- Japan

- /

- Retail Distributors

- /

- TSE:7460

Dividend Stocks To Consider In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policy uncertainties and mixed economic signals, investors are closely monitoring how these factors impact their portfolios. In such a climate, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those seeking to balance growth with regular returns amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.78% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.78% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.19% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.18% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.46% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.87% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Skandinaviska Enskilda Banken (OM:SEB A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Skandinaviska Enskilda Banken AB (publ) offers corporate, retail, investment, and private banking services with a market cap of approximately SEK325.07 billion.

Operations: Skandinaviska Enskilda Banken AB (publ) generates revenue from several segments, including Large Corporates & Financial Institutions (SEK32.02 billion), Corporate & Private Customers excluding Private Wealth Management & Family Office (SEK25.62 billion), Baltic operations (SEK13.34 billion), Private Wealth Management & Family Office (SEK4.61 billion), Life services (SEK3.80 billion), and Asset Management (SEK3.37 billion).

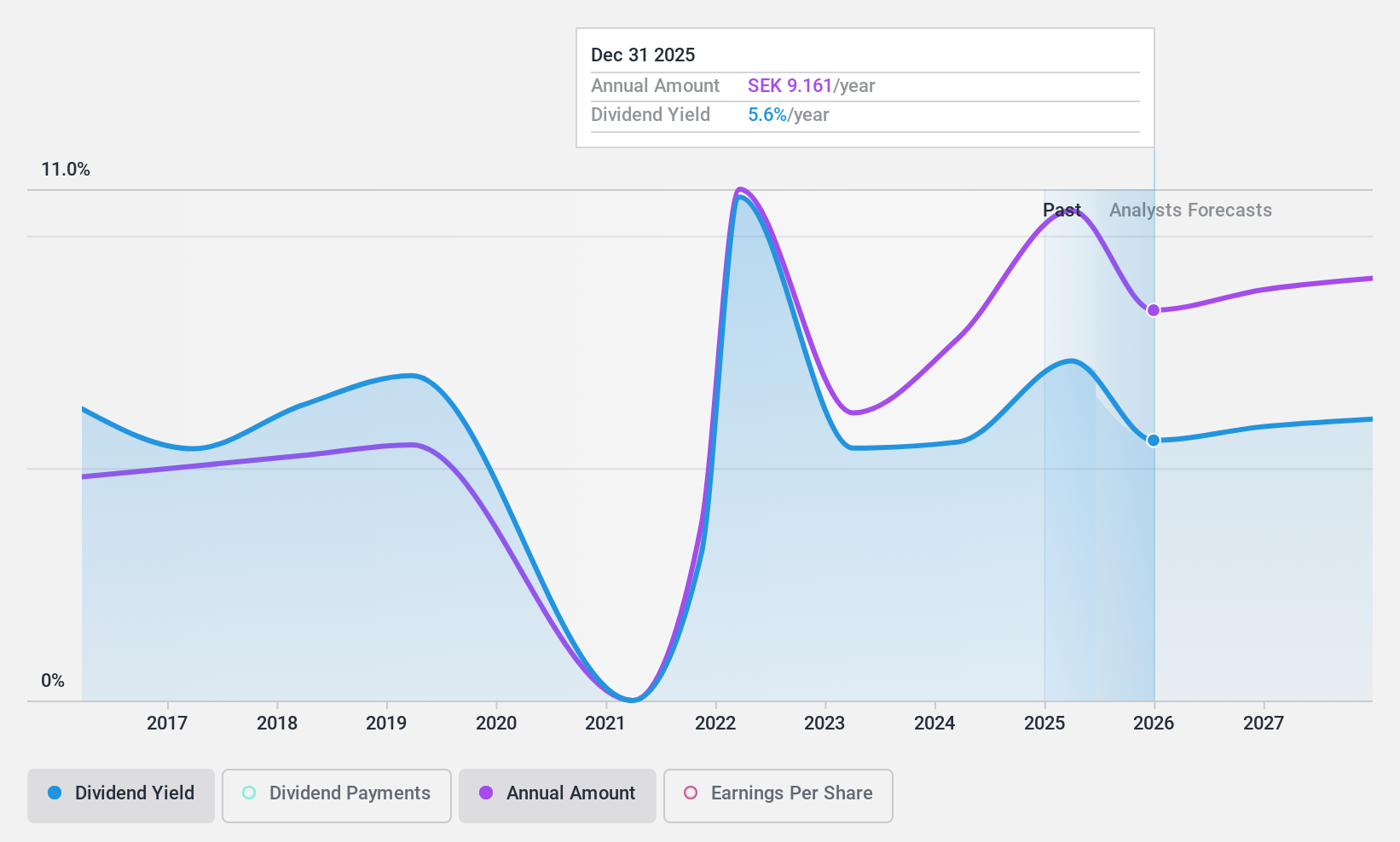

Dividend Yield: 7.1%

Skandinaviska Enskilda Banken's dividend yield is among the top 25% in Sweden, currently offering a competitive rate of 7.15%. Despite an increase over the past decade, its dividends have been volatile and unreliable, with a history of significant annual drops. However, the dividends are well-covered by earnings with a payout ratio of 48.6%, forecasted to remain sustainable at 53.5% in three years. Recent proposals include an ordinary dividend of SEK 8.50 and a special dividend of SEK 3 per share for April 2025 distribution.

- Click to explore a detailed breakdown of our findings in Skandinaviska Enskilda Banken's dividend report.

