- Japan

- /

- Real Estate

- /

- TSE:8802

Does Mitsubishi Estate’s (TSE:8802) Balanced Approach to Buybacks and Bonds Reveal Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- In the past quarter, Mitsubishi Estate completed the repurchase of 26,303,800 shares for ¥75,623.95 million and filed to list $500 million in bonds due 2030 on the Singapore market.

- This combination of shareholder returns through buybacks and strengthened financial flexibility via international bond issuance signals a balanced approach to capital management.

- We’ll explore how Mitsubishi Estate’s recent bond filing in Singapore could influence the company’s overall investment narrative.

Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

What Is Mitsubishi Estate's Investment Narrative?

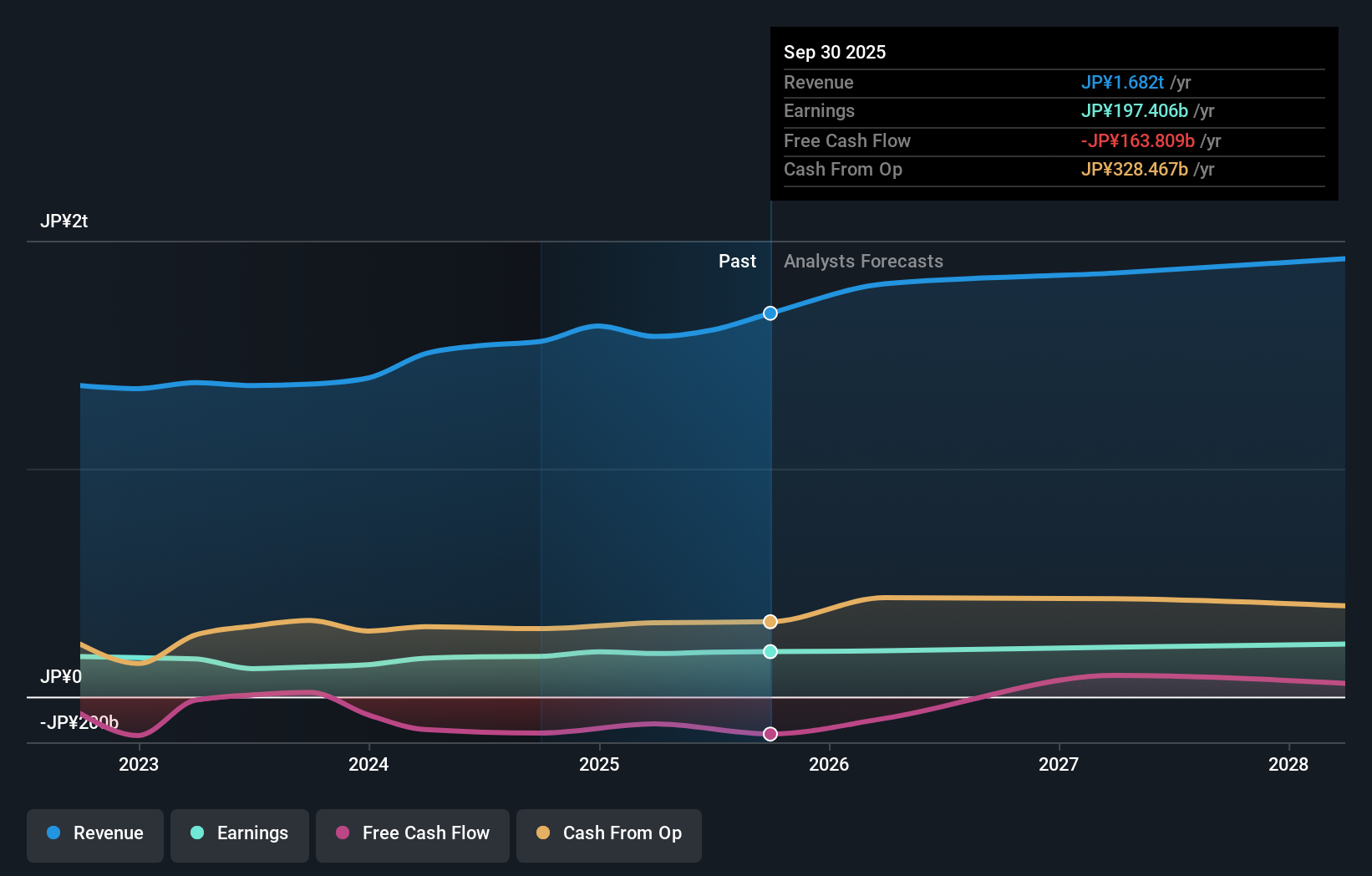

If you’re interested in Mitsubishi Estate, the core investment narrative centers on steady, long-haul value: consistent revenue and earnings growth, a history of rising dividends, and quality earnings. The latest share buyback completion and new S$500 million bond listing in Singapore reflect a pragmatic capital management mix, but for now, these actions are unlikely to shift the biggest short-term catalysts or the main risks. What’s most likely to matter in the near term remains upcoming earnings performance, the market’s view on whether valuation looks stretched compared to peers, and any impact on financial flexibility or debt coverage. The bond issue, while broadening funding options, won’t remove the challenges of relatively high debt or justify premium pricing overnight, so the key risks and drivers haven’t meaningfully changed with this news.

Yet, high leverage and valuation concerns still deserve attention if you’re weighing the risk side of the story. Mitsubishi Estate's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 3 other fair value estimates on Mitsubishi Estate - why the stock might be worth as much as 11% more than the current price!

Build Your Own Mitsubishi Estate Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mitsubishi Estate research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mitsubishi Estate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mitsubishi Estate's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8802

Mitsubishi Estate

Engages in the real estate activities in Japan and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives