- Japan

- /

- Construction

- /

- TSE:1934

Yurtec And 2 Other Small Caps with Promising Potential

Reviewed by Simply Wall St

In the current global market landscape, major indices like the S&P 500 have been reaching record highs driven by optimism around potential trade deals and advancements in artificial intelligence. However, large-cap stocks have generally outperformed their smaller-cap counterparts, highlighting a unique opportunity for investors to explore promising small-cap companies that may not yet be on everyone's radar. Identifying a good stock often involves looking beyond immediate headlines to find companies with solid fundamentals and growth potential that align well with evolving market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITE Tech | NA | 8.91% | 16.50% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Donpon Precision | 35.22% | -2.30% | 36.96% | ★★★★★★ |

| Jiin Ming Industry | 9.39% | -8.97% | -9.24% | ★★★★☆☆ |

| ILSEUNG | 39.02% | -4.46% | 33.48% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

| MNtech | 65.44% | 16.96% | -17.92% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Yurtec (TSE:1934)

Simply Wall St Value Rating: ★★★★★★

Overview: Yurtec Corporation is a facility engineering company that operates both in Japan and internationally, with a market cap of ¥101.42 billion.

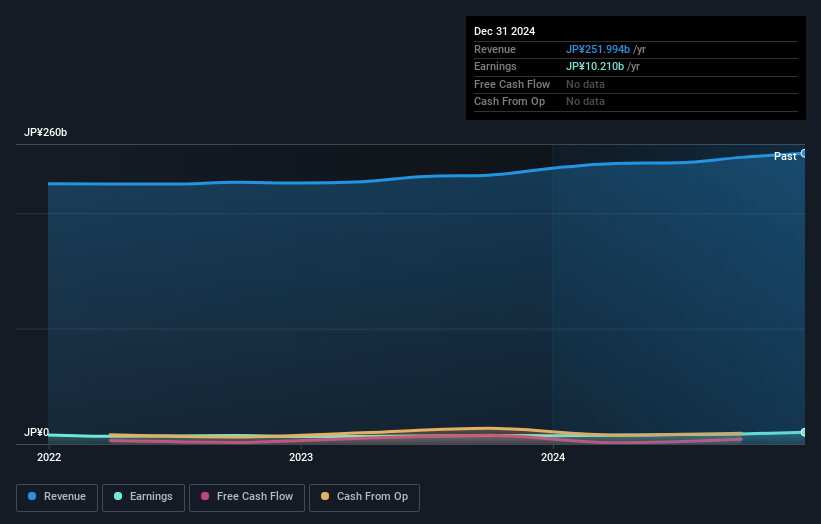

Operations: Yurtec generates revenue primarily through its facility engineering services in Japan and international markets. The company's net profit margin shows a notable trend, reflecting its operational efficiency over the periods observed.

Yurtec, a construction-focused entity, has shown resilience with its price-to-earnings ratio at 12.1x, undercutting the JP market average of 13.7x. Over the past five years, its debt-to-equity ratio decreased from 7.6% to 5.2%, indicating improved financial health. Earnings have grown by an annual rate of 11%, although recent growth of 17.2% lagged behind the industry’s pace of 20.8%. The company recently completed a share buyback program repurchasing over four million shares for ¥4,510 million and increased dividends to ¥23 per share from ¥14 last year, reflecting shareholder-friendly initiatives amidst robust earnings quality.

- Take a closer look at Yurtec's potential here in our health report.

Assess Yurtec's past performance with our detailed historical performance reports.

Geo Holdings (TSE:2681)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Geo Holdings Corporation operates in the amusement sector in Japan with a market capitalization of ¥70.64 billion.

Operations: Geo Holdings generates revenue primarily from its Retail Services segment, amounting to ¥417.81 billion. The company has a market capitalization of ¥70.64 billion.

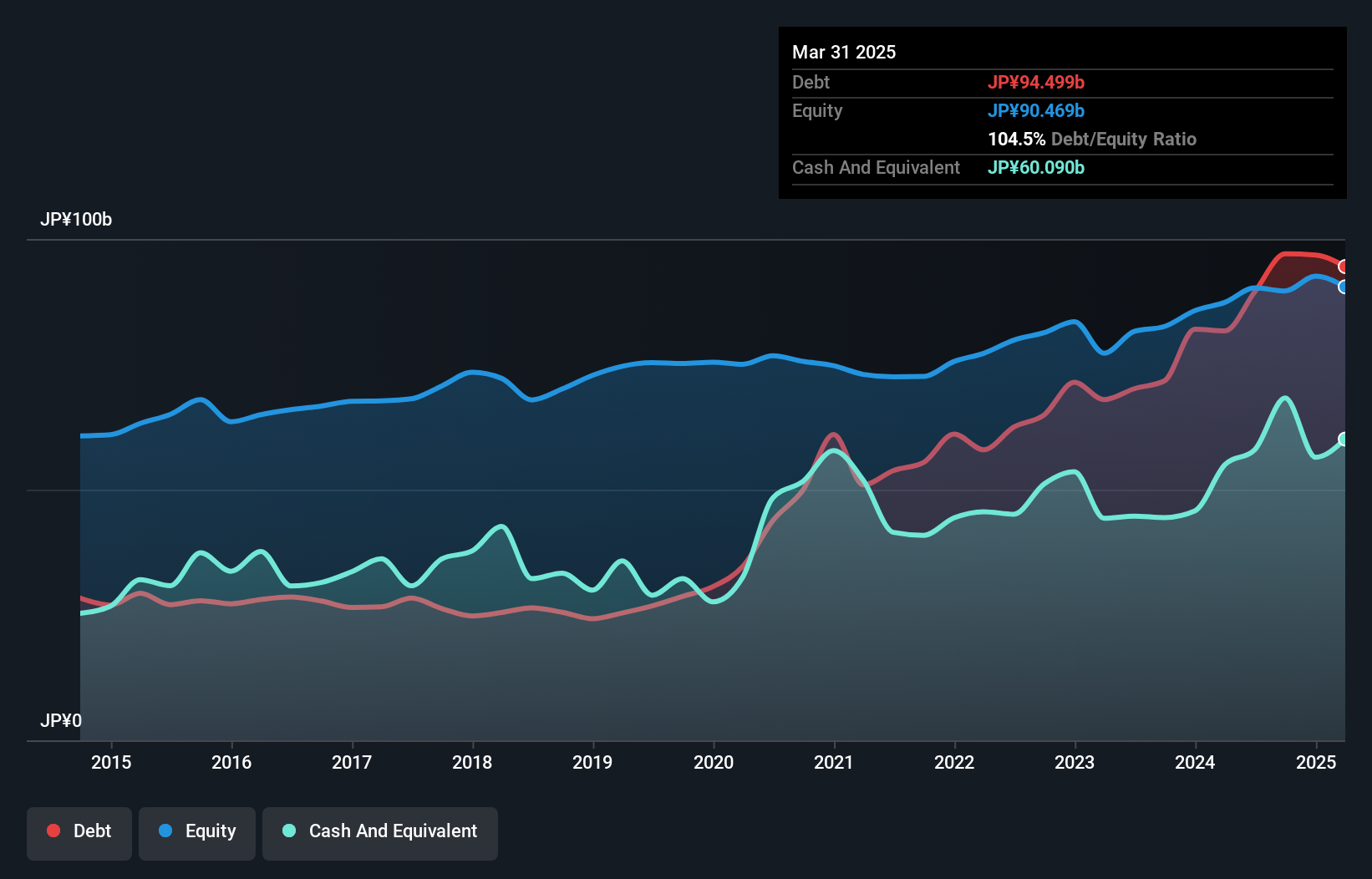

Geo Holdings, a nimble player in its sector, has shown impressive financial resilience. With interest payments well covered by EBIT at 481 times, the company demonstrates robust debt management. Trading at 15.5% below estimated fair value suggests potential for upward movement in valuation. The net debt to equity ratio stands at a satisfactory 32%, indicating prudent leverage use. Earnings grew by an impressive 16.5% last year, outpacing industry growth of 5.8%, and are forecasted to rise by another 20.6% annually. Recently, Geo Holdings increased its dividend payout to ¥17 per share from ¥12 last year, reflecting confidence in future cash flows.

- Dive into the specifics of Geo Holdings here with our thorough health report.

Gain insights into Geo Holdings' past trends and performance with our Past report.

Hanwa (TSE:8078)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hanwa Co., Ltd. is a diversified trading company engaged in the trade of steel, metals and alloys, nonferrous metals, food products, petroleum and chemicals, lumber, machinery, and other products both in Japan and globally with a market cap of ¥192.46 billion.

Operations: The steel business is the largest revenue segment for Hanwa, generating ¥1.20 trillion, followed by energy and household materials at ¥380.72 billion and overseas sales subsidiaries at ¥374.52 billion. The company's net profit margin shows a notable trend that warrants attention when analyzing its financial performance.

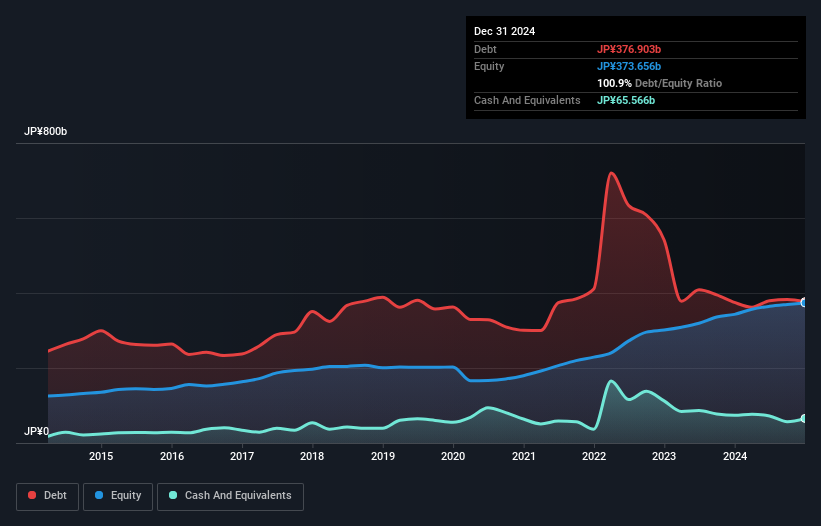

Hanwa, a noteworthy player in the trade distribution sector, has demonstrated impressive earnings growth of 18.5% over the past year, outpacing its industry peers at 1.7%. The company's debt to equity ratio has notably decreased from 177.1% to 103.5% over five years, though a net debt to equity ratio of 88.1% remains high by conventional standards. Trading at approximately 31% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent dividend hikes and robust earnings forecasts further underscore Hanwa's commitment to shareholder returns and its strategic focus on enhancing corporate governance through structural changes in board oversight.

- Click here to discover the nuances of Hanwa with our detailed analytical health report.

Review our historical performance report to gain insights into Hanwa's's past performance.

Turning Ideas Into Actions

- Unlock our comprehensive list of 4677 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1934

Yurtec

Operates as a facility engineering company in Japan and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives