- Japan

- /

- Real Estate

- /

- TSE:8844

How Much Did Cosmos Initia's(TYO:8844) Shareholders Earn From Share Price Movements Over The Last Year?

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. Unfortunately the Cosmos Initia Co., Ltd. (TYO:8844) share price slid 41% over twelve months. That's disappointing when you consider the market returned 6.7%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 26% in three years. Even worse, it's down 9.3% in about a month, which isn't fun at all.

Check out our latest analysis for Cosmos Initia

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

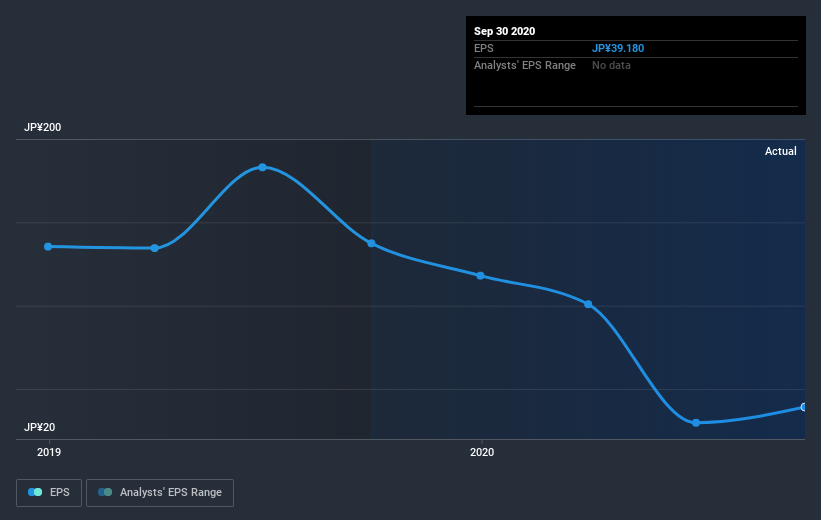

Unhappily, Cosmos Initia had to report a 71% decline in EPS over the last year. This fall in the EPS is significantly worse than the 41% the share price fall. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Cosmos Initia's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Cosmos Initia had a tough year, with a total loss of 39%, against a market gain of about 6.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Cosmos Initia better, we need to consider many other factors. For example, we've discovered 3 warning signs for Cosmos Initia (2 make us uncomfortable!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on JP exchanges.

If you decide to trade Cosmos Initia, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSE:8844

Cosmos Initia

Engages in the real estate sale, rental, and brokerage activities in Japan.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives