- Japan

- /

- Specialty Stores

- /

- TSE:7419

Undiscovered Gems To Explore On None Exchange In November 2024

Reviewed by Simply Wall St

As global markets respond to the recent U.S. election results, small-cap stocks have captured investor attention with the Russell 2000 Index leading gains, albeit still shy of record highs. Amidst this backdrop of anticipated economic growth and policy shifts, identifying promising stocks requires a keen eye for companies that can capitalize on favorable regulatory changes and potential tax benefits.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Lion Capital | NA | 21.26% | 24.46% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.07% | 35.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Mesnac (SZSE:002073)

Simply Wall St Value Rating: ★★★★★★

Overview: Mesnac Co., Ltd. focuses on the research, development, and innovation of information equipment and software applications for the rubber industry both in China and internationally, with a market cap of CN¥9.45 billion.

Operations: Mesnac generates revenue through its information equipment and software applications targeting the rubber industry. The company has a market cap of CN¥9.45 billion.

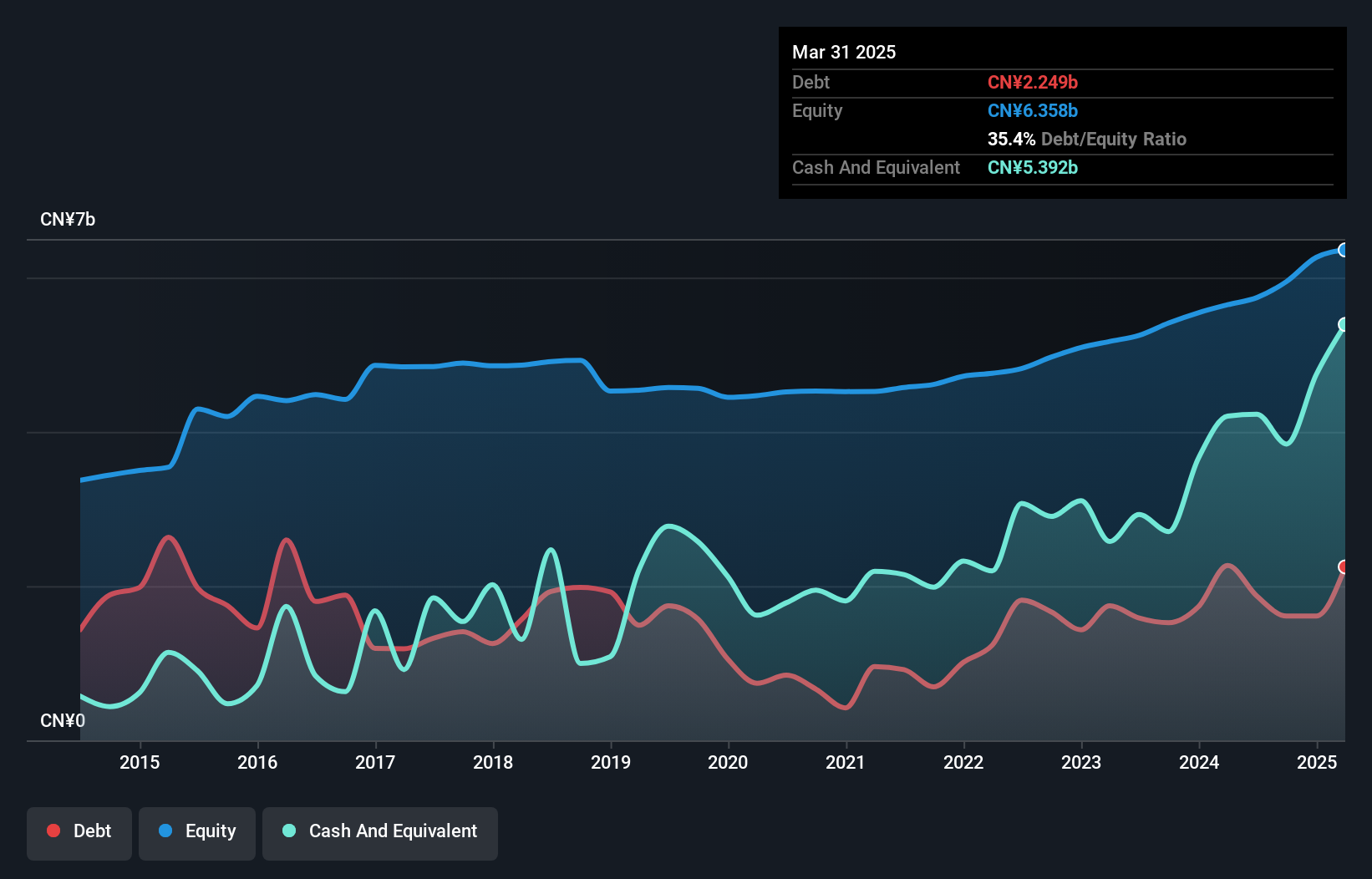

Mesnac, a promising company in the machinery sector, has demonstrated robust growth with earnings rising by 58.1% over the past year, outpacing the industry's -0.4%. Its price-to-earnings ratio of 20.2x suggests good value compared to the broader CN market's 37.3x. Financially sound, Mesnac holds more cash than its total debt and has successfully reduced its debt-to-equity ratio from 34.4% to 27.1% over five years. Recent earnings reports indicate net income climbed to CNY 343 million for nine months ending September 2024 from CNY 210 million a year prior, reflecting strong operational performance amidst industry challenges.

- Take a closer look at Mesnac's potential here in our health report.

Review our historical performance report to gain insights into Mesnac's's past performance.

Jiangyin Haida Rubber And Plastic (SZSE:300320)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangyin Haida Rubber And Plastic Co., Ltd. specializes in the production and sale of rubber and plastic products, with a market cap of CN¥7.50 billion.

Operations: Jiangyin Haida generates revenue primarily from its rubber and plastic product sales. The company's financial performance can be analyzed through its market capitalization of CN¥7.50 billion.

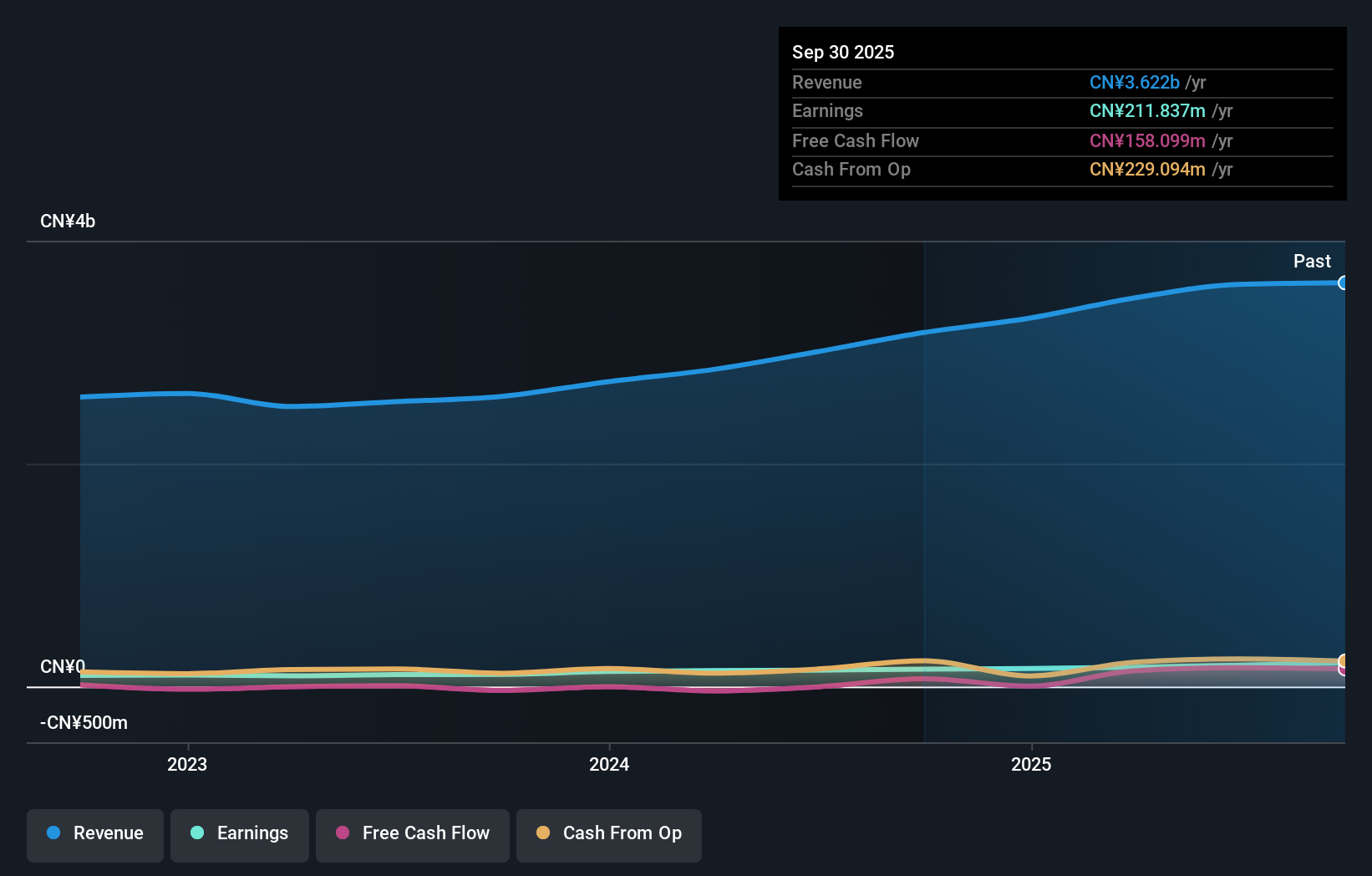

Jiangyin Haida, a nimble player in the rubber and plastic sector, has shown promising financial resilience. Over the past five years, its debt to equity ratio improved from 24% to 15.9%, with a satisfactory net debt to equity of 8.6%. The company reported impressive earnings growth of 41.5% last year, outpacing the industry average by a significant margin. Recent sales figures for nine months ending September 2024 reached CNY 2.35 billion, up from CNY 1.91 billion year-on-year, while net income rose to CNY 116.55 million from CNY 96.34 million previously—demonstrating robust operational performance amidst market volatility.

Nojima (TSE:7419)

Simply Wall St Value Rating: ★★★★★★

Overview: Nojima Corporation operates digital home electronics retail stores both in Japan and internationally, with a market capitalization of approximately ¥225.51 billion.

Operations: Nojima generates revenue primarily through the operation of mobile carrier stores and digital home electronics retail stores, contributing ¥355.45 billion and ¥282.52 billion respectively. The foreign operations segment adds ¥77.95 billion, while the internet business contributes ¥67.77 billion to the overall revenue stream.

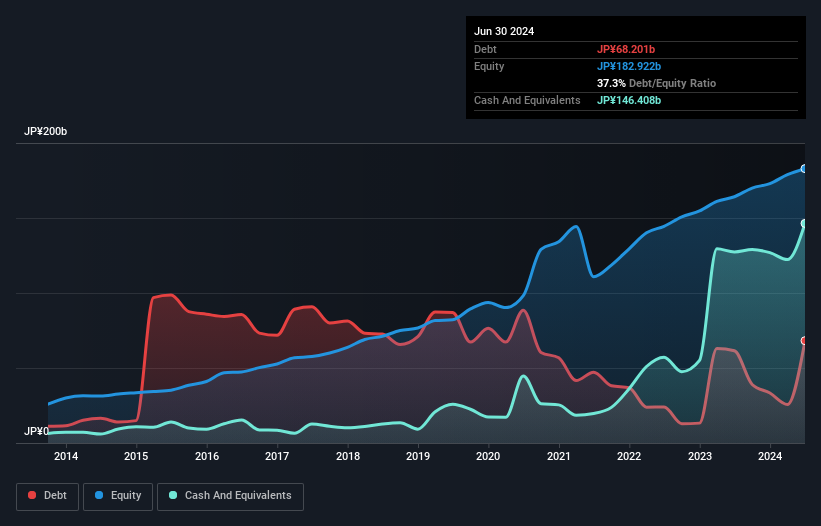

Nojima, a dynamic player in the specialty retail sector, has showcased impressive growth with earnings surging 26.5% over the past year, outpacing industry norms. The company has strategically reduced its debt to equity ratio from 75.3% to 34.2% over five years, indicating robust financial health and disciplined management. Recently, Nojima completed a share buyback of 1,789,500 shares for ¥2.98 billion and increased dividends to ¥18 per share from ¥15 last year. With net income projected at ¥27 billion for fiscal year ending March 2025 and high-quality earnings reported consistently, Nojima presents a compelling investment narrative within its niche market segment.

- Unlock comprehensive insights into our analysis of Nojima stock in this health report.

Assess Nojima's past performance with our detailed historical performance reports.

Taking Advantage

- Click here to access our complete index of 4676 Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nojima might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7419

Nojima

Operates digital home electronics retail stores in Japan and internationally.

Flawless balance sheet established dividend payer.