- Japan

- /

- Specialty Stores

- /

- TSE:2670

Assessing ABC-Mart (TSE:2670)’s Valuation as the Board Weighs a Potential Leadership Change

Reviewed by Simply Wall St

ABC-MartInc (TSE:2670) has called a board meeting for December 1, 2025, to review a proposed change in representative directors, putting leadership and future strategic direction in sharper focus for shareholders.

See our latest analysis for ABC-MartInc.

The leadership question is landing at a tricky moment, with the latest share price at ¥2,720.5 and a 90 day share price return of minus 16.4 percent. This contrasts with a still solid 5 year total shareholder return of about 69 percent, suggesting long term holders are ahead even as short term momentum has cooled.

If this leadership review has you reassessing your watchlist, it could also be a smart time to explore fast growing stocks with high insider ownership as potential fresh ideas beyond the usual retail names.

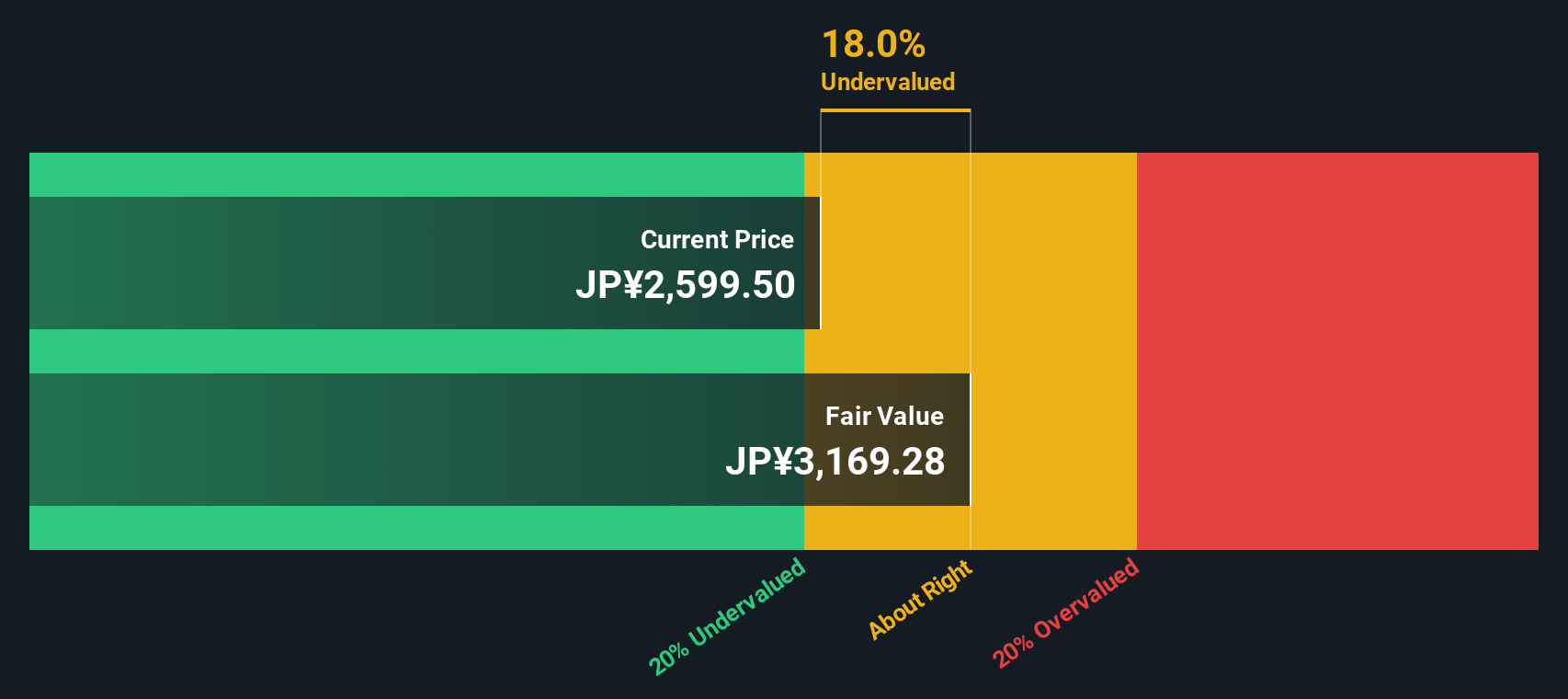

With leadership potentially shifting and the shares trading at a discount to analyst targets despite steady earnings growth, is ABC-MartInc quietly undervalued, or is the market already pricing in every step of its next expansion?

Price-to-Earnings of 14.8x: Is it justified?

ABC-MartInc last closed at ¥2,720.5, and on a price-to-earnings ratio of 14.8x it appears attractively priced relative to both its fair and peer benchmarks.

The price-to-earnings ratio compares what investors are paying today with the company’s current earnings. It is a core yardstick for established, profitable retailers like ABC-MartInc. For this stock, the SWS fair price-to-earnings ratio is estimated at 17.7x, suggesting the market is assigning a lower earnings multiple than the level indicated by this model.

In addition, ABC-MartInc trades on 14.8x earnings versus a much higher 25.8x peer average. This implies investors are valuing its profits more conservatively than comparable specialty retail names. If sentiment were to shift toward the estimated fair ratio, or even closer to the peer average, there could be scope for the earnings multiple to move higher from the current level.

Explore the SWS fair ratio for ABC-MartInc

Result: Price-to-Earnings of 14.8x (UNDERVALUED)

However, investors should watch for weaker consumer spending and execution risk on overseas expansion, either of which could cap margins and justify a lower valuation.

Find out about the key risks to this ABC-MartInc narrative.

Another View, What Does Cash Flow Say?

While earnings multiples hint at value, our DCF model also points to undervaluation, with ABC-MartInc trading about 12 percent below its estimated fair value of roughly ¥3,096 per share. If both earnings and cash flows see upside, is the discount a margin of safety or a sign investors doubt the growth path?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ABC-MartInc for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ABC-MartInc Narrative

If you see the story differently or simply prefer to test the numbers yourself, you can build a custom view in just minutes: Do it your way.

A great starting point for your ABC-MartInc research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next move?

Do not stop with a single stock. Sharpen your edge by hand picking new opportunities with powerful filters that surface ideas most investors overlook.

- Target income potential by reviewing these 14 dividend stocks with yields > 3% that could strengthen your portfolio with steadier cash returns.

- Capitalize on innovation by scanning these 25 AI penny stocks shaping the next wave of intelligent software and automation.

- Hunt for pricing mismatches through these 916 undervalued stocks based on cash flows that may offer upside before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2670

ABC-MartInc

Engages in the retailing of shoes, clothing, and general merchandise products for men, women, and kids in Japan.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026