- Japan

- /

- Industrial REITs

- /

- TSE:3249

Is IIF’s (TSE:3249) Capital Management Shift Signaling a New Financial Discipline?

Reviewed by Sasha Jovanovic

- Industrial & Infrastructure Fund Investment Corporation recently completed the repurchase of 7,755 investment units for ¥999.92 million and finalized interest rates for new unsecured, unguaranteed debt financing totaling ¥5.6 billion across three tranches with maturities extending to 2033.

- This combination of capital management through buybacks and refinancing at fixed rates provides greater clarity into the company’s financial strategy and stability.

- To see how IIF’s recent completion of its investment unit buyback informs its outlook, we’ll explore the updated investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Industrial & Infrastructure Fund Investment Investment Narrative Recap

To invest in Industrial & Infrastructure Fund Investment Corporation (IIF), you need to believe in Japan’s long-term need for resilient, inflation-resistant logistics and infrastructure assets. The recently completed investment unit buyback and new unsecured fixed-rate debt financing clarify IIF’s focus on stabilizing capital management, but these moves are not likely to materially shift the key short-term catalyst, which remains execution of CPI-linked rent transitions, nor do they significantly lessen exposure to interest rate risk.

The completion of IIF’s unit buyback stands out this month, returning nearly ¥1.0 billion to unitholders by reducing the outstanding share count. This action can incrementally support per-unit metrics but is best viewed alongside ongoing earnings guidance upgrades, which remain more central to near-term investor sentiment and are more directly relevant to major catalysts for future growth.

But while capital management strengthens the foundation, interest rate volatility is still a key issue for investors to remain aware of...

Read the full narrative on Industrial & Infrastructure Fund Investment (it's free!)

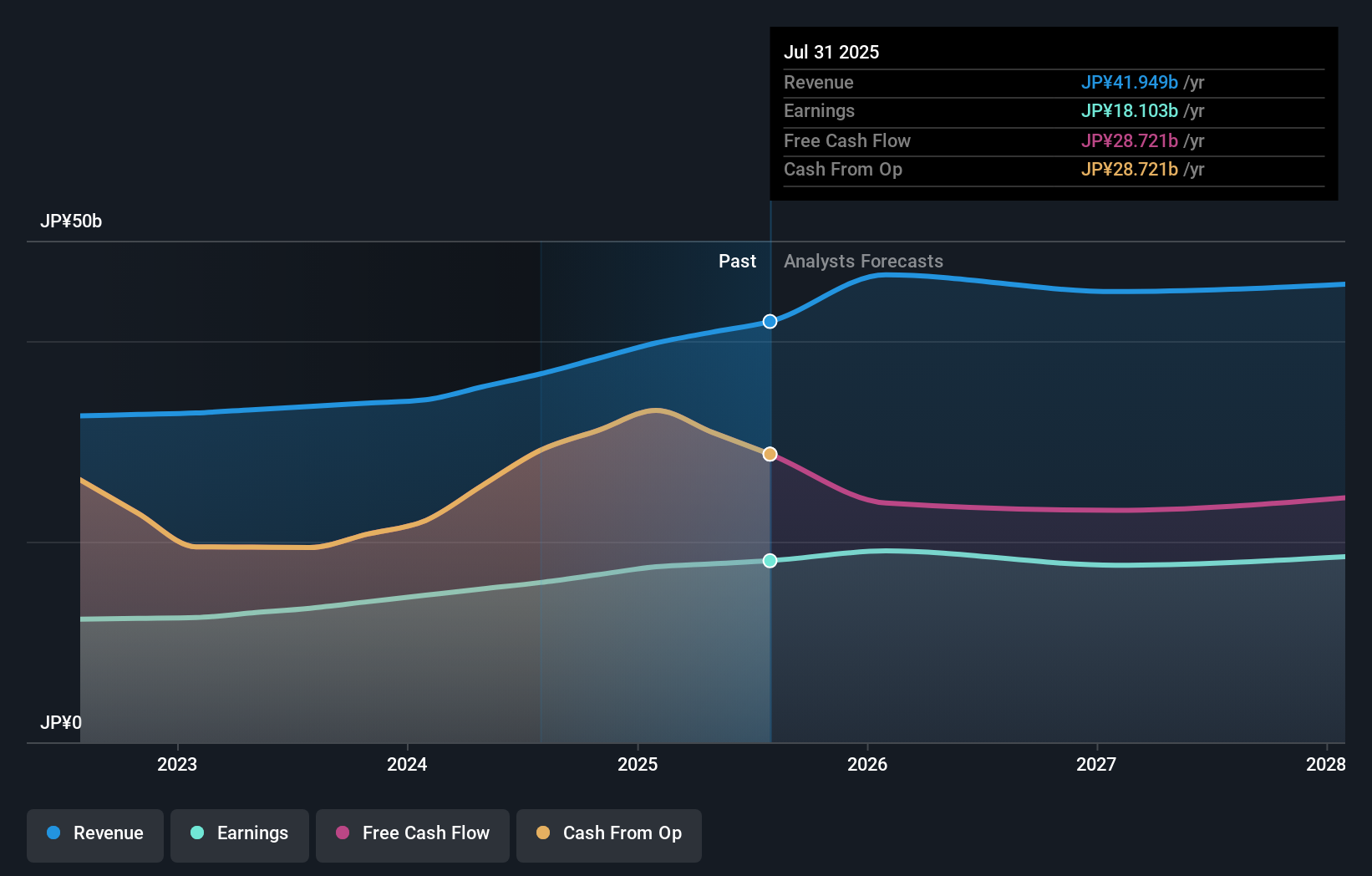

Industrial & Infrastructure Fund Investment's forecast projects ¥44.5 billion in revenue and ¥18.0 billion in earnings by 2028. This assumes 3.7% annual revenue growth and a ¥0.5 billion increase in earnings from ¥17.5 billion currently.

Uncover how Industrial & Infrastructure Fund Investment's forecasts yield a ¥144286 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community puts IIF’s worth at ¥81,116, far below consensus targets. As you consider why market participants differ so sharply, keep in mind that IIF’s growth still faces resistance from rising interest rates and changing rent structures, making diverse viewpoints essential reading.

Explore another fair value estimate on Industrial & Infrastructure Fund Investment - why the stock might be worth as much as ¥81116!

Build Your Own Industrial & Infrastructure Fund Investment Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Industrial & Infrastructure Fund Investment research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Industrial & Infrastructure Fund Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Industrial & Infrastructure Fund Investment's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3249

Industrial & Infrastructure Fund Investment

IIF was established on March 26, 2007 based on “Act on Investment Trust and Investment Corporation” (hereinafter referred to as “Investment Trust Law”) and became listed on the JREIT market of the Tokyo Stock Exchange on October 18, 2007 (ticker code: 3249).

6 star dividend payer with proven track record.

Market Insights

Community Narratives