- Japan

- /

- Office REITs

- /

- TSE:8955

Assessing Japan Prime Realty Investment (TSE:8955)’s Valuation After Its Follow-On Equity Offering Announcement

Reviewed by Simply Wall St

Japan Prime Realty Investment (TSE:8955) is moving ahead with a follow on equity offering of 100,000 new units, after board meetings to review and approve the issuance, putting dilution and growth plans in sharper focus for investors.

See our latest analysis for Japan Prime Realty Investment.

The follow on offering lands after a steady run, with a year to date share price return of about 33 percent and a roughly 40 percent one year total shareholder return. This signals that momentum is still broadly intact even as investors reassess dilution risk.

If this capital raise has you thinking more broadly about where money is rotating, it might be a good moment to explore fast growing stocks with high insider ownership.

Yet with units trading above analyst targets but screens flagging a deep intrinsic discount and solid long term returns, investors face a key question: is this REIT still mispriced or is future growth already fully reflected?

Price-to-Earnings of 22x: Is it justified?

On a headline basis, Japan Prime Realty Investment trades on a price-to-earnings ratio of 22x, roughly in line with its fair P E of 23.4x and modestly below peer averages, even after the strong recent unit price run.

The price-to-earnings multiple compares the current unit price with the REIT's earnings per unit. It is a key yardstick for income focused vehicles where distributions are closely linked to profits. For Japan Prime Realty Investment, this suggests investors are willing to pay a moderate premium for its earnings stream, potentially reflecting confidence in asset quality and leasing stability despite muted growth forecasts.

Compared with the Asian Office REITs industry average P E of 19.9x, the trust trades at a richer multiple. This underlines how the market is assigning it a quality premium over the broader regional peer group. Yet versus both its estimated fair P E of 23.4x and a peer set average of 23.7x, the current 22x level looks slightly conservative, hinting that if earnings hold up, there is room for the multiple to drift toward those fair value markers rather than compress sharply.

Explore the SWS fair ratio for Japan Prime Realty Investment

Result: Price-to-Earnings of 22x (ABOUT RIGHT)

However, softer revenue and earnings trends, along with equity dilution from new units, could pressure valuations if leasing momentum or asset performance disappoints.

Find out about the key risks to this Japan Prime Realty Investment narrative.

Another View: Big Gap on Fair Value

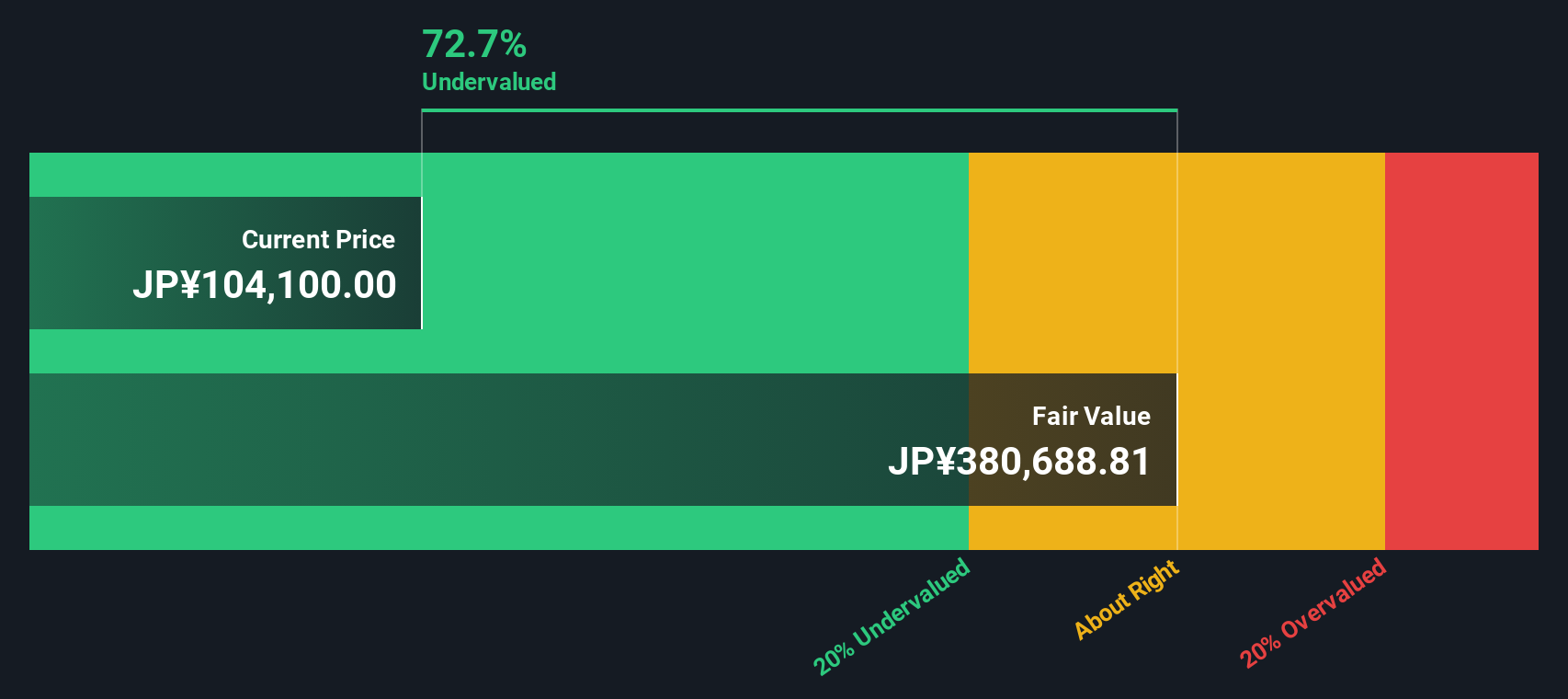

While the 22x earnings multiple looks roughly in line with fair value estimates, our DCF model paints a very different picture. It suggests Japan Prime Realty Investment is trading around 75 percent below its fair value of roughly ¥434,000 per unit. Is the market missing something structural, or is the DCF simply too optimistic for a mature REIT?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Japan Prime Realty Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 894 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Japan Prime Realty Investment Narrative

If you see the story differently or want to dig into the numbers yourself, you can build and customise a full view in under three minutes, Do it your way.

A great starting point for your Japan Prime Realty Investment research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in a few fresh ideas by using the Simply Wall St Screener to uncover opportunities you might otherwise overlook.

- Capture potential multi baggers early by scanning these 3590 penny stocks with strong financials with improving balance sheets, real revenue traction, and room for serious upside.

- Explore the structural shift toward intelligent automation by targeting these 27 AI penny stocks that pair strong growth metrics with credible long term business models.

- Strengthen your portfolio’s core by focusing on these 15 dividend stocks with yields > 3% that combine reliable payouts with solid fundamentals and room for future increases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8955

Japan Prime Realty Investment

Japan Prime Realty Investment Corporation (JPR) was established on September 14, 2001, under the Act on Investment Trusts and Investment Corporations (Act No.

6 star dividend payer with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A buy recommendation

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026