- Japan

- /

- Real Estate

- /

- TSE:3289

If EPS Growth Is Important To You, Tokyu Fudosan Holdings (TSE:3289) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Tokyu Fudosan Holdings (TSE:3289). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Tokyu Fudosan Holdings with the means to add long-term value to shareholders.

Tokyu Fudosan Holdings' Earnings Per Share Are Growing

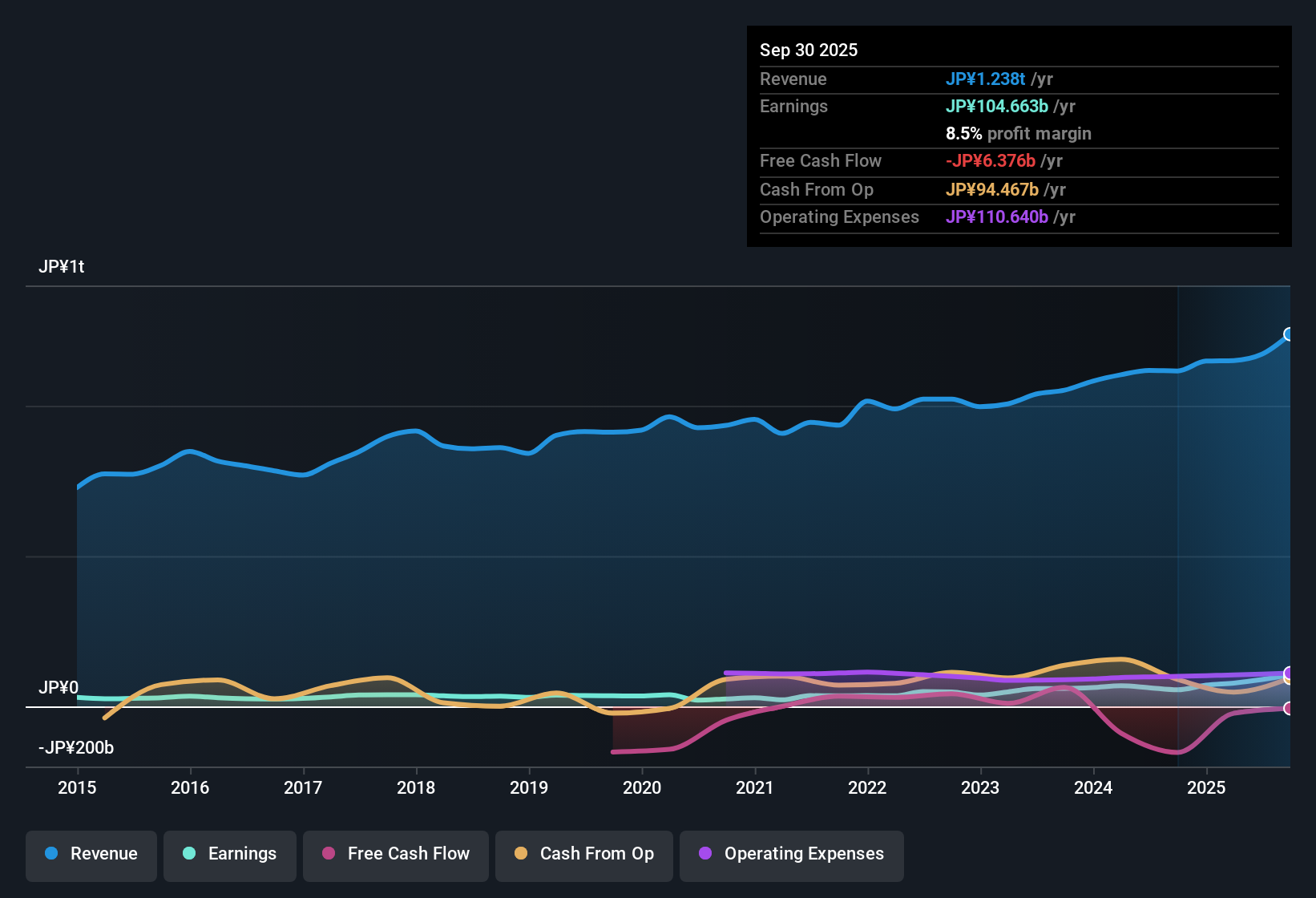

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Tokyu Fudosan Holdings has grown EPS by 30% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Tokyu Fudosan Holdings shareholders is that EBIT margins have grown from 10% to 14% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

See our latest analysis for Tokyu Fudosan Holdings

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Tokyu Fudosan Holdings' future EPS 100% free.

Are Tokyu Fudosan Holdings Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to Tokyu Fudosan Holdings, with market caps between JP¥622b and JP¥1.9t, is around JP¥153m.

The Tokyu Fudosan Holdings CEO received JP¥135m in compensation for the year ending March 2025. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Tokyu Fudosan Holdings To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Tokyu Fudosan Holdings' strong EPS growth. Strong EPS growth is a great look for the company and reasonable CEO compensation sweetens the deal for investors ass it alludes to management being conscious of frivolous spending. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. It is worth noting though that we have found 2 warning signs for Tokyu Fudosan Holdings (1 is a bit concerning!) that you need to take into consideration.

Although Tokyu Fudosan Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Japanese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tokyu Fudosan Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3289

Tokyu Fudosan Holdings

Engages in the real estate business in Japan and internationally.

Solid track record average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026