- Japan

- /

- Real Estate

- /

- TSE:8918

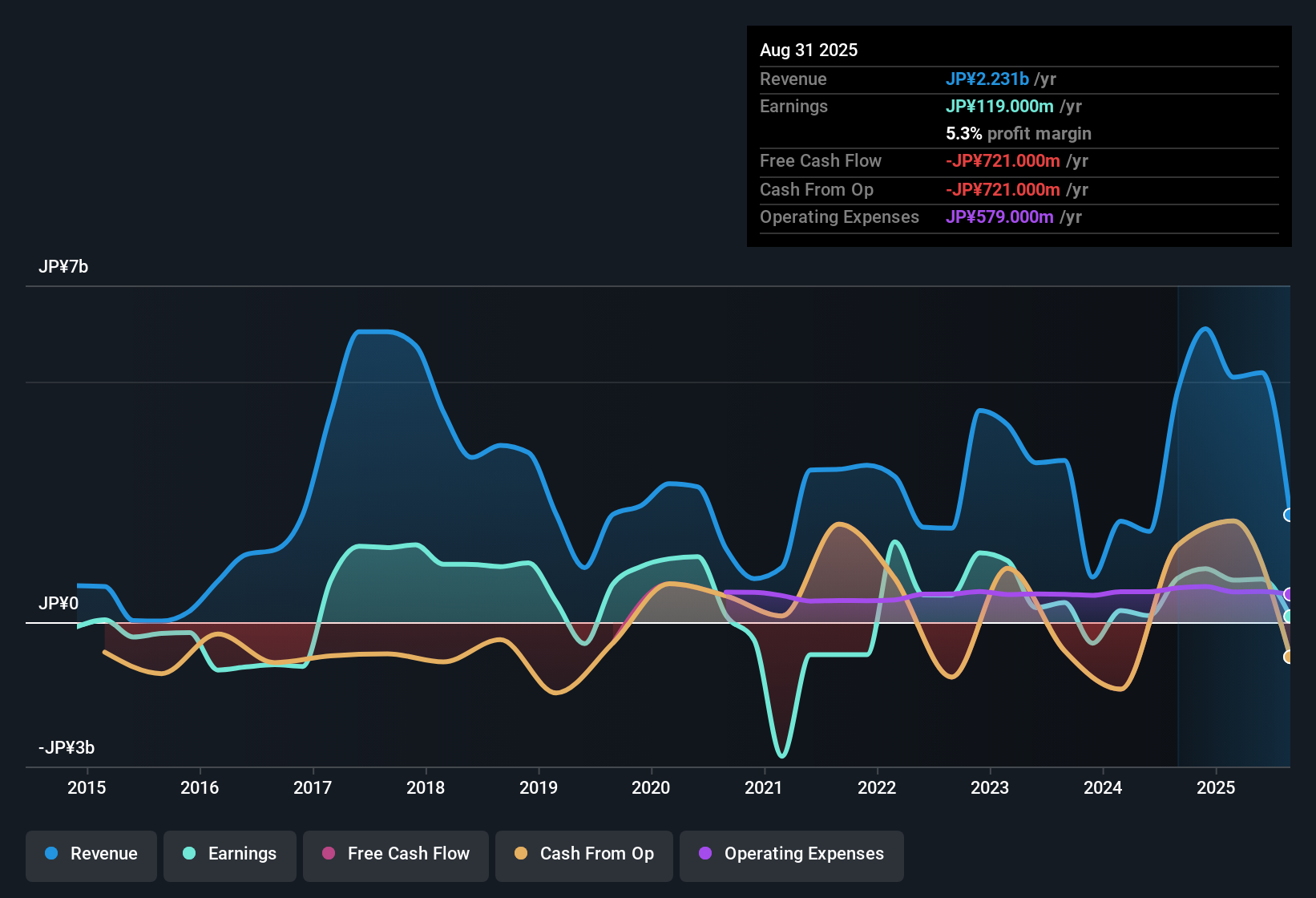

LAND (TSE:8918) Profit Margins Plummet to 5.3%, Undercutting Bullish Quality Narratives

Reviewed by Simply Wall St

LAND (TSE:8918) posted net profit margins of 5.3%, noticeably lower than last year’s 19%. Despite averaging 37.8% annual earnings growth over the past five years, the company saw negative earnings growth this year, highlighting a sharp reversal in its profitability trend. While its earnings have historically been high quality, the recent drop in margins, paired with significant volatility in earnings momentum, gives investors plenty to debate.

See our full analysis for LAND.The next section puts these headline results head to head with prevailing community narratives, highlighting where the market story gets confirmed or contradicted by the latest numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Skyrockets Far Above Sector Peers

- LAND is currently trading at a Price-To-Earnings ratio of 129.2x, which is more than 10 times higher than both the Japanese Real Estate industry average of 11.4x and the peer group average of 15.7x.

- Heavily elevated multiples raise questions for investors weighing value versus growth prospects, particularly when set against a year of negative earnings growth and significant contraction in margins.

- Despite the impressive average annual earnings growth of 37.8% over five years, the sudden drop into negative territory suggests the premium is not anchored in recent performance.

- Bulls may argue that high past growth rates justify some valuation stretch. However, critics will note that the recent reversal in earnings momentum directly undercuts this optimism.

DCF Valuation Points to Undervaluation

- At a share price of ¥10, LAND trades at a notable discount to its DCF fair value estimate of ¥24.03, suggesting long-term holders may see significant upside if fundamentals stabilize.

- The prevailing market view finds tension between premium headline valuation ratios and the apparent bargain versus DCF estimates.

- On one hand, value-driven investors could see the DCF gap as an attractive entry point, especially after a year marked by negative earnings growth and margin compression.

- On the other hand, the share price’s deep discount might reflect market doubts about near-term recovery, given profitability has sharply reversed from prior years.

Profit Margins Decline Raises Risk Flags

- Net profit margins shrank to 5.3% from last year’s 19%, a material drop that stands out even in a volatile sector and marks a pronounced shift from LAND's historical performance labeled as high quality.

- The prevailing market view contends that such compressed margins amplify downside risk, particularly as the company has simultaneously posted negative earnings growth after multiple years of outsized expansion.

- This steeper profitability contraction challenges any narrative that LAND’s earlier high margin track record is a near-term support for valuation.

- Bears highlight that margin compression paired with share price instability could continue to weigh on sentiment until clear improvement emerges.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on LAND's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

LAND’s sharply compressed profit margins, negative earnings growth, and premium valuation indicate inconsistent performance and raise doubts about near-term stability.

If you want more consistent results, use our stable growth stocks screener to discover companies that deliver steady earnings and revenue year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8918

LAND

Engages in the real estate and renewable energy investment businesses.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives