- Japan

- /

- Specialty Stores

- /

- TSE:3092

ZOZO (TSE:3092): Fresh Perspectives on Valuation as Investor Sentiment Shifts

Reviewed by Simply Wall St

ZOZO (TSE:3092) has caught the attention of investors lately as the stock continues to show some price movement this week. With a track record of steady revenue and net income growth, market watchers are eyeing upcoming trends.

See our latest analysis for ZOZO.

After a steady run, ZOZO's share price has pulled back over the past quarter but remains well ahead over the longer term. A 57% five-year total shareholder return signals sustained value creation and growing investor confidence.

If you want to see what other companies have been quietly outperforming, this is a great time to discover fast growing stocks with high insider ownership

Yet with shares off their highs despite robust long-term returns, the question now is whether investors are overlooking value in ZOZO, or if the current price already reflects expectations for further growth ahead.

Most Popular Narrative: 9.5% Undervalued

ZOZO's latest closing price of ¥1,333.50 is compared by the most widely followed narrative to a fair value of ¥1,473.44. This suggests a price lag and investor skepticism, even as revenue projections have been upgraded and margin expectations have dipped. This forms the basis for why some analysts believe the potential for future growth has not been fully reflected in the current price.

Integration of LYST is expected to expand ZOZO's customer base and international reach. By leveraging global e-commerce growth and the ongoing shift of apparel purchases to online platforms, this move could drive higher GMV and revenue growth over time.

Want to know what's fueling this confidence? The narrative hinges on ambitious revenue acceleration, profit margins beyond the industry norm, and bold future earnings multiples. Curious about the assumptions and projections supporting that higher fair value? Explore the calculations and drivers that could put ZOZO in a different league.

Result: Fair Value of ¥1,473.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ZOZO's over-reliance on the domestic market and rising promotional costs could challenge its ability to sustain growth and margins in the future.

Find out about the key risks to this ZOZO narrative.

Another View: Is ZOZO Trading at a Premium?

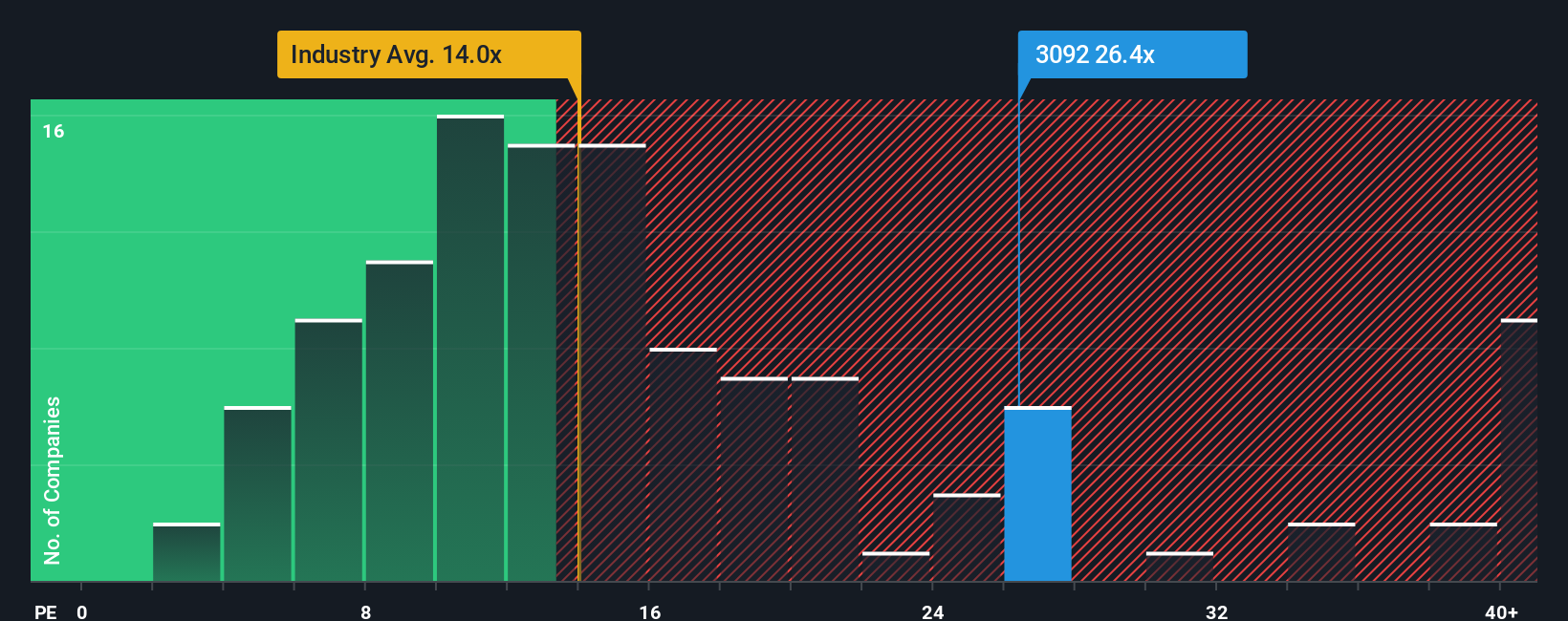

While the fair value model points to ZOZO being undervalued, a look at its price-to-earnings ratio tells a different story. At 26.1x, ZOZO trades well above the Japanese specialty retail industry average of 13.7x and the peer average of 20.8x, and even higher than its fair ratio of 21x. This premium could mean investors are banking on continued outperformance, or that there is limited room for future upside unless growth truly accelerates. Is the optimism justified, or could expectations be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ZOZO Narrative

If you have a different perspective or want to dig into the numbers yourself, it's easy to build your own story about ZOZO in just a few minutes. Do it your way

A great starting point for your ZOZO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Push beyond the obvious and spot unique investment opportunities many overlook. The next standout stock could be just a strategy away, so let your instincts guide you before smart money moves in.

- Amplify your returns with hidden gems by tapping into these 840 undervalued stocks based on cash flows delivering strong cash flow for tomorrow’s leaders.

- Benefit from breakthrough medical innovations. Find proven winners among these 33 healthcare AI stocks transforming patient care and health technology.

- Capture growth from the rise of digital assets by acting early with these 81 cryptocurrency and blockchain stocks that are powering the future of decentralized finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZOZO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3092

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives