Even though World Co., Ltd.'s (TSE:3612) recent earnings release was robust, the market didn't seem to notice. We think that investors have missed some encouraging factors underlying the profit figures.

Check out our latest analysis for World

Zooming In On World's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

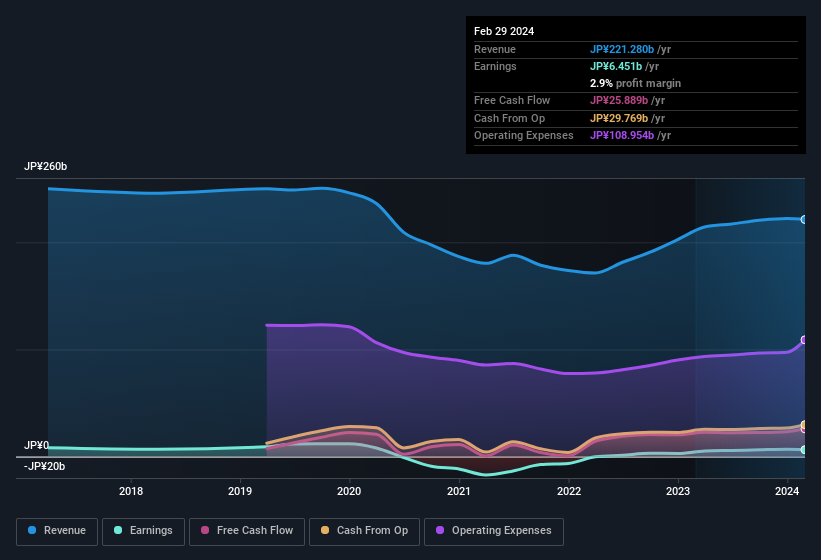

For the year to February 2024, World had an accrual ratio of -0.14. That implies it has good cash conversion, and implies that its free cash flow solidly exceeded its profit last year. In fact, it had free cash flow of JP¥26b in the last year, which was a lot more than its statutory profit of JP¥6.45b. World's free cash flow improved over the last year, which is generally good to see.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On World's Profit Performance

As we discussed above, World has perfectly satisfactory free cash flow relative to profit. Based on this observation, we consider it likely that World's statutory profit actually understates its earnings potential! And the EPS is up 46% over the last twelve months. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of World.

This note has only looked at a single factor that sheds light on the nature of World's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade World, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if World might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3612

World

Through its subsidiaries, plans, manufactures, retails, sells, and imports/exports apparel and fashion products in Japan and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives