There's no doubt that money can be made by owning shares of unprofitable businesses. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So, the natural question for Tiemco (TYO:7501) shareholders is whether they should be concerned by its rate of cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Tiemco

When Might Tiemco Run Out Of Money?

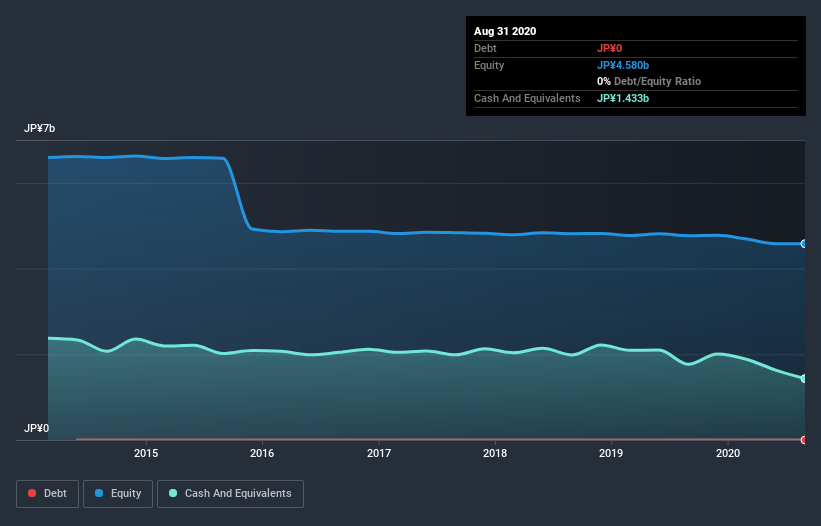

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. Tiemco has such a small amount of debt that we'll set it aside, and focus on the JP¥1.4b in cash it held at August 2020. In the last year, its cash burn was JP¥328m. Therefore, from August 2020 it had 4.4 years of cash runway. There's no doubt that this is a reassuringly long runway. The image below shows how its cash balance has been changing over the last few years.

How Well Is Tiemco Growing?

It was quite stunning to see that Tiemco increased its cash burn by 401% over the last year. While that's concerning on it's own, the fact that operating revenue was actually down 11% over the same period makes us positively tremulous. In light of the above-mentioned, we're pretty wary of the trajectory the company seems to be on. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Tiemco has developed its business over time by checking this visualization of its revenue and earnings history.

Can Tiemco Raise More Cash Easily?

Even though it seems like Tiemco is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Tiemco's cash burn of JP¥328m is about 16% of its JP¥2.1b market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Tiemco's Cash Burn?

On this analysis of Tiemco's cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Tiemco's situation. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 1 warning sign for Tiemco that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Tiemco, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tiemco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:7501

Tiemco

Plans, develops, manufactures, imports, exports, and sells fishing tackle and outdoor products under the Tiemco Fly Hooks, Sight Master, and Foxfire brands in Japan and internationally.

Adequate balance sheet minimal.

Market Insights

Community Narratives