- According our valuation report, there's an indication that Skandinaviska Enskilda Banken's share price might be on the cheaper side.

Maruichi Steel Tube (TSE:5463)

Simply Wall St Dividend Rating: ★★★★★☆

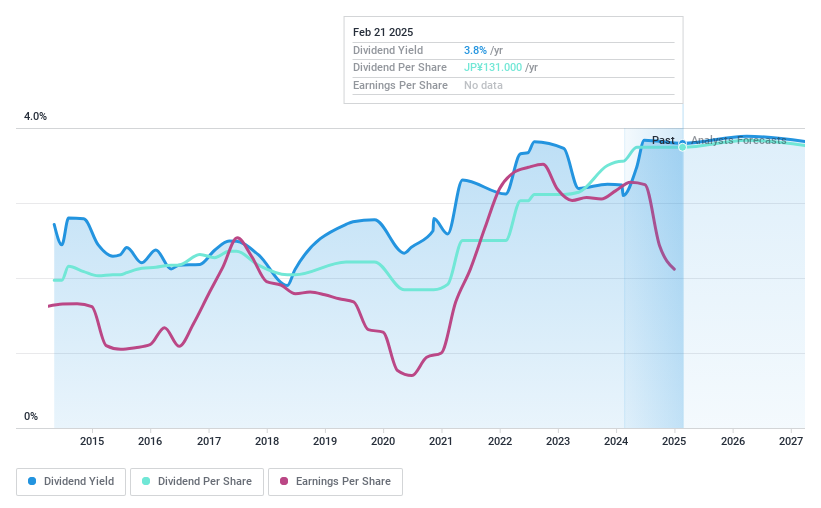

Overview: Maruichi Steel Tube Ltd., along with its subsidiaries, produces and distributes steel tubes, surface-treated steel sheets, and poles across Japan, North America, and Asia, with a market capitalization of ¥281.52 billion.

Operations: Maruichi Steel Tube Ltd.'s revenue segments are comprised of ¥54.46 billion from Asia, ¥158.33 billion from Japan, and ¥57.31 billion from North America.

Dividend Yield: 3.8%

Maruichi Steel Tube's dividend yield is in the top 25% of the Japanese market at 3.78%, with payments covered by earnings and cash flows, reflecting payout ratios of 53.9% and 72.7%, respectively. Despite a history of volatility over the past decade, dividends have shown growth. Recent announcements include a share buyback program aimed at improving capital efficiency, potentially enhancing shareholder value alongside consistent dividend payouts like the recent ¥55 per share declaration for Q2 FY2025.

- Take a closer look at Maruichi Steel Tube's potential here in our dividend report.

- The valuation report we've compiled suggests that Maruichi Steel Tube's current price could be inflated.

YagiLtd (TSE:7460)

Simply Wall St Dividend Rating: ★★★★☆☆

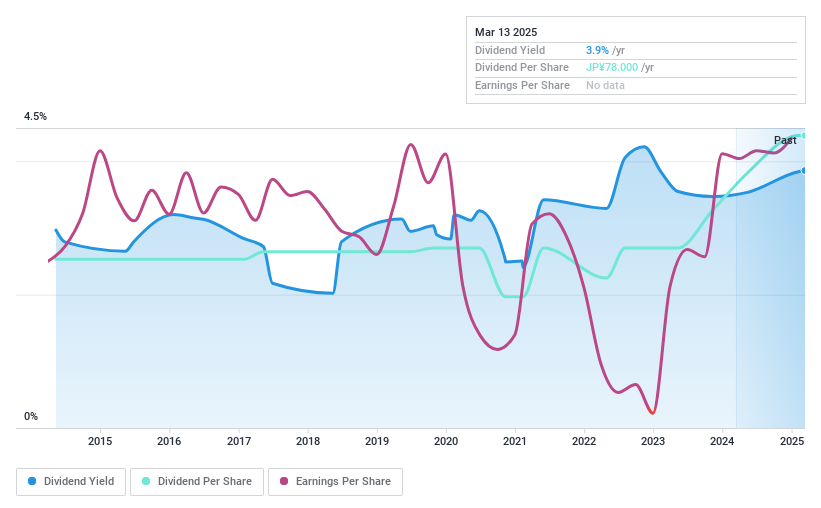

Overview: Yagi & Co., Ltd. is a fiber trading company based in Japan with a market capitalization of ¥17.19 billion.

Operations: Yagi & Co., Ltd. generates its revenue from several segments, including the Apparel Business at ¥41.51 billion, Material Business at ¥23.65 billion, Lifestyle Business at ¥7.53 billion, Real Estate Business at ¥821.48 million, and Brand/Retail Business (excluding Lifestyle) at ¥9.46 billion.

Dividend Yield: 3.3%

Yagi Ltd.'s dividend payments are well-covered by earnings and cash flows, with payout ratios of 22.7% and 12%, respectively, indicating strong coverage. However, its dividends have been volatile over the past decade despite a growth trend. Trading significantly below its estimated fair value suggests potential for capital appreciation. The current yield of 3.32% is below the top tier in Japan's market, reflecting both opportunities and challenges for dividend investors.

- Get an in-depth perspective on YagiLtd's performance by reading our dividend report here.

- The valuation report we've compiled suggests that YagiLtd's current price could be quite moderate.

Next Steps

- Gain an insight into the universe of 1954 Top Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7460

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives