- Japan

- /

- Office REITs

- /

- TSE:8951

Nippon Building Fund (TSE:8951) Secures ¥1 Billion Loan Amid Strategic Dividend Adjustments

Reviewed by Simply Wall St

Nippon Building Fund (TSE:8951) recently announced a ¥1 billion unsecured, unguaranteed long-term borrowing from The Yamanashi Chuo Bank, Ltd., with a favorable interest rate of 0.526%, highlighting its strategic financial maneuvers in a challenging market environment. As the company prepares to release its first-half 2024 results, investors should be attentive to the expected earnings decline and revenue challenges, while also considering the potential growth avenues through strategic alliances and innovation.

Get an in-depth perspective on Nippon Building Fund's performance by reading our analysis here.

Core Advantages Driving Sustained Success for Nippon Building Fund

With a net profit margin of 44%, Nippon Building Fund demonstrates strong financial health, surpassing last year's 42.1%. Earnings have consistently grown at 7.5% annually over the past five years, outpacing the Office REITs industry average. The company's strategic alliances, as highlighted by CEO Daisuke Yamashita, enhance market reach and service offerings. A commitment to innovation is evident in their product line, which has significantly boosted customer retention. Moreover, dividends have steadily increased over the past decade, supported by a payout ratio of 75.5% and a cash payout ratio of 41%, indicating financial stability and shareholder value.

Learn about Nippon Building Fund's dividend strategy and how it impacts shareholder returns and financial stability.Strategic Gaps That Could Affect Nippon Building Fund

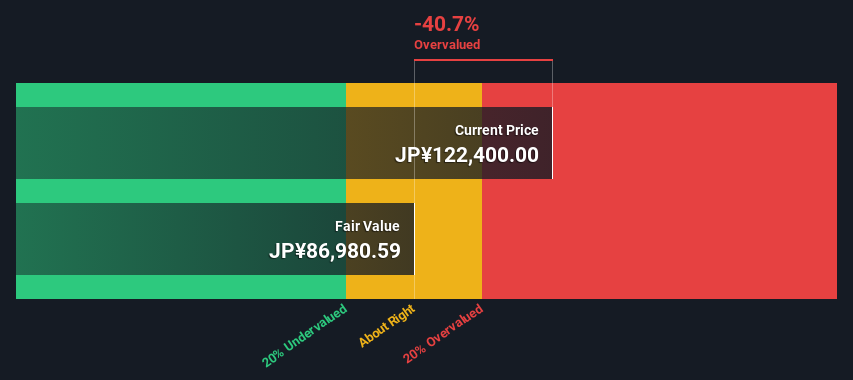

While the company has several strengths, it faces challenges with a low return on equity of 6%, and forecasts indicate a 4.3% annual earnings decline over the next three years. Revenue is also expected to decrease by 0.7% annually. The high net debt to equity ratio of 80.1% raises concerns about financial leverage. Additionally, the current share price of ¥131,100 is significantly higher than the SWS fair ratio of ¥84,561.03, suggesting it is expensive compared to industry peers. These factors, coupled with a history of volatile dividend payments, present potential risks to financial stability.

To dive deeper into how Nippon Building Fund's valuation metrics are shaping its market position, check out our detailed analysis of Nippon Building Fund's Valuation.Areas for Expansion and Innovation for Nippon Building Fund

Opportunities abound in enhancing return on equity and revenue growth strategies. Stabilizing dividend payments could attract more investors, while strategic alliances provide avenues for expanding distribution channels. The company's proactive approach in forming partnerships with key industry players positions it well to capitalize on emerging market opportunities and strengthen its competitive edge.

See what the latest analyst reports say about Nippon Building Fund's future prospects and potential market movements.Key Risks and Challenges That Could Impact Nippon Building Fund's Success

Economic headwinds and regulatory changes pose significant threats, potentially affecting consumer spending and compliance costs. Supply chain vulnerabilities, as noted in the latest earnings call, could disrupt operations. High debt levels may impact financial flexibility, and the history of volatile dividends could deter potential investors. Addressing these challenges is crucial for maintaining market share and long-term profitability.

To gain deeper insights into Nippon Building Fund's historical performance, explore our detailed analysis of past performance.Conclusion

Nippon Building Fund's impressive net profit margin and consistent earnings growth highlight its strong financial health and effective market strategies. However, the company's low return on equity and forecasted earnings decline suggest potential challenges in sustaining this growth. The high share price relative to its fair value indicates that the market may have overly optimistic expectations, which could pose risks if financial performance does not meet these expectations. Addressing strategic gaps, such as improving financial leverage and stabilizing dividends, will be crucial for maintaining investor confidence and ensuring long-term success in a competitive market.

Make It Happen

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Building Fund might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:8951

Nippon Building Fund

NBF (Nippon Building Fund Inc.) is Japan's largest real estate investment trust (J-REIT) which invests in office buildings primarily in Tokyo as well as nationwide.

Solid track record established dividend payer.