- Japan

- /

- Specialty Stores

- /

- TSE:2726

PAL GROUP Holdings (TSE:2726) Margin Decline Challenges Bullish Growth Narratives

Reviewed by Simply Wall St

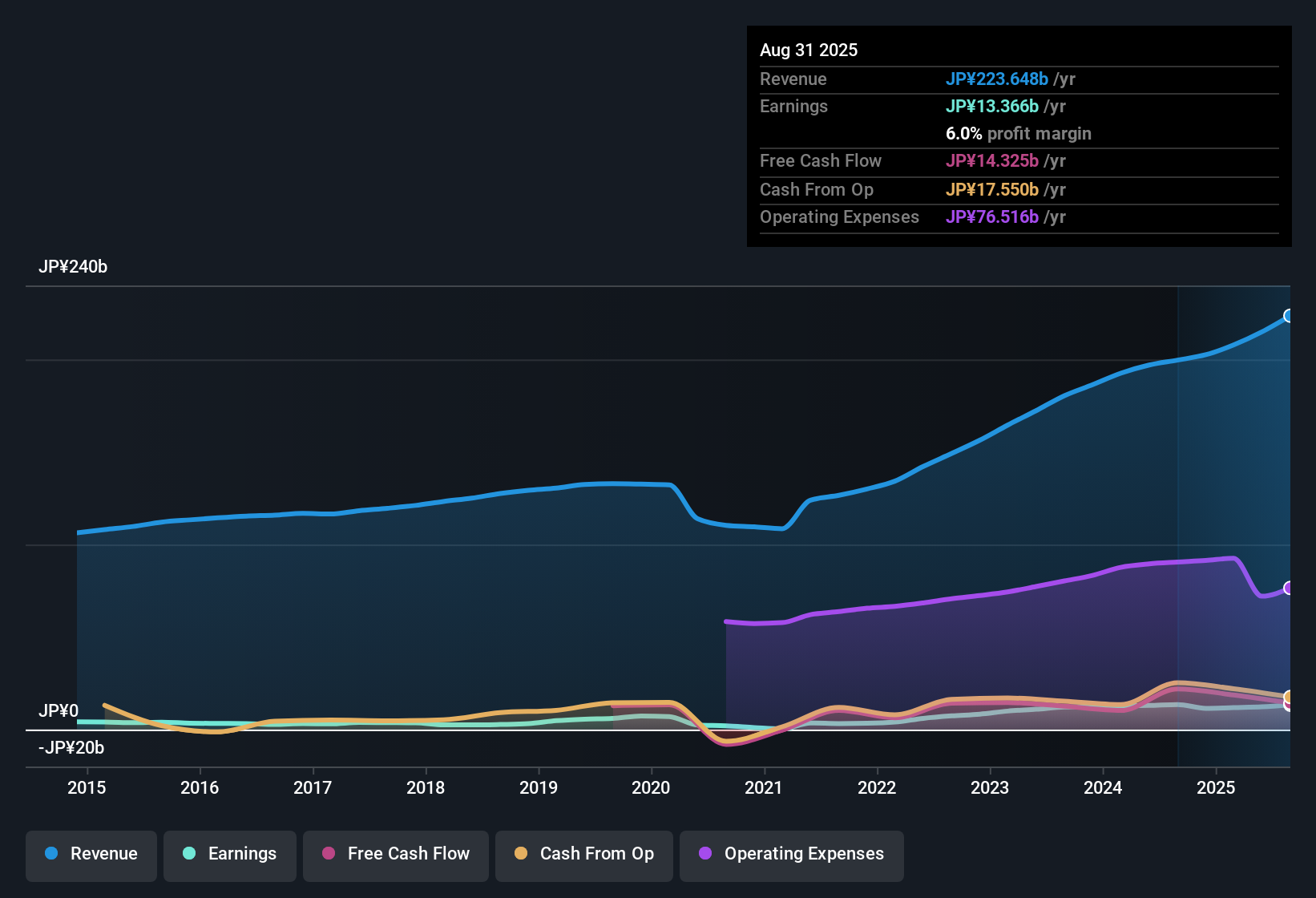

PAL GROUP Holdings (TSE:2726) posted net profit margins of 6%, down from last year's 6.8%, marking a year of negative earnings growth despite a robust five-year annualized earnings growth rate of 34.2%. However, with earnings forecast to grow 15.8% per year and revenue expected to outpace the Japanese market at 7.2% annual growth, the company is still set to deliver high-quality results that outshine broader sector averages. Investors will need to weigh this impressive longer-term momentum and the company’s valuation premium against recent volatility in the share price.

See our full analysis for PAL GROUP Holdings.Now, let’s see how these earnings numbers compare with the key narratives followed by the market and the Simply Wall St community. Where do the stories align, and where do they diverge?

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Sits Above Market Price

- The current share price stands at ¥2,033, which is roughly 13% below the DCF fair value of ¥2,327.38. PAL GROUP trades at a price-to-earnings ratio of 26.4x, substantially higher than both the Japanese specialty retail average of 13.8x and its peer group at 20.9x.

- Despite this valuation premium, the prevailing view highlights a key tension for investors:

- On one hand, robust five-year annualized earnings growth of 34.2% and strong forward guidance could justify the higher multiple, especially as revenue is projected to outpace the Japanese market.

- On the other hand, the disconnect between a relatively expensive P/E and a market price still sitting below DCF fair value suggests investors remain wary of recent share price volatility and the risk that future growth may not fully materialize.

Growth Outlook Outpaces the Sector

- Earnings are forecast to grow at 15.8% per year and revenue at 7.2% annually, both surpassing the expected rates for the Japanese market: 8.2% for earnings and 4.4% for revenue.

- This setup heavily supports the positive investment case for PAL GROUP Holdings:

- Projected revenue growth more than 50% higher than the market average points to sustained demand and strong execution, reflecting the company's ability to differentiate within consumer retail.

- The solid margin of outperformance in both profit and sales forecasts marks PAL GROUP as a growth leader relative to sector peers.

Profit Margins Narrow as Share Price Volatility Continues

- Net profit margins declined to 6%, down from 6.8% last year, and the stock has not shown stable price performance over the past three months.

- This margin compression and share price movement both challenge the more enthusiastic outlook:

- While historical growth has been strong, the recent profit margin dip signals possible pressure from costs, competition, or changing consumer habits that could limit upside if not reversed.

- The lack of short-term share price stability suggests the market remains cautious, with the premium P/E unlikely to be sustained if further margin contraction or volatility persists.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on PAL GROUP Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

PAL GROUP Holdings faces declining profit margins and recent share price volatility. This raises concerns about near-term stability, despite strong long-term growth forecasts.

If short-term inconsistency is a dealbreaker, use our stable growth stocks screener to identify companies with a proven record of stable earnings and steady growth across all cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2726

PAL GROUP Holdings

Engages in the planning, manufacture, wholesale, and retail of clothing products, including men’s and women’s clothing and accessories in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives