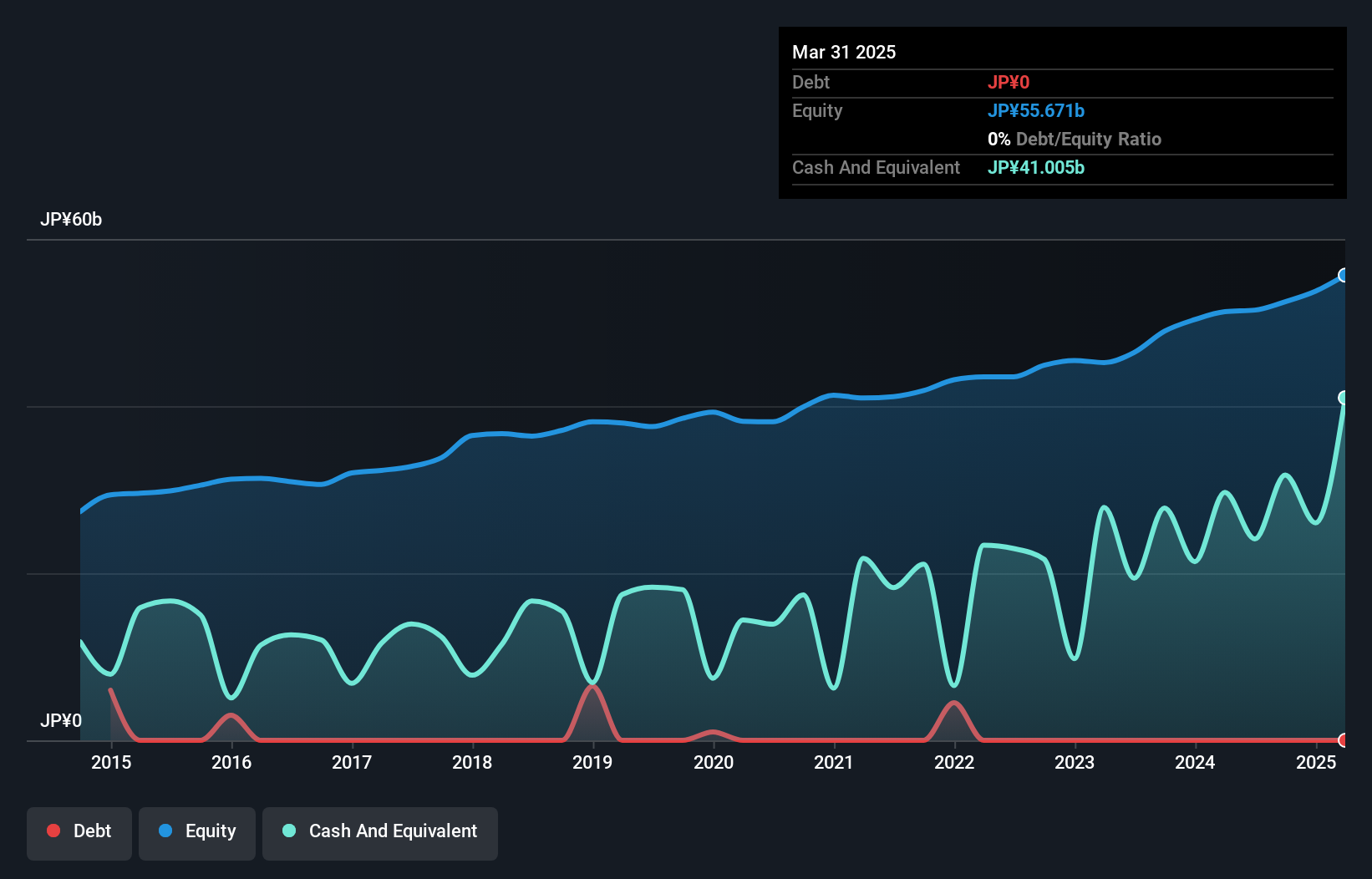

Happinet, a player in the retail distribution scene, shines with no debt on its books and trades at 79.6% below its fair value estimate. Over the past year, earnings surged by 25.8%, outpacing the industry average of -1.5%. This growth is likely supported by high-quality earnings and positive free cash flow, suggesting robust operational performance. The absence of financial leverage issues further underscores its solid footing in a competitive market landscape. With these figures in mind, Happinet seems well-positioned within its niche for continued stability and potential future growth opportunities.

Seika (TSE:8061)

Simply Wall St Value Rating: ★★★★★★

Overview: Seika Corporation is engaged in the import, sale, and export of plants, machinery, and environmental protection and electronic information system equipment across Asia, Europe, the United States, and other international markets with a market cap of ¥584 billion.

Operations: Seika's revenue streams are primarily derived from its Product Business at ¥33.53 billion, Electric Power Business at ¥33.32 billion, and Industrial Machinery Business at ¥25.98 billion.

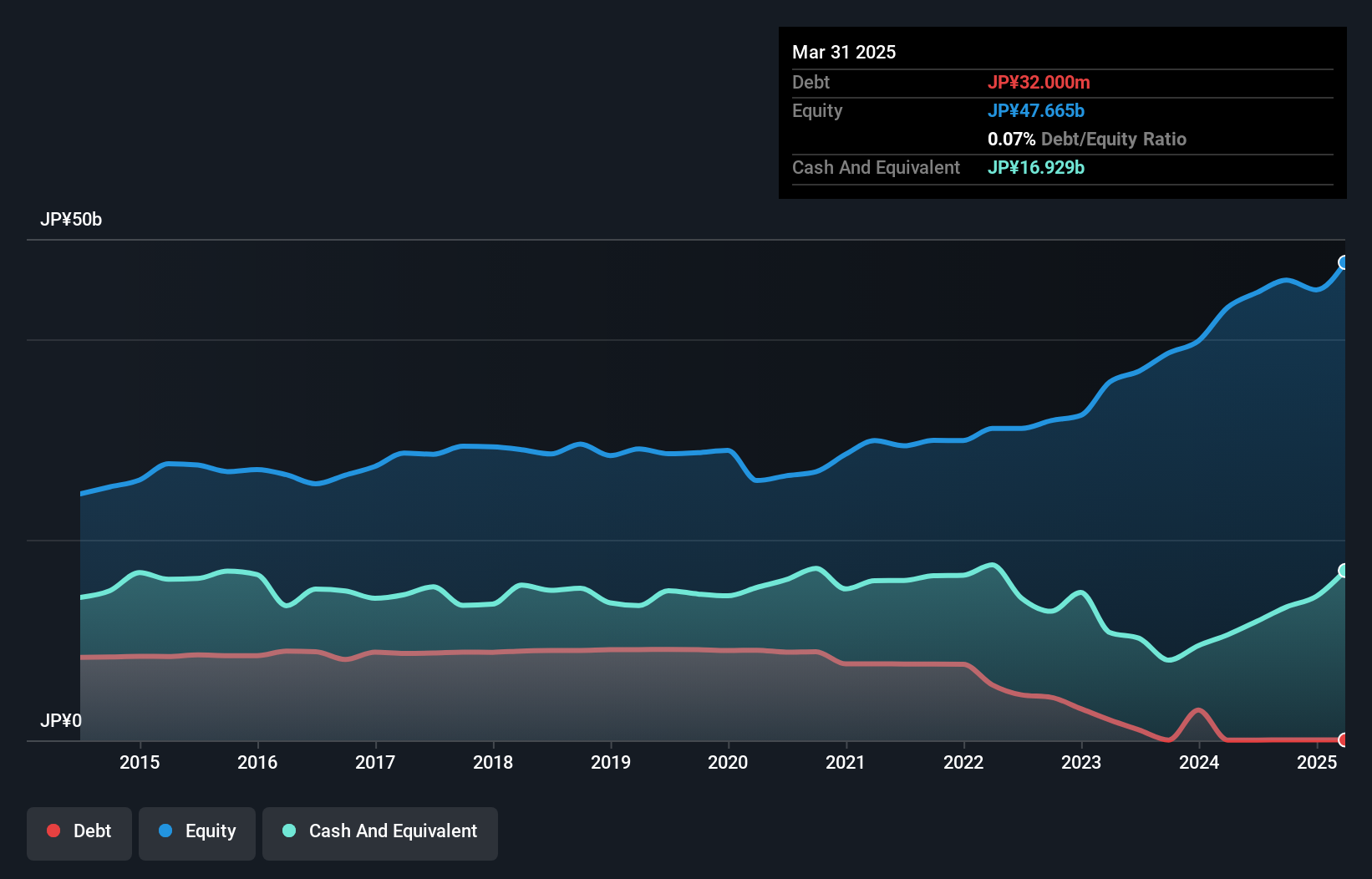

Seika, a noteworthy player in the trade distributors sector, has been making waves with its impressive earnings growth of 43% over the past year, outpacing the industry's modest 0.4%. The company's financial health is robust, highlighted by a significant reduction in its debt-to-equity ratio from 31.5% to a mere 0.09% over five years and more cash than total debt. A one-off gain of ¥2.9 billion has notably impacted recent financial results, yet Seika remains undervalued at 93% below estimated fair value. Moreover, it announced an increased dividend payout from ¥60 to ¥90 per share this quarter.

- Dive into the specifics of Seika here with our thorough health report.

Gain insights into Seika's past trends and performance with our Past report.

Shinkong Insurance (TWSE:2850)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shinkong Insurance Co., Ltd. offers property insurance services to both individuals and corporations in Taiwan, with a market cap of NT$33.81 billion.

Operations: Shinkong Insurance generates revenue primarily from its property insurance segment, amounting to NT$20.59 billion.

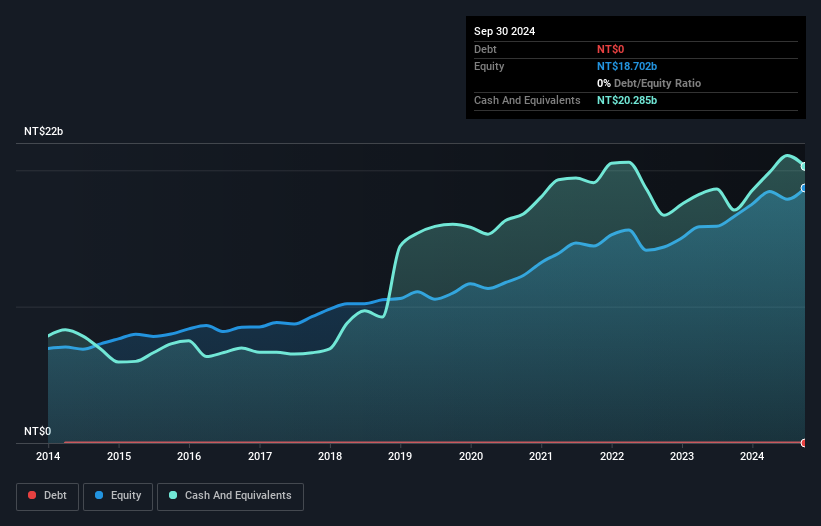

Shinkong Insurance, a smaller player in the insurance sector, has been making strides with earnings growing 15.9% annually over the last five years. Despite not outpacing the industry’s 91.8% growth this past year, it remains debt-free and boasts high-quality earnings. The company is trading at a significant discount of 37.2% below its estimated fair value, suggesting potential undervaluation. Recent financials show third-quarter revenue at TWD 5,323 million and net income of TWD 815 million, down from TWD 996 million previously; however, nine-month figures reveal improved net income at TWD 2,502 million compared to TWD 2,167 million last year.

- Take a closer look at Shinkong Insurance's potential here in our health report.

Explore historical data to track Shinkong Insurance's performance over time in our Past section.

Next Steps

- Unlock our comprehensive list of 4502 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Happinet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7552

Flawless balance sheet with proven track record and pays a dividend.