- Japan

- /

- Specialty Stores

- /

- TSE:3186

3 Japanese Growth Companies With High Insider Ownership And Up To 18% Revenue Growth

Reviewed by Simply Wall St

Amid recent political developments and shifts in monetary policy, Japan's stock markets have experienced some volatility, with indices like the Nikkei 225 and TOPIX registering declines. As investors navigate these changes, growth companies with high insider ownership are often considered attractive due to their potential for alignment between management and shareholder interests, particularly when they demonstrate strong revenue growth.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 26.1% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 38.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Inforich (TSE:9338) | 19.1% | 29.5% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

| freee K.K (TSE:4478) | 23.9% | 74.1% |

Let's take a closer look at a couple of our picks from the screened companies.

NEXTAGE (TSE:3186)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NEXTAGE Co., Ltd. operates in Japan, focusing on the sale of new and used cars, with a market cap of ¥118.85 billion.

Operations: Revenue Segments (in millions of ¥):

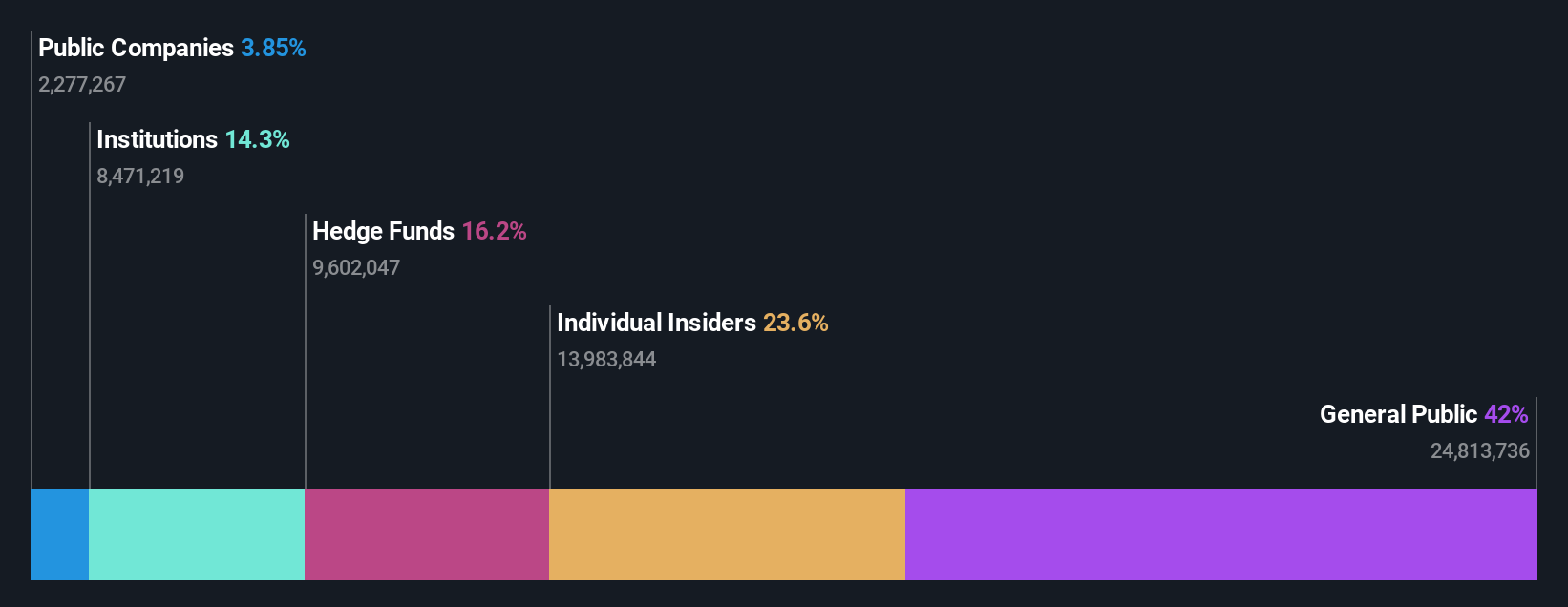

Insider Ownership: 38.3%

Revenue Growth Forecast: 11.4% p.a.

NEXTAGE is poised for substantial growth with earnings expected to rise significantly at 23.7% annually, outpacing the Japanese market. Despite a volatile share price and declining profit margins, it trades well below its estimated fair value. Revenue growth of 11.4% per year surpasses the market average but remains under 20%. The company faces challenges with debt coverage and dividend sustainability, while insider trading activity has been minimal recently.

- Navigate through the intricacies of NEXTAGE with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, NEXTAGE's share price might be too pessimistic.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥169.44 billion.

Operations: Revenue Segments (in millions of ¥): The company generates revenue primarily through its cloud-based accounting and HR software solutions in Japan.

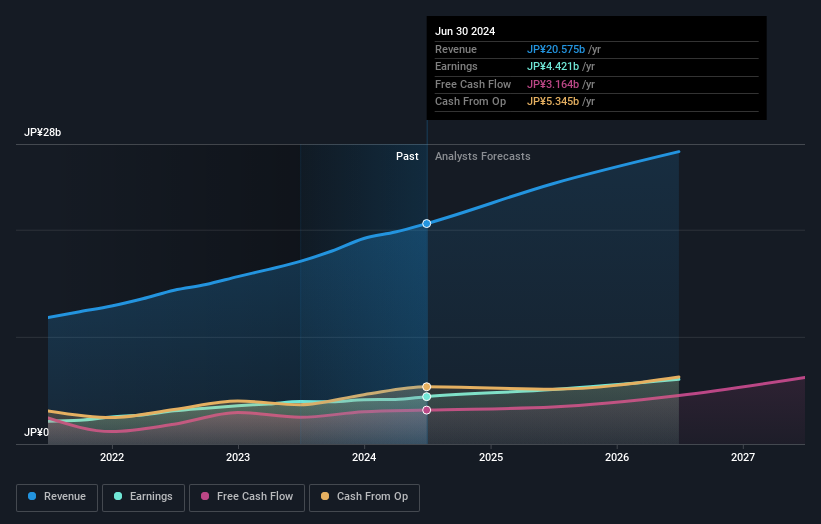

Insider Ownership: 23.9%

Revenue Growth Forecast: 18.2% p.a.

freee K.K. is set for strong growth with expected earnings increases of 74.08% annually, surpassing market averages, and revenue growth forecast at 18.2% per year. Trading significantly below its estimated fair value, the company anticipates profitability within three years. Recent leadership changes include Yasuhiro Kimura's appointment as CPO to drive product strategies further. Despite share price volatility, insider trading activity has been minimal recently, indicating stability in insider sentiment.

- Click here and access our complete growth analysis report to understand the dynamics of freee K.K.

- Our expertly prepared valuation report freee K.K implies its share price may be lower than expected.

KeePer Technical Laboratory (TSE:6036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: KeePer Technical Laboratory Co., Ltd. operates in Japan, focusing on the development, manufacturing, and sale of car coatings, car washing chemicals and equipment, with a market cap of ¥117.22 billion.

Operations: Revenue segments for TSE:6036 include car coatings, car washing chemicals, and equipment sales in Japan.

Insider Ownership: 29.6%

Revenue Growth Forecast: 15.5% p.a.

KeePer Technical Laboratory is experiencing robust growth, with earnings projected to rise 15.88% annually, outpacing the Japanese market average. The company is trading at a substantial discount to its estimated fair value and has shown consistent revenue increases, including a 12.3% year-over-year sales boost in August 2024. Recent expansions include new store openings in strategic locations like Nagoya and Tokyo, enhancing its market presence without significant insider trading activity reported recently.

- Click here to discover the nuances of KeePer Technical Laboratory with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that KeePer Technical Laboratory is trading beyond its estimated value.

Make It Happen

- Delve into our full catalog of 101 Fast Growing Japanese Companies With High Insider Ownership here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NEXTAGE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3186

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives