- Hong Kong

- /

- Transportation

- /

- SEHK:2643

Asian Value Stock Picks That Investors Might Be Overlooking

Reviewed by Simply Wall St

As global markets navigate volatility and geopolitical tensions, the Asian stock markets have shown mixed performance, with Japan's yen strength impacting exporters and China's economic challenges persisting amid trade tensions with the U.S. In this environment, identifying undervalued stocks can be a strategic move for investors seeking opportunities in Asia; these stocks often possess strong fundamentals or growth potential that may not yet be reflected in their current market prices.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Century Huatong GroupLtd (SZSE:002602) | CN¥19.10 | CN¥38.01 | 49.7% |

| Tongguan Gold Group (SEHK:340) | HK$2.75 | HK$5.49 | 49.9% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥39.50 | CN¥76.84 | 48.6% |

| Teikoku Sen-i (TSE:3302) | ¥3410.00 | ¥6729.50 | 49.3% |

| TaewoongLtd (KOSDAQ:A044490) | ₩31100.00 | ₩61902.66 | 49.8% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.37 | CN¥26.43 | 49.4% |

| Kinsus Interconnect Technology (TWSE:3189) | NT$146.50 | NT$285.68 | 48.7% |

| Insource (TSE:6200) | ¥937.00 | ¥1811.07 | 48.3% |

| HD Hyundai Construction Equipment (KOSE:A267270) | ₩104000.00 | ₩201910.55 | 48.5% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.07 | CN¥54.10 | 50% |

Let's explore several standout options from the results in the screener.

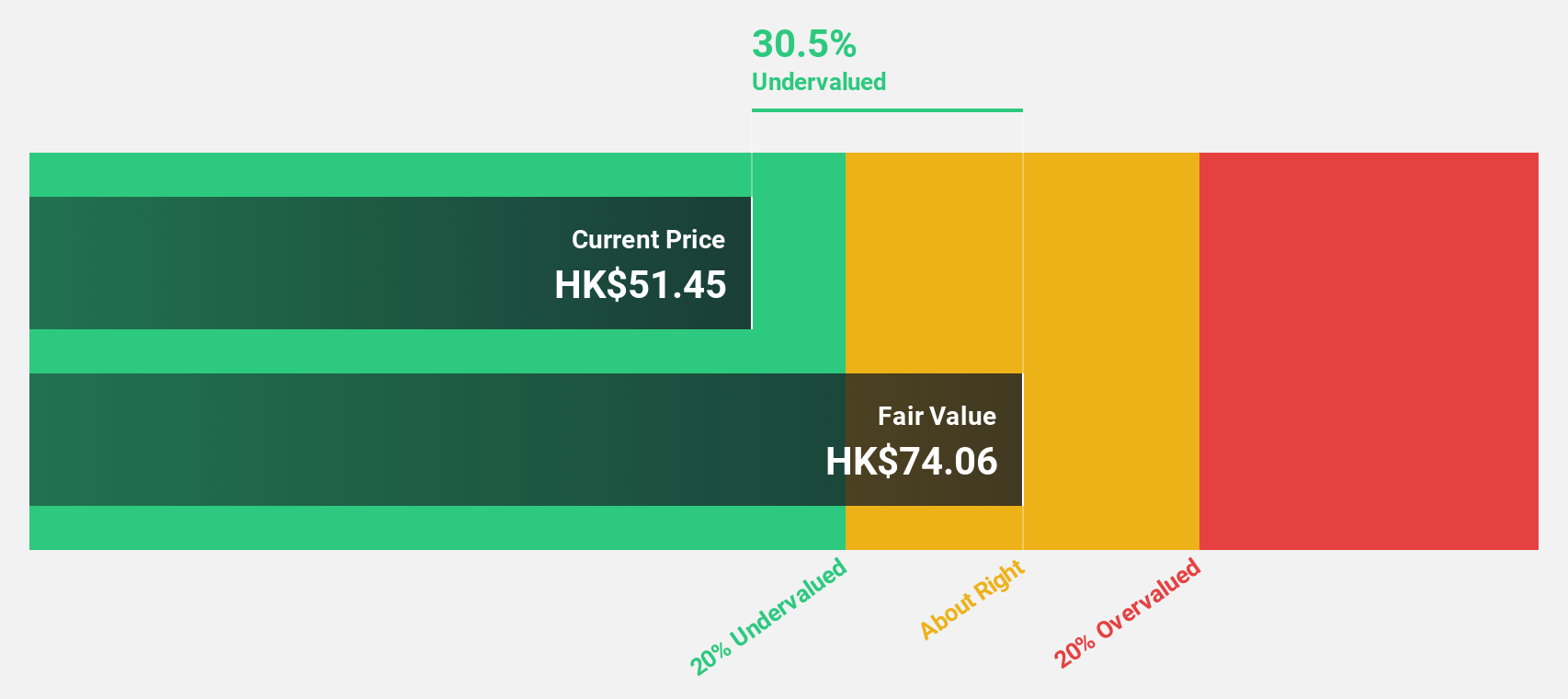

CaoCao (SEHK:2643)

Overview: CaoCao Inc. operates as a ride-hailing platform in China with a market cap of HK$27.78 billion.

Operations: The company's revenue is derived from its operations in the transportation sector, specifically railroads, amounting to CN¥17.95 billion.

Estimated Discount To Fair Value: 31.1%

CaoCao Inc. is trading at HK$51, significantly below its estimated fair value of HK$74.01, indicating it may be undervalued based on cash flows. Despite recent volatility in share price and negative shareholders' equity, the company's revenue is forecast to grow at 25.9% annually, outpacing the Hong Kong market's growth rate of 8.6%. Earnings are projected to increase by 95.85% per year, suggesting strong future profitability potential despite current financial challenges.

- The analysis detailed in our CaoCao growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of CaoCao stock in this financial health report.

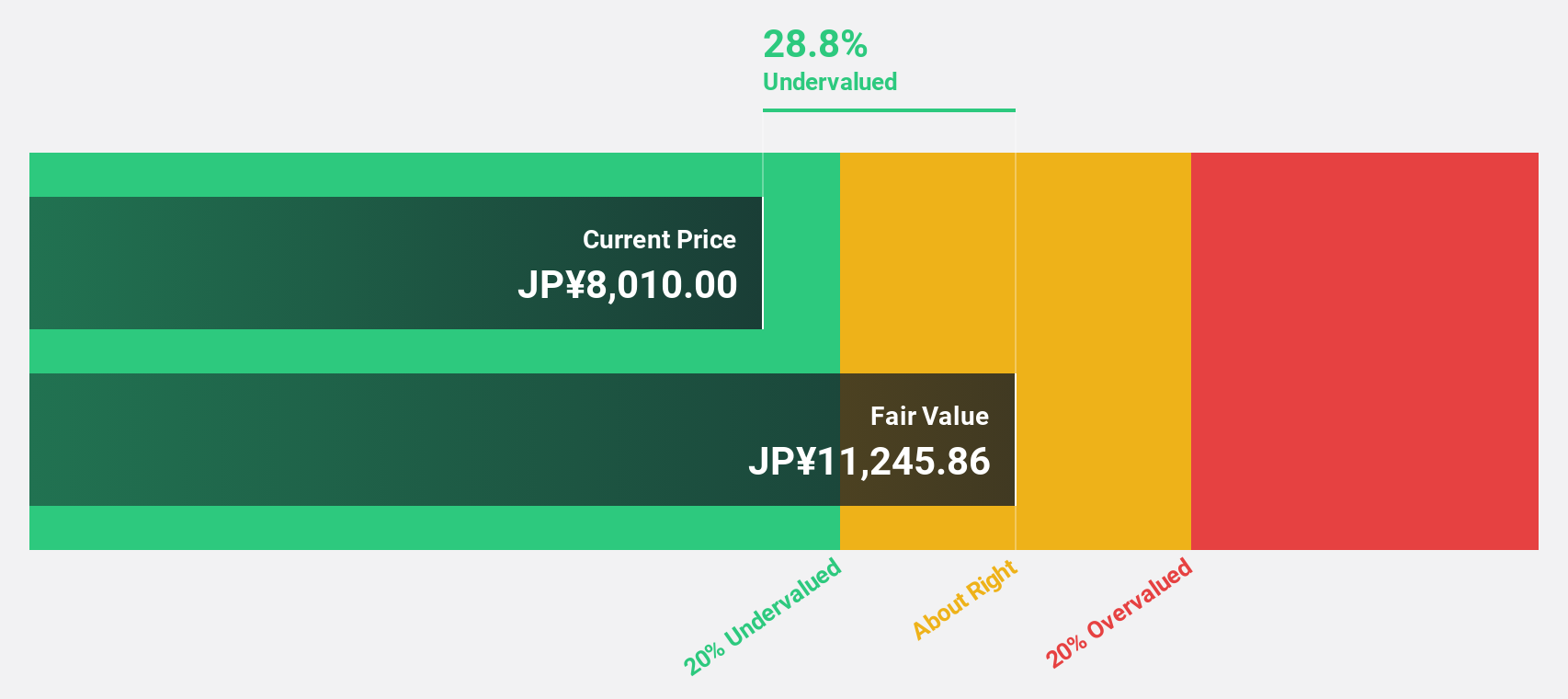

JINS HOLDINGS (TSE:3046)

Overview: JINS HOLDINGS Inc. operates through its subsidiaries in the planning, manufacturing, sales, and import/export of eyewear both in Japan and internationally with a market cap of ¥193.27 billion.

Operations: The company's revenue is primarily derived from its Domestic Eye Wear Business, contributing ¥77.93 billion, and its Overseas Eyewear Business, which adds ¥20.65 billion.

Estimated Discount To Fair Value: 26.1%

JINS HOLDINGS, trading at ¥8,280, is significantly below its estimated fair value of ¥11,204.89. The company's earnings grew by 78.3% last year and are projected to rise 9.5% annually, outpacing the Japanese market's growth rate of 8%. Despite recent share price volatility and a modest revenue growth forecast of 7.3%, JINS remains undervalued based on cash flows with strong profit potential supported by solid sales performance in Japan and expansion into the Philippines.

- In light of our recent growth report, it seems possible that JINS HOLDINGS' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in JINS HOLDINGS' balance sheet health report.

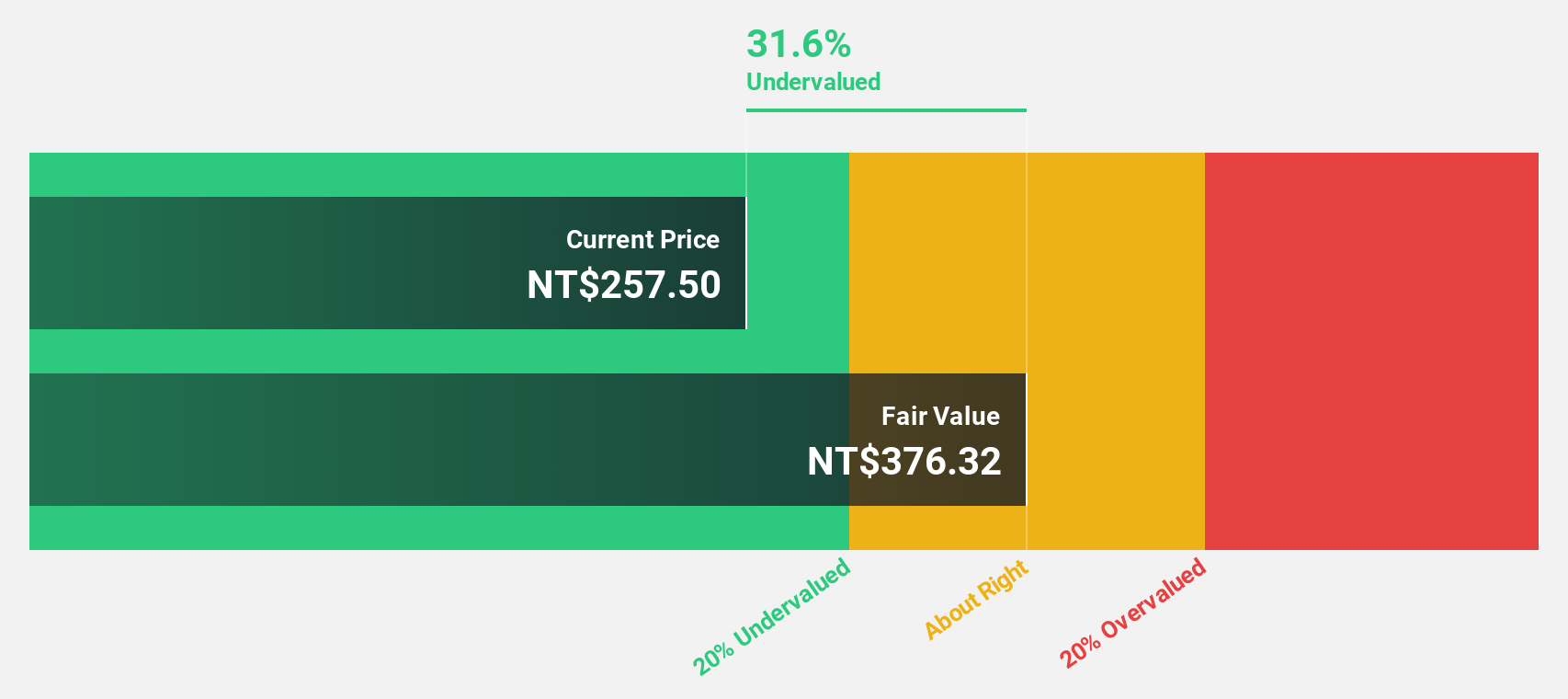

Elite Advanced Laser (TWSE:3450)

Overview: Elite Advanced Laser Corporation offers electronic manufacturing services in Taiwan and has a market cap of NT$38.68 billion.

Operations: The company's revenue is derived from three main segments: Photoelectric (NT$1.44 billion), Silicon Photonics (NT$3.01 billion), and Semiconductor (NT$5.02 billion).

Estimated Discount To Fair Value: 29.5%

Elite Advanced Laser, with a recent net income of TWD 417.79 million for the first half of 2025, shows strong cash flow potential by trading at NT$265.5, significantly below its fair value estimate of NT$376.78. Despite high share price volatility, earnings have surged by a very large margin over the past year and are projected to grow annually by 51.3%, outpacing Taiwan's market average growth rate, highlighting its undervaluation based on cash flows.

- The growth report we've compiled suggests that Elite Advanced Laser's future prospects could be on the up.

- Dive into the specifics of Elite Advanced Laser here with our thorough financial health report.

Seize The Opportunity

- Get an in-depth perspective on all 273 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2643

High growth potential and fair value.

Market Insights

Community Narratives