Not Many Are Piling Into Rakuten Group, Inc. (TSE:4755) Stock Yet As It Plummets 26%

Rakuten Group, Inc. (TSE:4755) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Longer-term, the stock has been solid despite a difficult 30 days, gaining 18% in the last year.

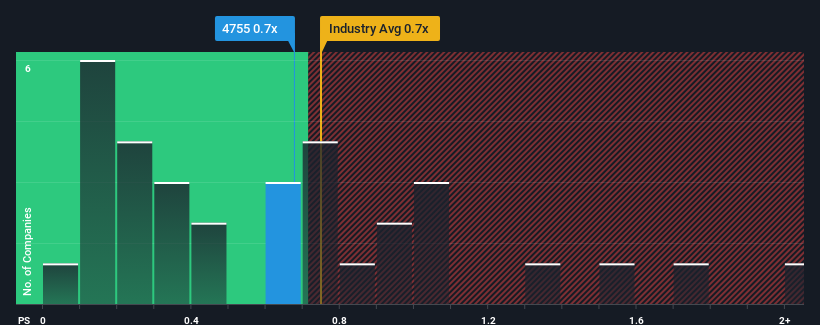

Even after such a large drop in price, there still wouldn't be many who think Rakuten Group's price-to-sales (or "P/S") ratio of 0.7x is worth a mention when it essentially matches the median P/S in Japan's Multiline Retail industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Rakuten Group

What Does Rakuten Group's Recent Performance Look Like?

There hasn't been much to differentiate Rakuten Group's and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rakuten Group.Is There Some Revenue Growth Forecasted For Rakuten Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Rakuten Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.3% last year. This was backed up an excellent period prior to see revenue up by 39% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 8.9% per year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 6.2% per year, which is noticeably less attractive.

With this information, we find it interesting that Rakuten Group is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Following Rakuten Group's share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Rakuten Group's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 1 warning sign for Rakuten Group that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives