- Japan

- /

- Retail Distributors

- /

- TSE:4935

A Piece Of The Puzzle Missing From Liberta Co.,Ltd.'s (TSE:4935) 49% Share Price Climb

Liberta Co.,Ltd. (TSE:4935) shareholders would be excited to see that the share price has had a great month, posting a 49% gain and recovering from prior weakness. The last month tops off a massive increase of 147% in the last year.

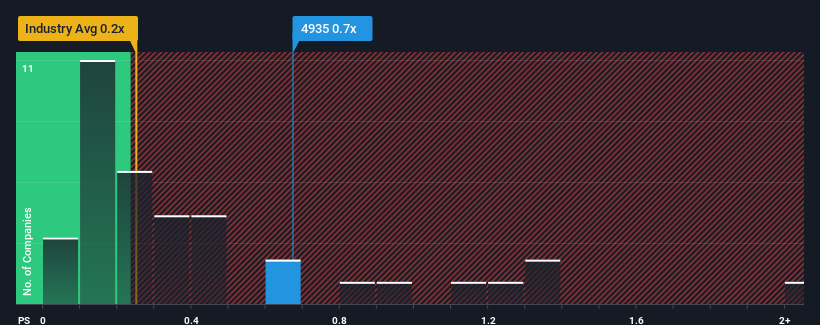

Although its price has surged higher, it's still not a stretch to say that LibertaLtd's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Retail Distributors industry in Japan, where the median P/S ratio is around 0.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for LibertaLtd

What Does LibertaLtd's P/S Mean For Shareholders?

LibertaLtd could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on LibertaLtd.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like LibertaLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 53% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 25% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 4.6%, which is noticeably less attractive.

In light of this, it's curious that LibertaLtd's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From LibertaLtd's P/S?

LibertaLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at LibertaLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you settle on your opinion, we've discovered 3 warning signs for LibertaLtd (2 are significant!) that you should be aware of.

If these risks are making you reconsider your opinion on LibertaLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4935

LibertaLtd

Engages in the planning and sale of beauty products, household and daily miscellaneous goods, and functional clothing products in Japan and internationally.

Slight with imperfect balance sheet.

Market Insights

Community Narratives