- Japan

- /

- Oil and Gas

- /

- TSE:5021

3 Leading Japanese Dividend Stocks Yielding Up To 4.1%

Reviewed by Simply Wall St

Japan's stock markets recently experienced sharp declines following political developments, with the Nikkei 225 Index and TOPIX Index registering significant losses. Despite this volatility, dividend stocks remain an attractive option for investors seeking stable income streams, especially in uncertain market conditions. A good dividend stock typically offers a reliable payout history and strong fundamentals, making it a potential anchor in a fluctuating economic landscape.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.14% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.95% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.00% | ★★★★★★ |

| Kondotec (TSE:7438) | 3.74% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.27% | ★★★★★★ |

| CMC (TSE:2185) | 3.75% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.53% | ★★★★★★ |

Click here to see the full list of 444 stocks from our Top Japanese Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

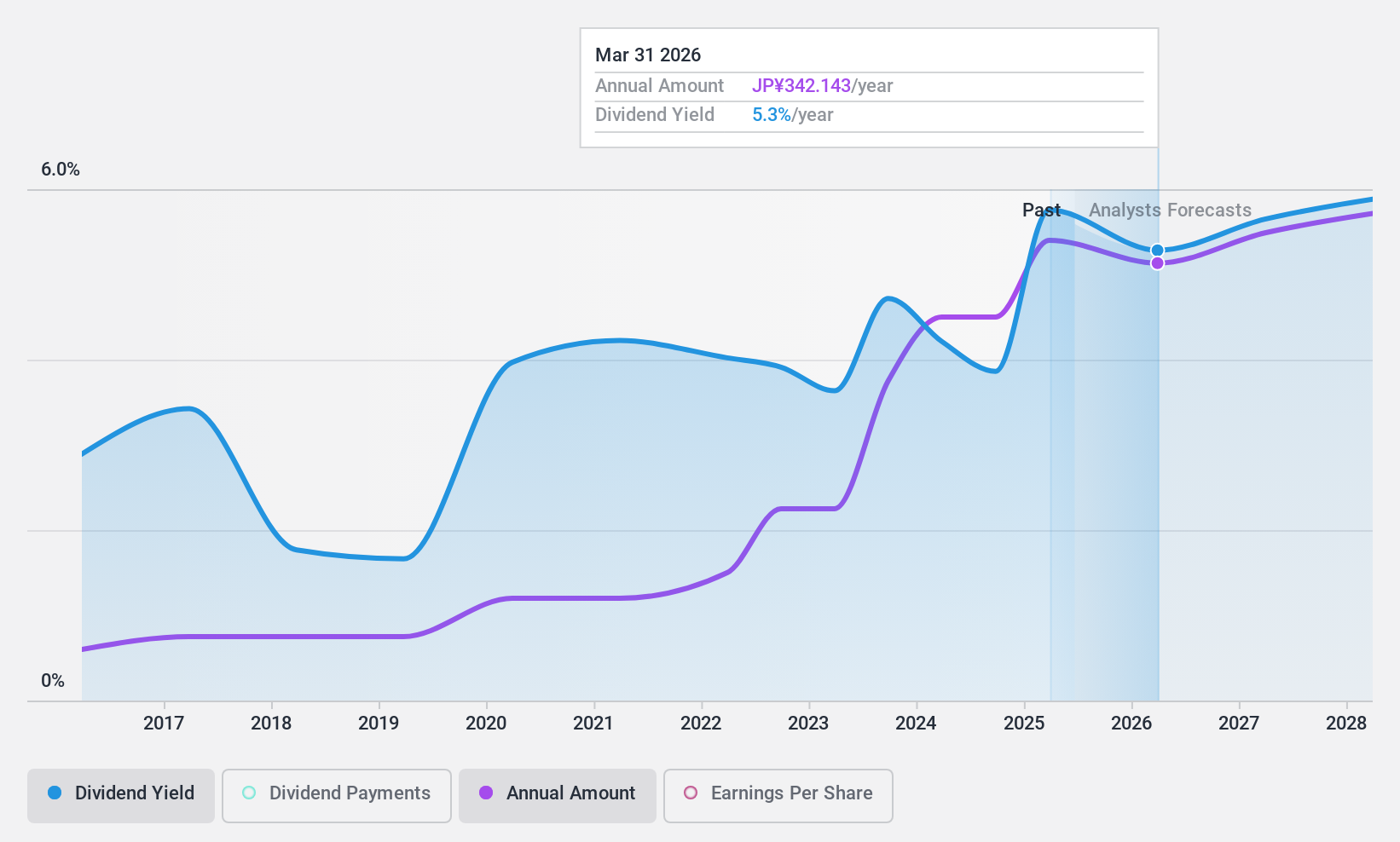

Cosmo Energy Holdings (TSE:5021)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cosmo Energy Holdings Co., Ltd. operates in the oil industry both in Japan and internationally through its subsidiaries, with a market cap of approximately ¥728.33 billion.

Operations: Cosmo Energy Holdings Co., Ltd. generates revenue primarily from its Petroleum segment at ¥2.49 billion, followed by the Petrochemical Business at ¥346.26 million, and Oil Exploration and Production at ¥121.91 million, with additional contributions from its Renewable Energy Business totaling ¥13.81 million.

Dividend Yield: 3.5%

Cosmo Energy Holdings offers a reliable dividend yield of 3.53%, supported by a low payout ratio of 24.9% and a cash payout ratio of 25.3%, indicating dividends are well-covered by earnings and cash flows. Despite trading at 41.9% below its estimated fair value, the company has high debt levels but has become profitable this year. Recent share buybacks totaling ¥14.35 billion may enhance shareholder value further, complementing its stable dividend history over the past decade.

- Navigate through the intricacies of Cosmo Energy Holdings with our comprehensive dividend report here.

- Our valuation report here indicates Cosmo Energy Holdings may be undervalued.

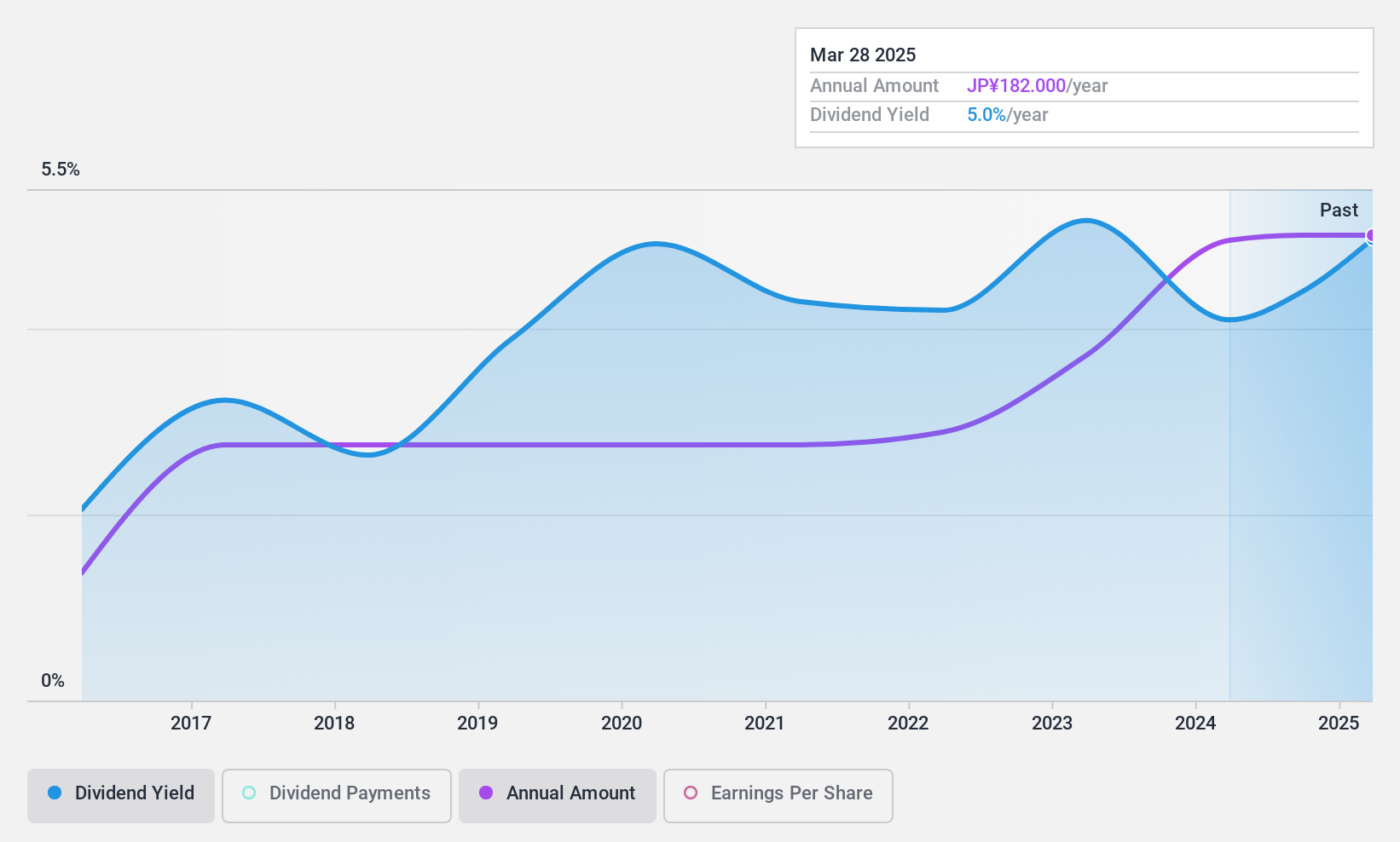

Toyo Kanetsu K.K (TSE:6369)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyo Kanetsu K.K. operates in plant and machinery, material handling systems, and other businesses across Japan, Southeast Asia, and internationally with a market cap of ¥33.48 billion.

Operations: Toyo Kanetsu K.K. generates revenue through its operations in plant and machinery as well as material handling systems across various regions including Japan and Southeast Asia.

Dividend Yield: 4.2%

Toyo Kanetsu K.K. offers a dividend yield of 4.19%, ranking it in the top 25% of Japanese dividend payers, though its dividends have been volatile over the past decade. The company announced a decrease in year-end dividends to ¥132 per share for fiscal 2025 from ¥229 previously, despite earnings growth and a low payout ratio of 35.6%. However, dividends are not covered by free cash flow due to lack thereof, raising sustainability concerns.

- Get an in-depth perspective on Toyo Kanetsu K.K's performance by reading our dividend report here.

- The analysis detailed in our Toyo Kanetsu K.K valuation report hints at an inflated share price compared to its estimated value.

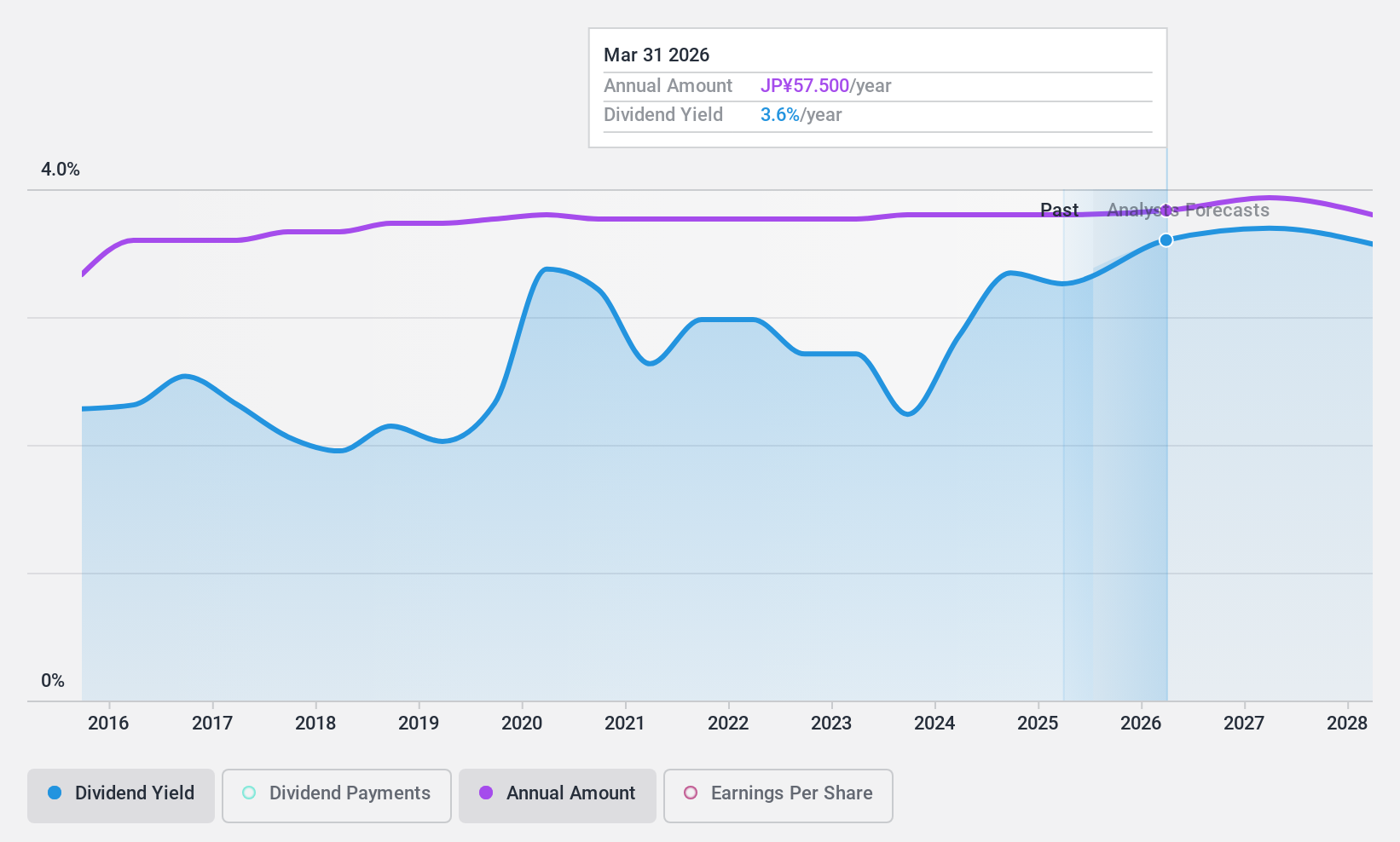

Daiichikosho (TSE:7458)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daiichikosho Co., Ltd. operates in Japan, focusing on the sale and rental of commercial karaoke systems, with a market cap of ¥193.60 billion.

Operations: Daiichikosho Co., Ltd.'s revenue is primarily derived from its Karaoke and Restaurant Business, generating ¥65.50 billion, followed by Commercial Karaoke at ¥61.10 billion, and Music Soft contributing ¥6.50 billion.

Dividend Yield: 3.1%

Daiichikosho maintains stable dividend payments, with a 10-year history of reliability and growth. Despite a low payout ratio of 48.6%, dividends are not covered by free cash flow, raising sustainability concerns. The company offers a dividend yield of 3.09%, below the top tier in Japan. Recent buybacks totaling ¥3.10 billion reflect strategic capital allocation, though the stock's removal from the FTSE All-World Index may impact investor sentiment.

- Delve into the full analysis dividend report here for a deeper understanding of Daiichikosho.

- Our comprehensive valuation report raises the possibility that Daiichikosho is priced lower than what may be justified by its financials.

Next Steps

- Reveal the 444 hidden gems among our Top Japanese Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5021

Cosmo Energy Holdings

Through its subsidiaries, engages in the oil business in Japan and internationally.

Solid track record established dividend payer.

Market Insights

Community Narratives