- Japan

- /

- Real Estate

- /

- TSE:3498

Board Overhaul And New CEO Might Change The Case For Investing In Kasumigaseki Capital (TSE:3498)

Reviewed by Sasha Jovanovic

- Kasumigaseki Capital Co. Ltd. recently approved a revamped executive structure at its 14th Annual General Meeting, appointing a new President and CEO, multiple Deputy Presidents, several Senior Executive Officers, and a refreshed slate of outside directors and audit & supervisory board members.

- An interesting feature of this overhaul is the influx of independent directors with deep backgrounds in investment banking, real estate, and corporate governance, which could influence how the company manages risk, capital allocation, and future growth initiatives.

- We’ll now examine how this broadened leadership bench, particularly the addition of experienced independent directors, reshapes Kasumigaseki Capital’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Kasumigaseki CapitalLtd's Investment Narrative?

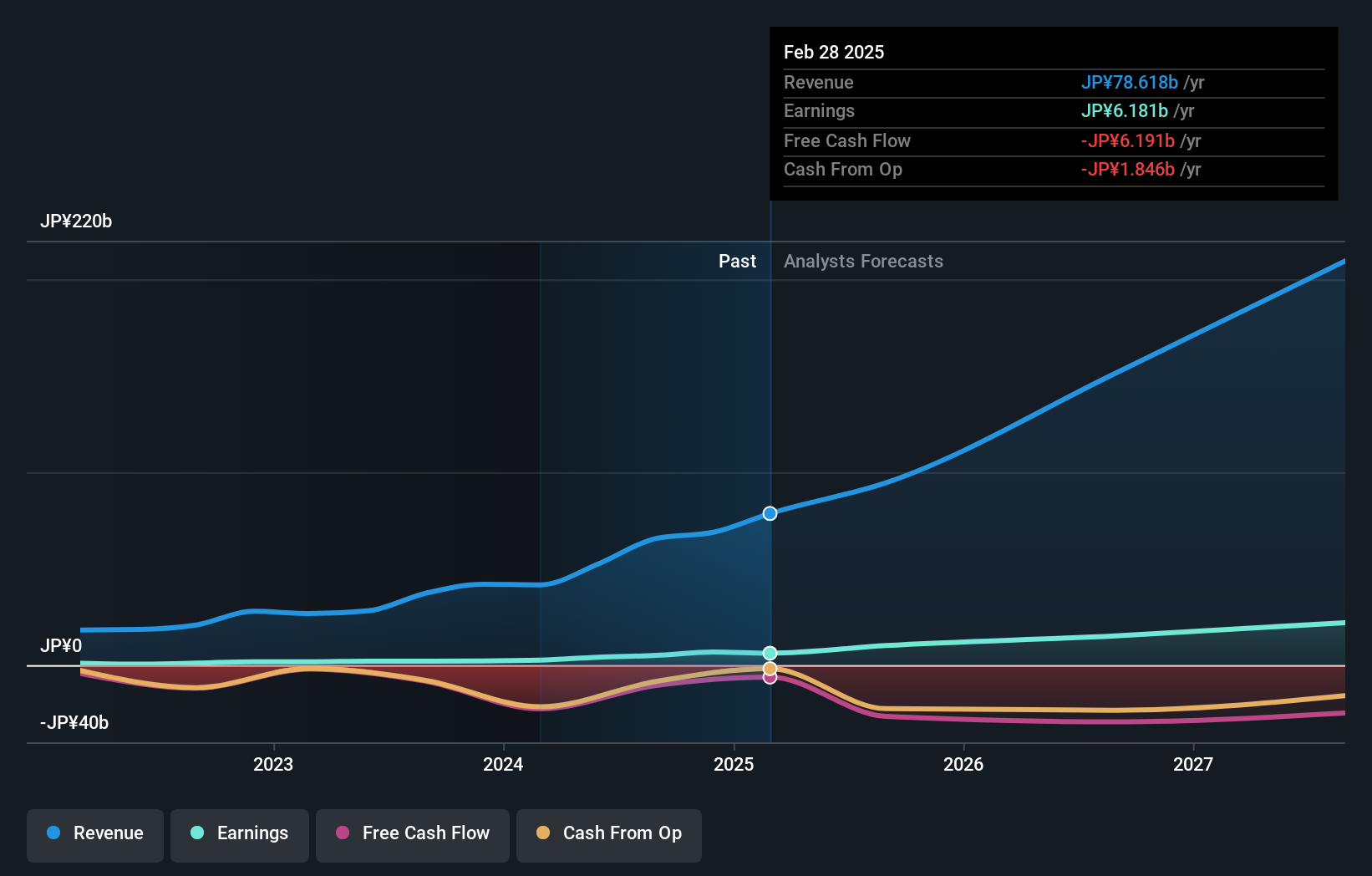

To own Kasumigaseki Capital, you really have to buy into a story of rapid expansion in real estate and alternative investments, tempered by an active effort to tighten governance and capital discipline. Short term, the key catalysts remain execution against ambitious FY2025–26 earnings and revenue guidance and how the company manages its relatively high leverage and cash flow coverage, rather than the share price drift over the past quarter. The newly installed executive structure, with a fresh CEO and multiple senior insiders stepping up alongside seasoned outside directors from Mizuho and the legal and HR worlds, could matter for how quickly Kasumigaseki recalibrates risk, funding, and project selection. If this board refresh improves oversight and capital allocation, it may gradually reshape how investors view both the growth plan and the balance sheet risk.

However, the company’s use of debt and cash flow coverage is something investors should not overlook. Kasumigaseki CapitalLtd's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on Kasumigaseki CapitalLtd - why the stock might be worth 45% less than the current price!

Build Your Own Kasumigaseki CapitalLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kasumigaseki CapitalLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kasumigaseki CapitalLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kasumigaseki CapitalLtd's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kasumigaseki CapitalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3498

Kasumigaseki CapitalLtd

Engages in real estate consulting businesses in Japan.

Exceptional growth potential with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026