As global markets grapple with heightened trade tensions and economic uncertainty, small-cap stocks have been particularly hard hit, with the Russell 2000 Index experiencing a significant decline. Despite these challenges, the current environment can present unique opportunities for discerning investors to identify undervalued stocks that possess strong fundamentals and resilience in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| CTCI Advanced Systems | 28.82% | 23.23% | 27.69% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Time Interconnect Technology | 78.17% | 24.96% | 19.51% | ★★★★☆☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Guangdong Kitech New Material HoldingLtd (SZSE:300995)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangdong Kitech New Material Holding Co., Ltd. operates in the new materials industry with a market capitalization of CN¥2.13 billion.

Operations: Kitech generates its revenue primarily from the sale of new materials, with a focus on innovative products tailored for industrial applications. The company's cost structure includes raw material expenses and manufacturing costs, impacting its profitability. Notably, Kitech has experienced fluctuations in its gross profit margin over recent periods.

Guangdong Kitech New Material Holding Ltd. has seen its earnings grow by 180% over the past year, significantly outpacing the chemicals industry's -4%. Despite this impressive growth, its earnings have decreased by 58% annually over five years. The company's debt to equity ratio rose from 2.8% to 12.2%, but with a net debt to equity ratio of just 0.2%, it remains satisfactory. A recent shareholders meeting focused on governance improvements, suggesting a proactive approach to corporate structure and strategy adjustments amidst volatile share prices in recent months.

- Take a closer look at Guangdong Kitech New Material HoldingLtd's potential here in our health report.

Learn about Guangdong Kitech New Material HoldingLtd's historical performance.

Shandong Sanyuan BiotechnologyLtd (SZSE:301206)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Sanyuan Biotechnology Co., Ltd. focuses on the research, development, production, and sale of erythritol and compound sugar products in China and has a market cap of CN¥5.05 billion.

Operations: The company generates revenue primarily from its Food Additives Business, which amounts to CN¥663.23 million. The net profit margin is a key financial metric to consider when evaluating the company's profitability.

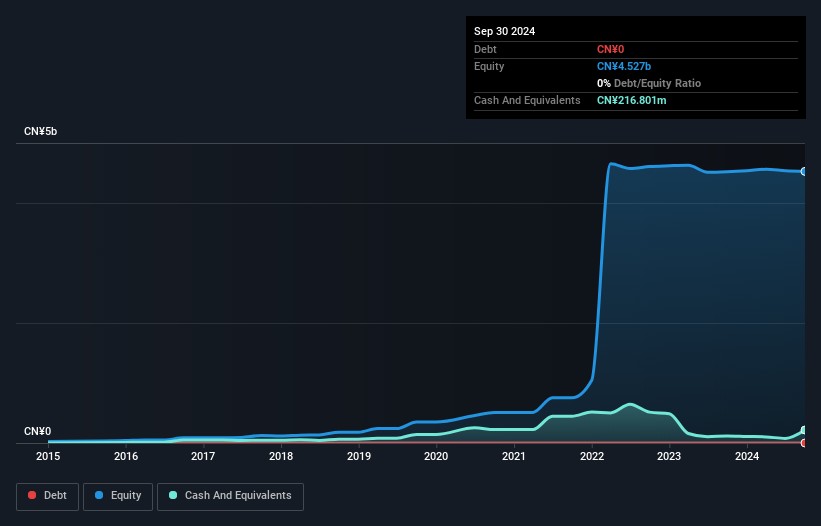

Shandong Sanyuan Biotechnology, operating debt-free for the past five years, showcases impressive earnings growth of 81% over the last year, outpacing its industry peers. Despite this robust performance, free cash flow remains negative at -100.50 million CNY as of September 2024. The company recently repurchased 930,000 shares for CNY 23.87 million between January and March 2025, completing a buyback plan totaling 1.63 million shares for CNY 41.48 million since July 2024. With high-quality earnings and a forecasted annual growth rate of nearly 37%, Shandong Sanyuan seems poised to capitalize on future opportunities in its sector.

GOLDCRESTLtd (TSE:8871)

Simply Wall St Value Rating: ★★★★☆☆

Overview: GOLDCREST Co.,Ltd. is involved in the planning, development, and sale of new condominiums in Japan, with a market capitalization of ¥103.19 billion.

Operations: GOLDCREST Ltd. primarily generates revenue through its Real Estate Sales Business, contributing ¥26.06 billion, followed by Real Estate Management at ¥4.20 billion and Real Estate Rental at ¥3.03 billion. The company's net profit margin shows a notable trend, reflecting the efficiency of its operations in managing costs relative to revenue generation.

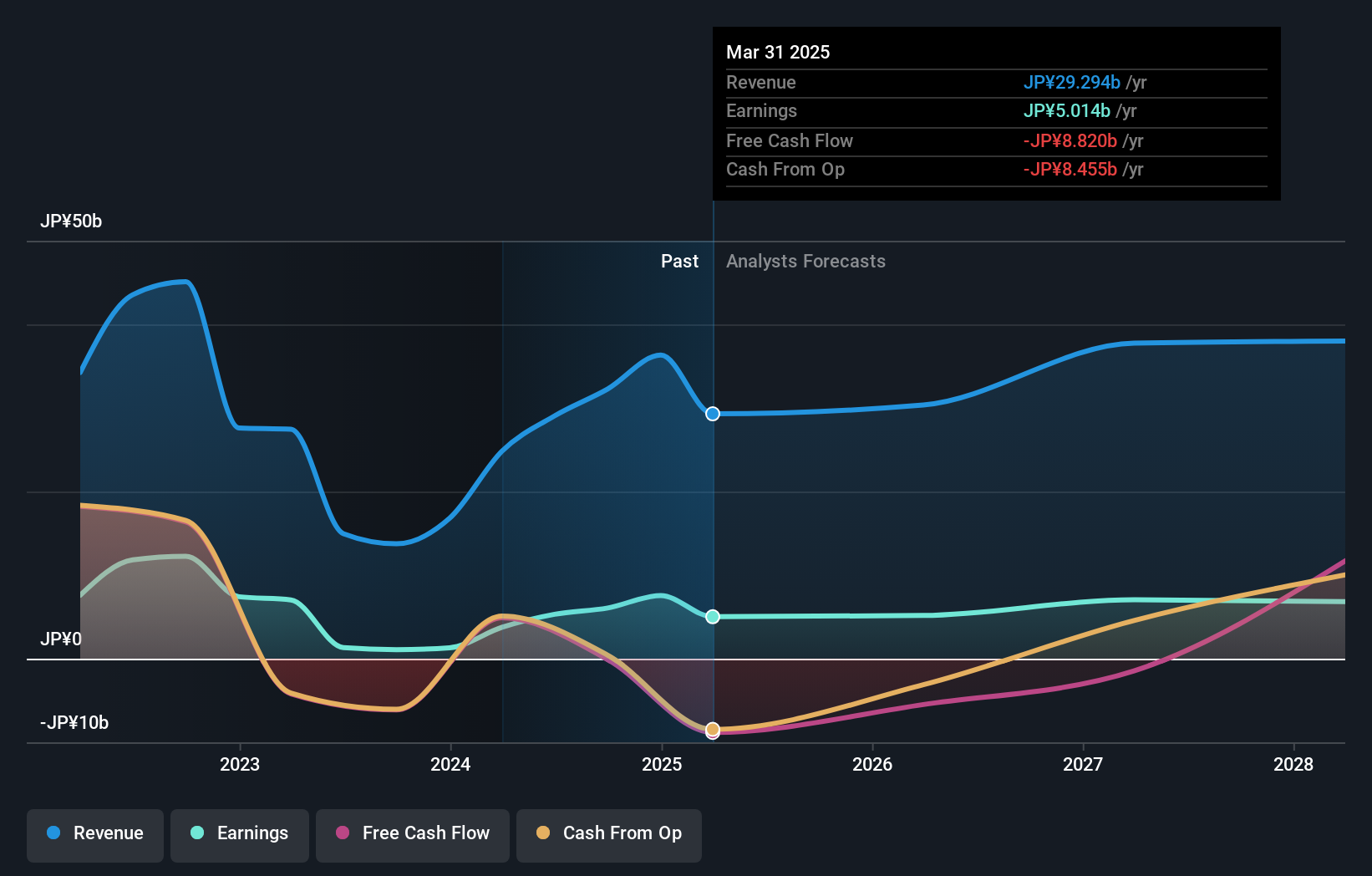

GOLDCREST Ltd. has been drawing attention with its remarkable earnings growth of 477% over the past year, significantly outpacing the Real Estate industry's 20.7%. Despite an increase in its debt to equity ratio from 42.3% to 49.6% over five years, the company maintains a strong financial position with more cash than total debt and robust interest coverage at 28.5 times EBIT. Recent announcements highlighted sales of ¥24,252 million and net income of ¥4,593 million for nine months ending December 2024, showcasing high-quality earnings despite not being free cash flow positive yet.

- Click to explore a detailed breakdown of our findings in GOLDCRESTLtd's health report.

Review our historical performance report to gain insights into GOLDCRESTLtd's's past performance.

Where To Now?

- Dive into all 3160 of the Global Undiscovered Gems With Strong Fundamentals we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300995

Guangdong Kitech New Material HoldingLtd

Guangdong Kitech New Material Holding Co.,Ltd.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives