Treasure Factory (TSE:3093) Valuation Gap Challenges Bearish Narratives Despite Margins Slightly Below Last Year

Reviewed by Simply Wall St

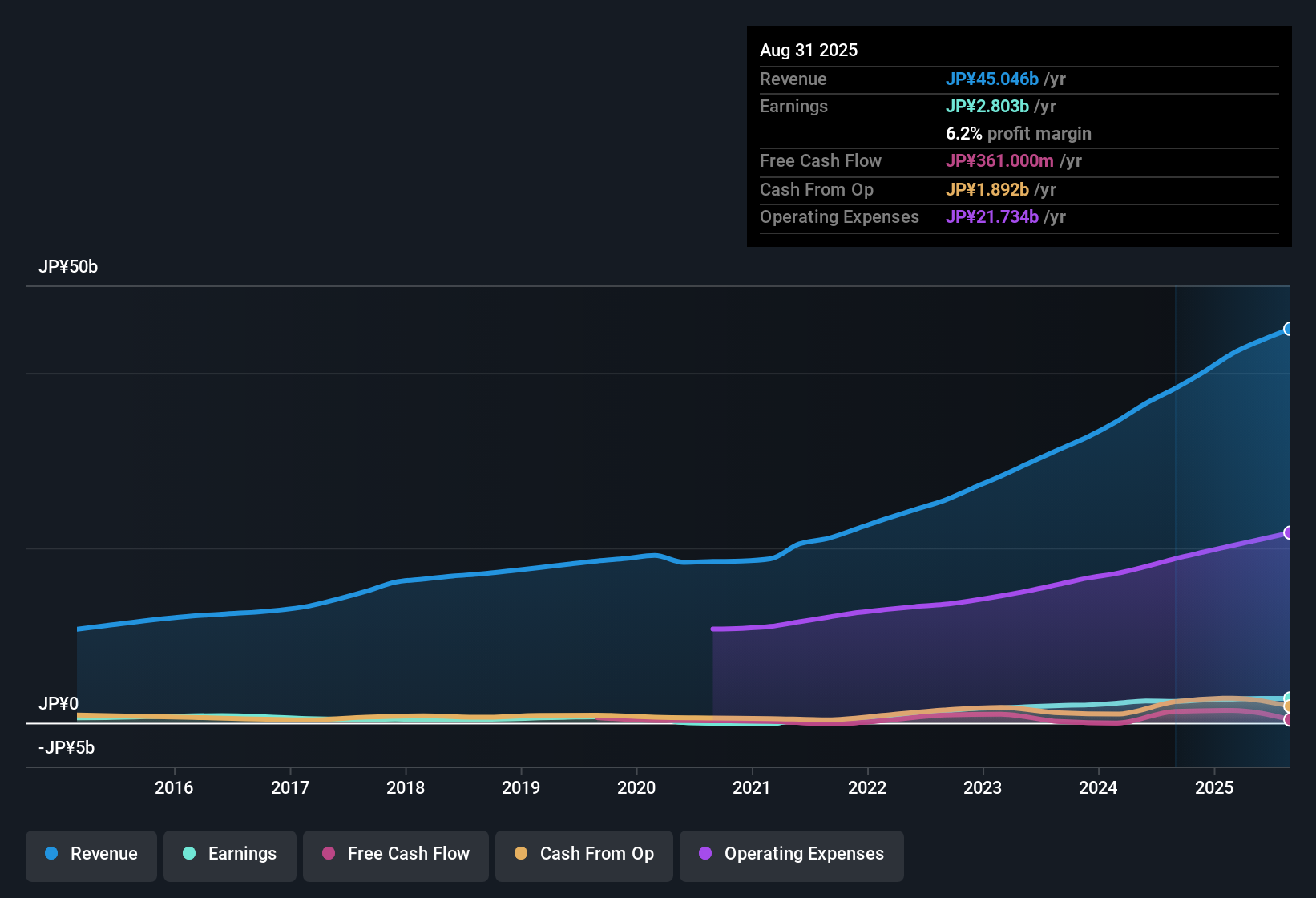

Treasure Factory Ltd. (TSE:3093) is set to deliver revenue growth of 8.9% per year and earnings growth of 12.1%, both handily outpacing the broader Japanese market forecasts. At a current net profit margin of 6.2%, just below last year’s 6.4%, the company maintains solid profitability while its earnings per share are forecast to climb at 12.09% annually. These results, along with a Price-to-Earnings Ratio of 13.8x and a share price of ¥1,650 trading well below the estimated fair value, support a picture of strong value and ongoing growth momentum for investors.

See our full analysis for Treasure FactoryLTD.Now let’s see how these headline results compare with the narratives that have shaped market expectations. Investors can look forward to some confirmation and a few potential surprises.

Curious how numbers become stories that shape markets? Explore Community Narratives

Five-Year Earnings Surge Outpaces Peers

- Historical earnings growth averaged a rapid 44.7% per year over the past five years, a pace that far exceeds recent performance and market norms.

- Recent performance heavily supports the view that Treasure Factory’s earnings growth is more than a one-off:

- The 12.1% annual earnings growth forecast stands well above the Japanese market average of just 8.1% per year, directly echoing the optimism that ongoing digital initiatives and sector tailwinds are long-term positives.

- However, the most recent year saw earnings rise by 14.3%, down from the multi-year average. This shows momentum has moderated but not stalled, which matches the prevailing analysis that Treasure Factory remains ahead of peers but will not see sky-high growth rates every year.

Net Margins Hold Despite Minor Slippage

- The company’s net profit margin is at 6.2%, just under last year’s 6.4%, signaling stable operating efficiency even as growth decelerates.

- There is little evidence here of the margin drag that often worries investors, because:

- Margins have only dipped moderately and still sit well above many multi-line retail sector averages, challenging cautious views that intensified competition or digital investment would erode profitability faster.

- The prevailing market perspective suggests online expansion carries execution risk, but so far the small margin drop accompanies healthy growth, rather than signaling trouble. This fact is not widely acknowledged by skeptics.

Shares Trade at a Substantial Discount to DCF Fair Value

- The current share price of ¥1,650 stands significantly below the estimated DCF fair value of ¥2,145.43, and the Price-to-Earnings Ratio of 13.8x trails both the multi-line retail industry average (17.9x) and peer average (68.7x).

- This valuation gap underpins the view that Treasure Factory offers strong value to investors:

- The discount against DCF and peer multiples backs up analysis that positive growth outlook and sector momentum have not fully translated into the share price, with investors yet to price in longer-term upside.

- Despite impressive growth metrics and industry trends favoring sustainability and digital retail, shares remain undervalued even as broader market participants increasingly recognize the company’s execution strengths.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Treasure FactoryLTD's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Treasure Factory’s impressive value and rapid multi-year growth, the recent slowdown in earnings and minor margin dip suggest less consistent performance may lie ahead.

If you want to focus on reliable steadiness, check out stable growth stocks screener to spot companies demonstrating consistent earnings and revenue expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Treasure FactoryLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3093

Treasure FactoryLTD

Engages in the development and operation of reuse stores in Japan.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives