- Japan

- /

- Hospitality

- /

- TSE:7085

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a landscape of record-high indexes and robust economic indicators, smaller-cap stocks have been outperforming their larger counterparts, capturing the interest of investors seeking opportunities beyond the usual blue-chip names. In this environment, identifying promising small-cap stocks can be particularly rewarding, as these companies often possess untapped potential and the agility to thrive amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.32% | -9.98% | 7.95% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 18.55% | 49.61% | 71.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Power HF | 2.91% | -6.25% | -22.13% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Universal Microwave Technology (TPEX:3491)

Simply Wall St Value Rating: ★★★★★☆

Overview: Universal Microwave Technology, Inc. specializes in designing, developing, and manufacturing custom microwave/mm-wave devices and antennas for broadband wireless communications with a market cap of NT$19.18 billion.

Operations: The company generates revenue primarily from designing, developing, and manufacturing microwave/mm-wave devices and antennas for broadband wireless communications. With a market cap of NT$19.18 billion, its financial performance is influenced by the demand in the telecommunications sector.

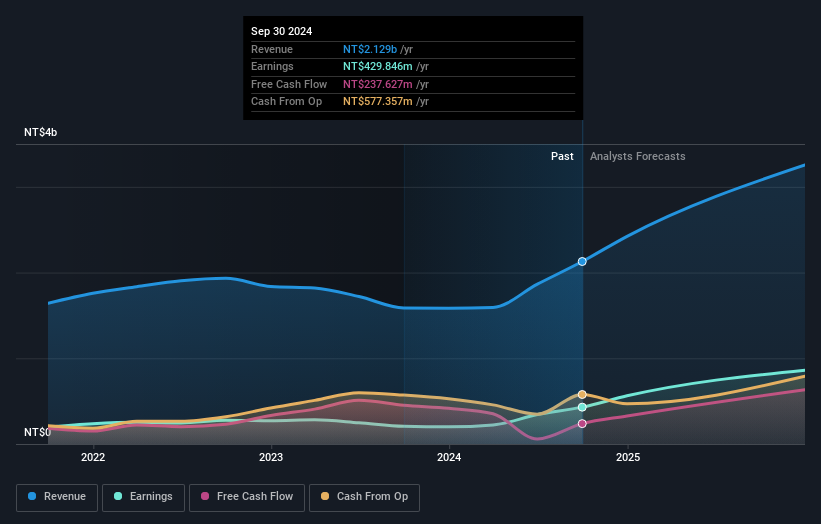

Universal Microwave Technology, a company in the electronics sector, has shown impressive growth with earnings surging by 108.7% over the past year, outpacing the industry average of 9%. The company's recent financials reflect strong performance; third-quarter sales reached TWD 639.64 million, up from TWD 375.53 million last year, while net income rose to TWD 132.43 million from TWD 45.94 million. With a debt-to-equity ratio increasing to 35.9% over five years and high-quality earnings reported, it seems well-positioned for continued success in its niche market despite rising leverage concerns.

CURVES HOLDINGS (TSE:7085)

Simply Wall St Value Rating: ★★★★★★

Overview: CURVES HOLDINGS Co., Ltd. operates and manages women's fitness clubs under the Curves brand in Japan with a market cap of ¥72.82 billion.

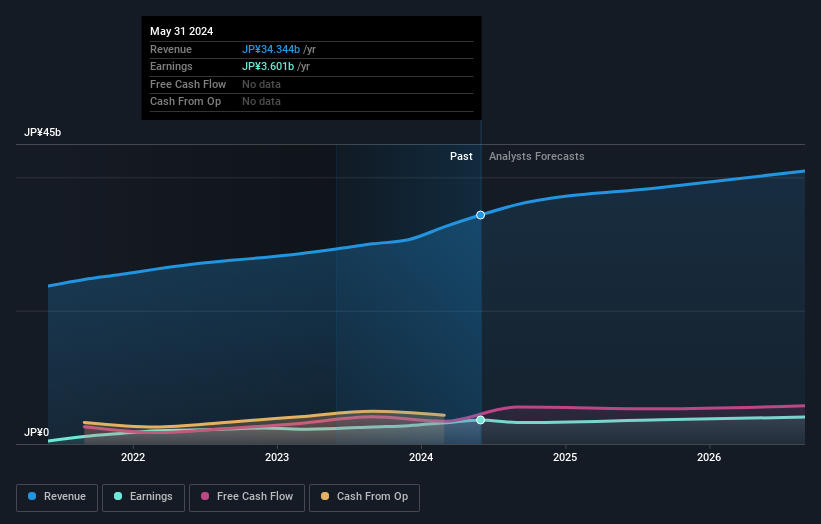

Operations: The primary revenue stream for CURVES HOLDINGS is derived from its Curves Business segment, generating ¥35.47 billion. The company's financial performance can be evaluated through its net profit margin trends, which provide insight into profitability efficiency over time.

CURVES HOLDINGS, a notable player in its sector, has shown impressive financial health with a net debt to equity ratio of 1.9%, which is satisfactory by industry standards. Over the past five years, this metric has improved significantly from 208% to 44.6%. The company's earnings have surged by 39.8% over the last year, outpacing the Hospitality industry's growth rate of 27.6%. Recent developments include an increase in dividend guidance for fiscal year ending August 2025, indicating strong confidence in future profitability with expected net sales reaching JPY 38 billion and operating profit at JPY 6.3 billion.

- Take a closer look at CURVES HOLDINGS' potential here in our health report.

Gain insights into CURVES HOLDINGS' past trends and performance with our Past report.

Nishimatsuya Chain (TSE:7545)

Simply Wall St Value Rating: ★★★★★★

Overview: Nishimatsuya Chain Co., Ltd. operates a chain of specialty stores for baby and children's living goods in Japan, with a market cap of ¥136 billion.

Operations: The company's revenue is primarily derived from its chain of specialty stores focused on baby and children's living goods in Japan. It has a market cap of approximately ¥136 billion.

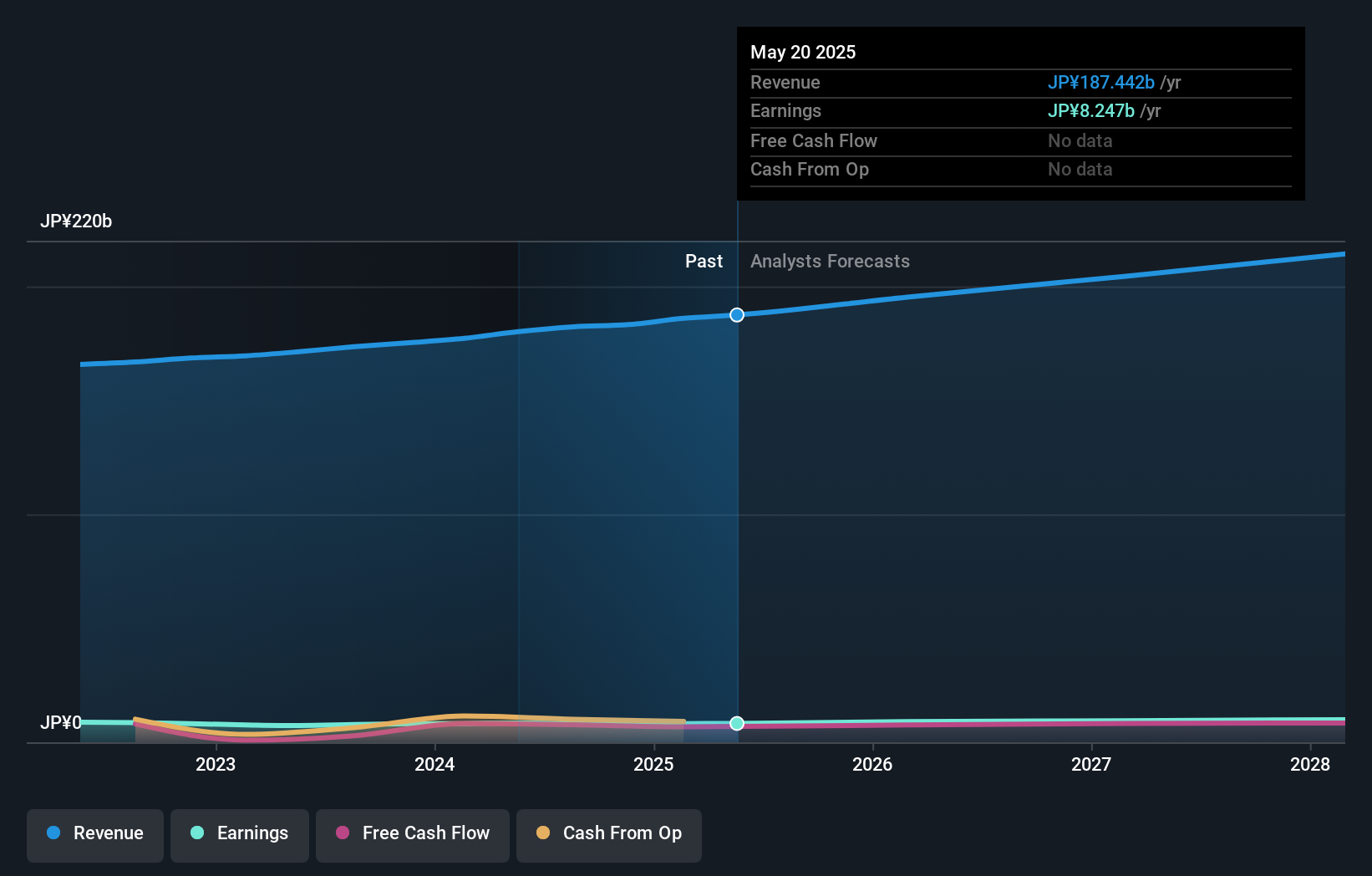

Nishimatsuya Chain, a player in the specialty retail sector, showcases a promising profile with earnings growth of 5.6% over the past year, outpacing the industry average of 4.6%. The company is trading at 24.5% below its estimated fair value, suggesting potential undervaluation. It has initiated a share buyback program, repurchasing 200,100 shares for ¥499.78 million recently to enhance shareholder value and adapt to market conditions. With high-quality past earnings and more cash than total debt, Nishimatsuya seems well-positioned financially while maintaining interest coverage comfortably above obligations.

Turning Ideas Into Actions

- Dive into all 4631 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7085

CURVES HOLDINGS

Engages in the operation and management of fitness club for women under the Curves brand name in Japan.

Flawless balance sheet and undervalued.