- Japan

- /

- Industrial REITs

- /

- TSE:3466

LaSalle LOGIPORT REIT (TSE:3466) Margin Dips Below 50%, Testing Confidence in Sector Resilience

Reviewed by Simply Wall St

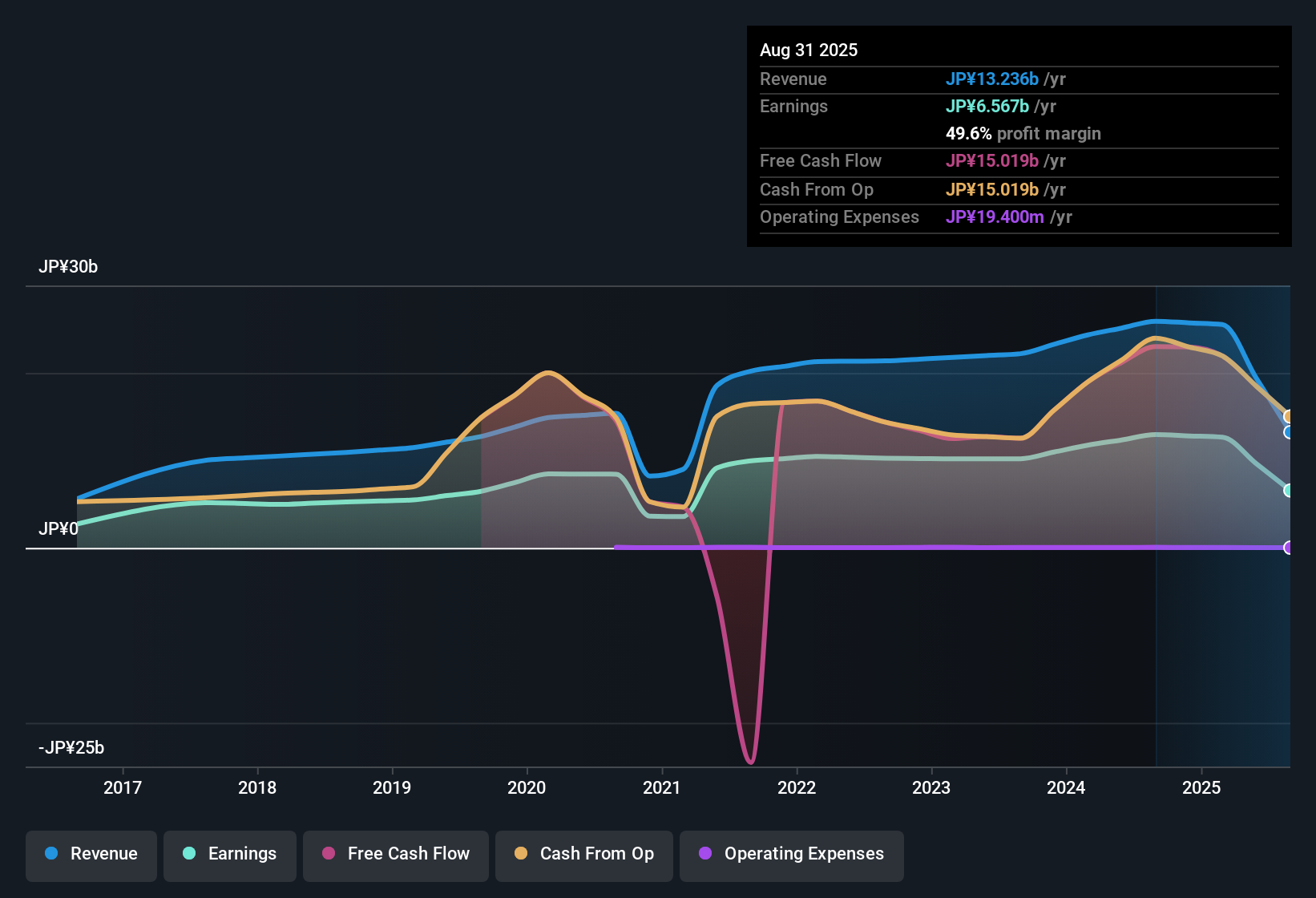

LaSalle LOGIPORT REIT (TSE:3466) posted a net profit margin of 49.6% for the current period, just below last year's 50%, while earnings over the past five years have grown at an average rate of 8.9% annually. The company’s Price-to-Earnings Ratio stands at 40.8x, well above both its peer group average of 26.7x and the Asian Industrial REIT industry average of 19.9x, with shares currently trading at ¥149,200, significantly above an estimated fair value of ¥45,855.21. While profitability remains high, the recent slip in margin and negative annual earnings growth contrast with the company’s longer-term growth track record, raising questions about the sustainability of these robust results.

See our full analysis for LaSalle LOGIPORT REIT.Next, we will see how these earnings stack up against the key narratives surrounding LaSalle LOGIPORT REIT, highlighting where expectations align with reality and where surprises might leave room for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Holds Despite Recent Dip

- Net profit margin for the latest period came in at 49.6%, slightly under last year’s 50%. This reflects a marginal decline but still signals robust underlying profitability compared to industry norms.

- Market analysis points out that steady profitability like this, even with a minor decrease, continues to reinforce LaSalle LOGIPORT REIT’s reputation for resilience in the face of structural tailwinds in logistics real estate.

- Despite the slight decline, these margins remain above many industrial REIT peers, supporting the idea that the business benefits from strong pricing or operational advantages.

- At the same time, observers note that a moderation in margins could be an early indication of sector challenges, echoing investor caution about potential headwinds for future distribution growth.

Five-Year Growth Track Shows a Shift

- Over the past five years, average annual earnings growth was 8.9%, but the most recent period saw negative year-on-year growth, interrupting the previous steady upward pattern.

- It is notable that while the company’s long-term trend is solid, the recent stall in growth puts pressure on the widely held view that logistics REITs are positioned for dependable expansion.

- The difference between historical strength and the latest softness raises questions about how much the sector can continue to outperform without new catalysts.

- This development prompts investors to pay closer attention to any signs of moderation in tenant or rent growth, especially since sector narratives often focus on uninterrupted momentum.

Valuation Premium Faces Fair Value Gap

- The Price-to-Earnings ratio is 40.8x, placing the stock well above the peer group’s 26.7x and the industry’s 19.9x. The current share price of ¥149,200 is more than three times higher than the DCF fair value estimate of ¥45,855.21.

- Prevailing analysis notes that although investors have historically paid a premium for perceived safety and growth, today’s wide valuation gap to DCF fair value increases scrutiny on how much premium is warranted.

- Such a sharp premium may only be maintained if above-average growth and profitability return, which appears less certain given recent slower earnings trends.

- Investors considering entry at these levels must weigh the comfort of sector stability against the risk of overpaying if mean reversion or competitive pressures begin to affect valuation multiples.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on LaSalle LOGIPORT REIT's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite LaSalle LOGIPORT REIT’s impressive long-term margins, its recent negative earnings growth and stretched valuation raise questions about continued outperformance.

If stretched prices and slowing results give you pause, use our these 878 undervalued stocks based on cash flows to discover companies trading at more attractive valuations, with stronger upside potential for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3466

LaSalle LOGIPORT REIT

With LaSalle REIT Advisors K.K. as the organizer, LaSalle LOGIPORT REIT (LLR) was established on October 9, 2015, pursuant to the Investment Trusts Act, and was listed on the J-REIT section of the Tokyo Stock Exchange (Securities Code: 3466) on February 17, 2016.

Average dividend payer with questionable track record.

Market Insights

Community Narratives