- Japan

- /

- Specialty Stores

- /

- TSE:3092

Is ZOZO Fairly Priced After a 16% Drop in 2025?

Reviewed by Bailey Pemberton

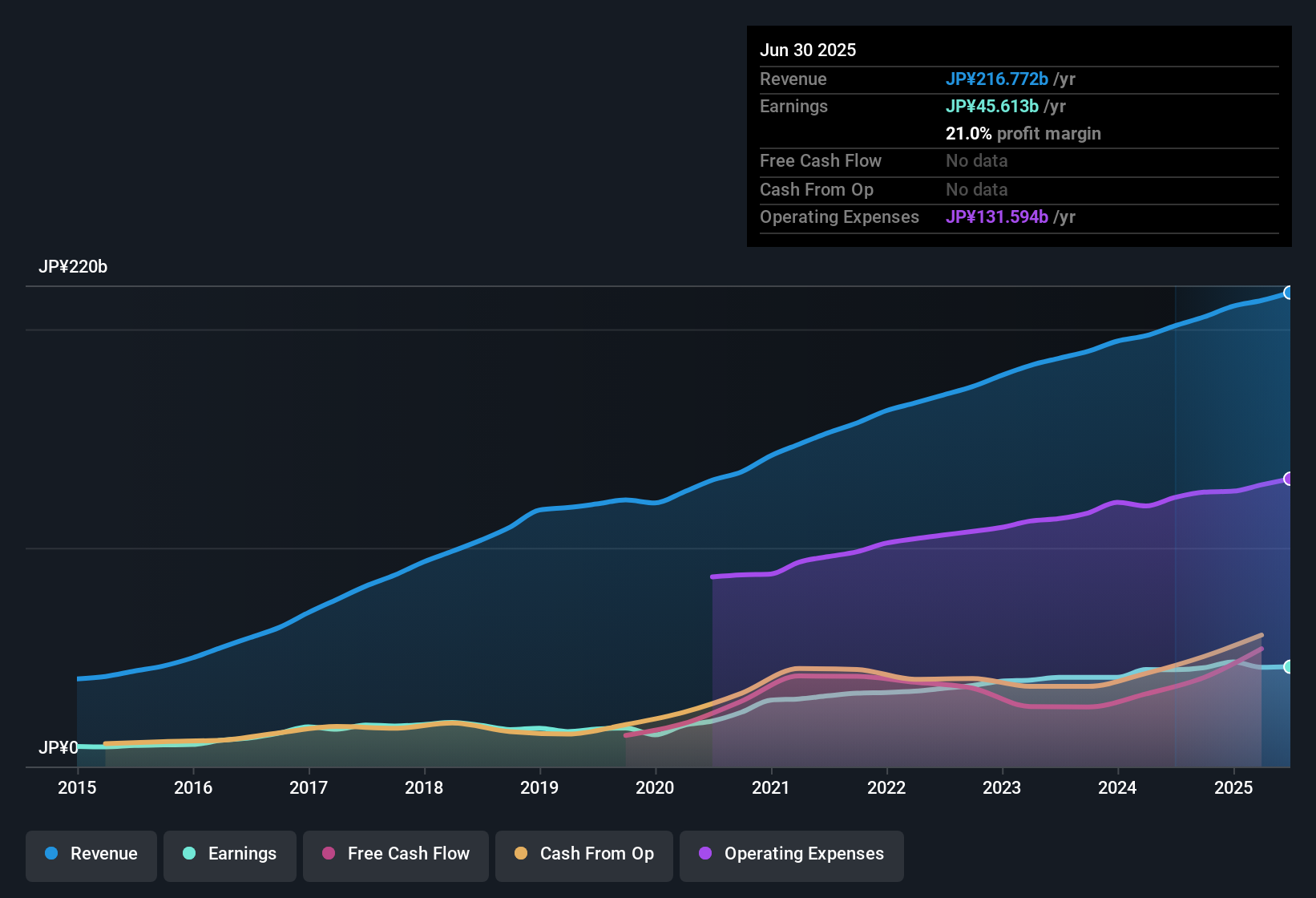

If you are considering what to do with your ZOZO shares right now, you are not alone. Investors are taking a close look at this Japanese e-commerce leader after a stretch of uneven performance. There is no denying the excitement around ZOZO’s longer-term record, with the stock up 70.1% over the last five years and climbing 40.4% over three. However, more recent returns have been less inspiring. Over the past year, ZOZO’s share price has fallen 16.2%, a trend that continued into this year with another 16.0% drop year-to-date despite a small 3.9% bounce in the last week.

This change in momentum has plenty of people wondering if the market’s mood on ZOZO is shifting, or if these dips are simply a result of broader sector jitters and evolving investor risk appetites. Notably, ZOZO has kept up its push into new digital offerings and has made headlines with several platform upgrades aimed at enhancing its user experience. While these moves demonstrate the company’s commitment to innovation, they have not triggered a sustained positive response in the share price just yet.

With volatility in the rearview mirror and fresh business initiatives in progress, it is time to revisit the key question every ZOZO investor faces right now: is the stock undervalued, or is the current price justified? According to standard valuation checks, ZOZO’s valuation score currently stands at 0 out of 6, meaning the company does not appear undervalued on any of the major metrics we track. Still, just looking at the numbers never tells the whole story. Let us break down these valuation methods, and stick around for an even sharper way to judge ZOZO’s worth before you make your next move.

ZOZO scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ZOZO Discounted Cash Flow (DCF) Analysis

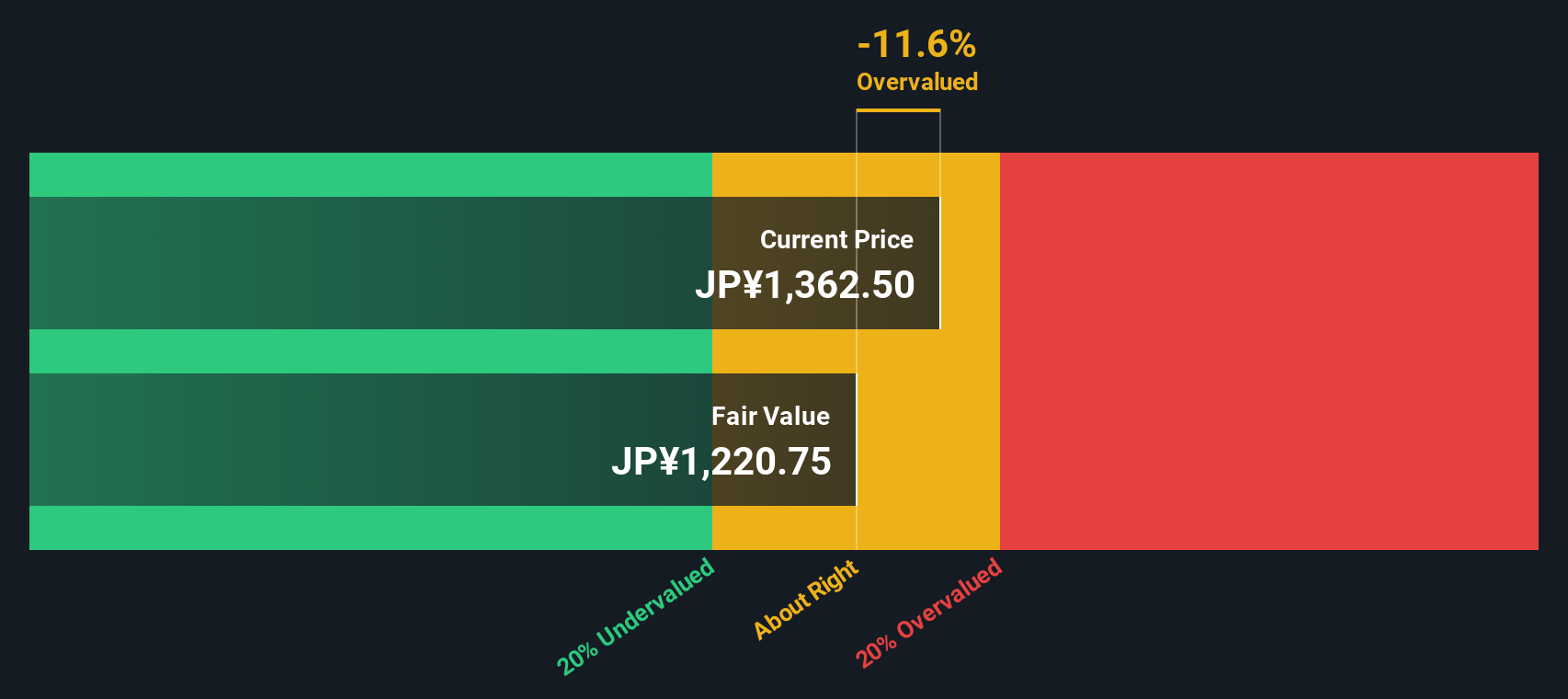

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them back to present value, giving us an estimate of the stock's true worth based on expected long-term performance. For ZOZO, the DCF model starts with the latest twelve months Free Cash Flow, which stands at ¥51.3 billion. Analysts expect cash flows to grow over the next few years, with projections rising to ¥62.3 billion by 2030. These projections come from analysts for the first five years, and further estimates are extrapolated through industry models.

After discounting each year’s estimated cash flow to today’s value, the DCF analysis calculates ZOZO’s estimated intrinsic value at ¥1,223 per share. This figure is about 9.7% above the current share price, so ZOZO stock appears to be trading just slightly above what the DCF model suggests it is worth.

Based on this modest premium, ZOZO is not dramatically overvalued or undervalued according to this method. For long-term investors, the stock’s current price is very close to its fair value derived from future cash flow expectations.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out ZOZO's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: ZOZO Price vs Earnings (PE)

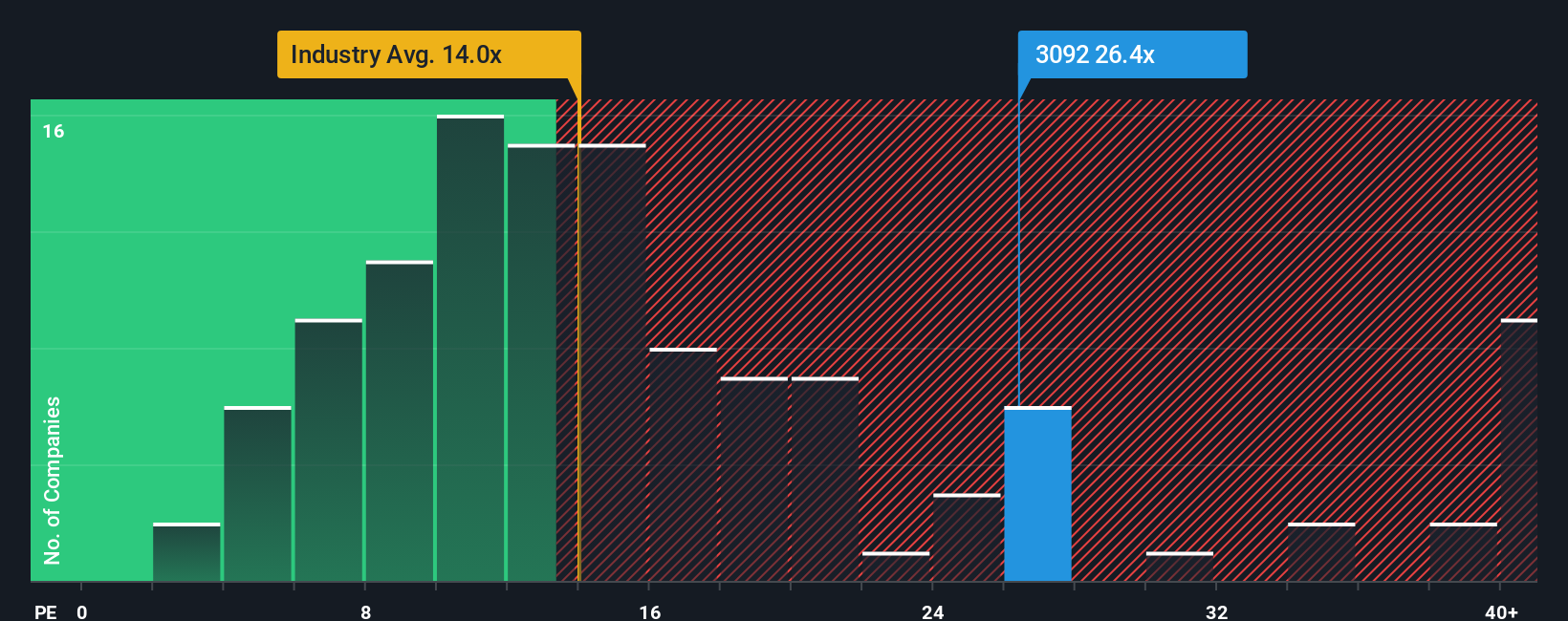

The Price-to-Earnings (PE) ratio is a go-to valuation tool for profitable companies like ZOZO, since it compares the company’s current share price to its earnings. A higher PE often reflects stronger long-term growth expectations or a lower perceived risk, while a lower PE can signal either limited growth, higher risk, or undervaluation. What makes a “normal” or “fair” PE depends on how fast a company is growing, its profit stability, and the overall risk investors see in its industry.

ZOZO’s current PE ratio sits at 26x, noticeably ahead of the Specialty Retail industry average of 14x and also higher than the peer group average of 21x. On the surface, this suggests the market may be pricing in premium growth, profitability or other positive features relative to similar companies.

To fine-tune this comparison, Simply Wall St calculates a “Fair Ratio,” which is a custom PE multiple that factors in ZOZO’s growth outlook, risk profile, margins, industry trends and size. This approach goes beyond simple peer or industry averages by accounting for elements that can otherwise distort fair value. In ZOZO’s case, the Fair Ratio is 20.8x, just below the actual 26x multiple. The gap is less than 0.10 in absolute terms, indicating the stock’s current price levels are in line with what you would expect from a rational, data-driven perspective.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ZOZO Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is the story that you build around a company like ZOZO, combining your perspective on its future with the numbers behind your forecast: your assumptions about its revenue, earnings, and margins. This process helps you arrive at a personal fair value. Rather than relying solely on standard metrics, Narratives spark a much deeper connection between the company's evolving story, its financial outlook, and what you think its shares are really worth today.

This approach is easy and accessible to everyone using Simply Wall St’s platform, found on each company’s Community page that is used by millions of investors. By building or following a Narrative, you can see at a glance how your view (or others’ views) compares to the current market price. This makes it far clearer when the share price looks attractive or signals caution. Importantly, Narratives update dynamically as new news and earnings get released, so your outlook always reflects the latest information.

For instance, when it comes to ZOZO right now, some investors’ Narratives suggest a bullish fair value of ¥2,100 per share while others feel a more cautious ¥1,000 is justified, all based on their different views of ZOZO’s growth, risks, and industry outlook.

Do you think there's more to the story for ZOZO? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZOZO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3092

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives