- Japan

- /

- Real Estate

- /

- TSE:3245

Top Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets continue to respond positively to recent political developments and economic indicators, with U.S. stocks reaching record highs amid optimism around trade policies and AI investments, investors are increasingly focusing on dividend stocks as a potential source of stable income in an evolving landscape. In this context, identifying strong dividend stocks involves looking for companies with a history of consistent payouts and the ability to maintain dividends despite market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.98% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

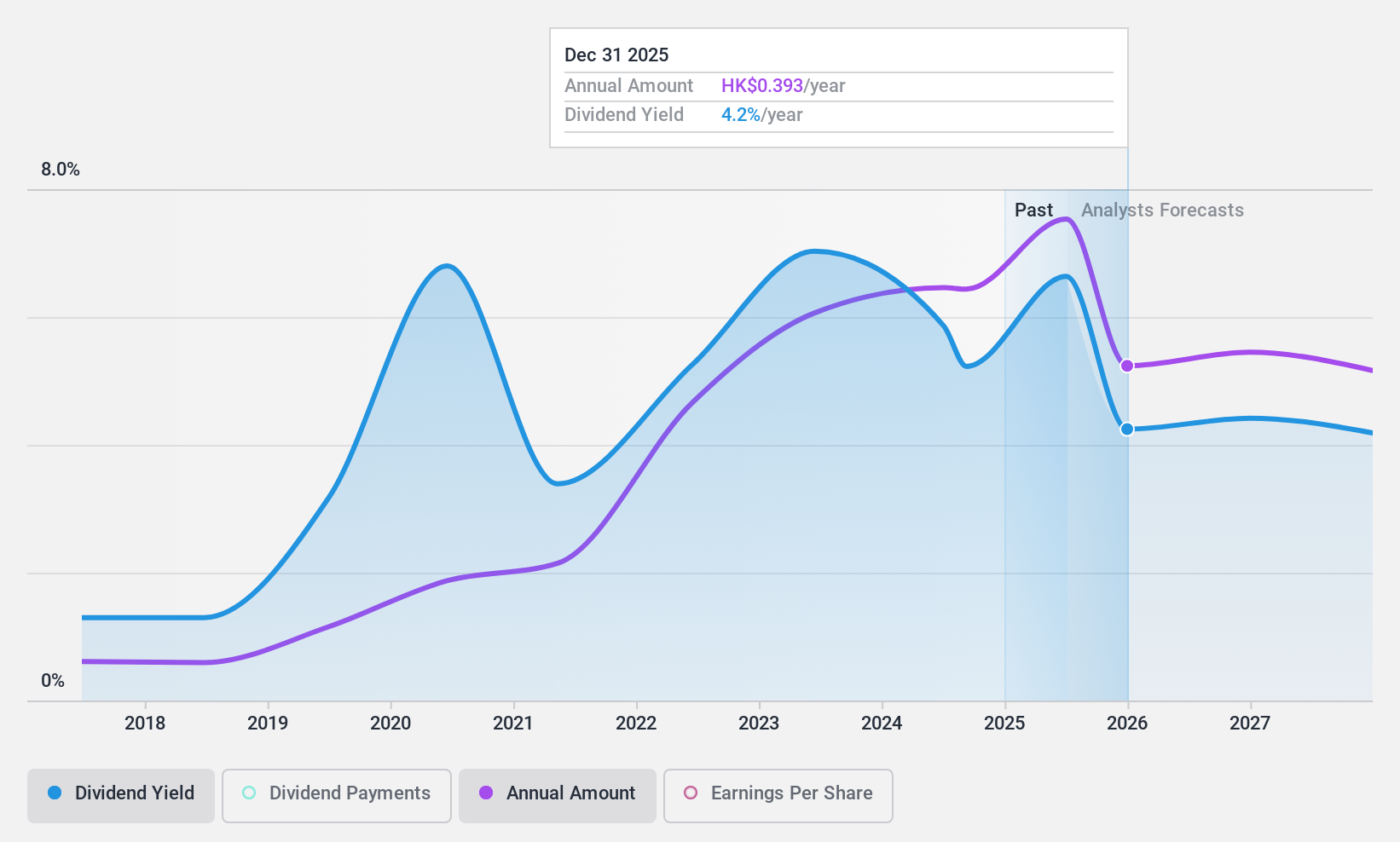

China Coal Energy (SEHK:1898)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Coal Energy Company Limited engages in mining, producing, processing, trading, and selling coal both domestically in the People’s Republic of China and internationally, with a market cap of HK$149.40 billion.

Operations: China Coal Energy Company Limited generates revenue through its activities in coal mining, production, processing, trading, and sales within China and on the international stage.

Dividend Yield: 5.3%

China Coal Energy's dividend payments are covered by earnings and cash flows, with a payout ratio of 52.4% and a cash payout ratio of 31.2%. Despite this coverage, the dividends have been volatile over the past decade, indicating an unreliable track record. The dividend yield stands at 5.32%, lower than the top quartile in Hong Kong. Recent production increases in coal and other products suggest operational strength, but historical dividend volatility remains a concern for income-focused investors.

- Unlock comprehensive insights into our analysis of China Coal Energy stock in this dividend report.

- The analysis detailed in our China Coal Energy valuation report hints at an deflated share price compared to its estimated value.

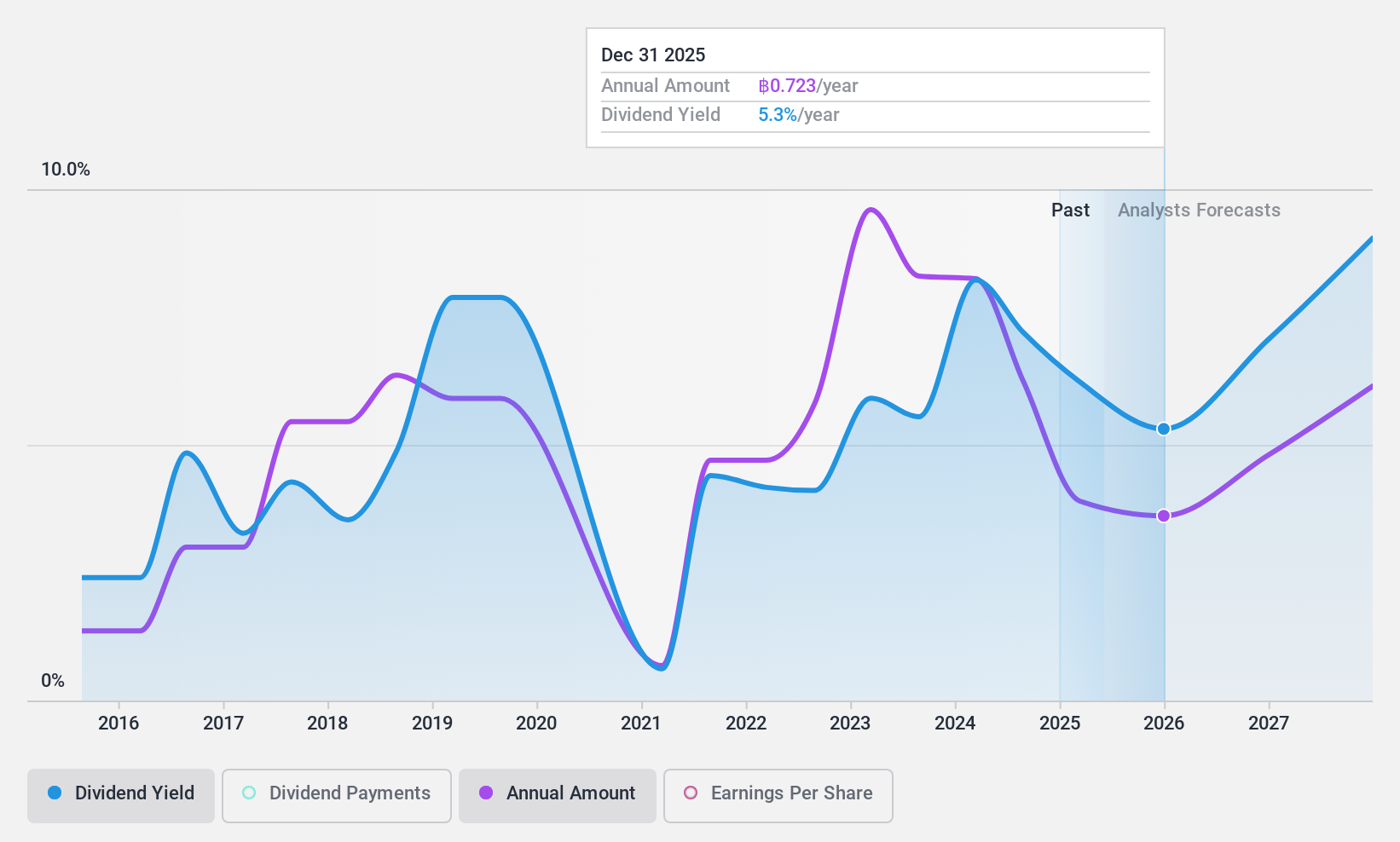

AAPICO Hitech (SET:AH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AAPICO Hitech Public Company Limited manufactures and distributes automobile parts, dies, and jigs across Thailand, China, Malaysia, and Portugal with a market cap of THB4.94 billion.

Operations: AAPICO Hitech generates revenue primarily from the manufacture of auto parts, which accounts for THB20.73 billion, and from sales of automobiles and provision of repair services, contributing THB9.73 billion.

Dividend Yield: 8.4%

AAPICO Hitech's dividend yield of 8.45% ranks in the top 25% of Thai dividend payers, yet it is not well-covered by free cash flows due to a high cash payout ratio of 113.7%. Although dividends have grown over the past decade, they have been volatile and unreliable. Recent business expansions, including a new subsidiary for OEM automotive parts manufacturing, may impact future earnings stability and dividend sustainability.

- Click here to discover the nuances of AAPICO Hitech with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, AAPICO Hitech's share price might be too pessimistic.

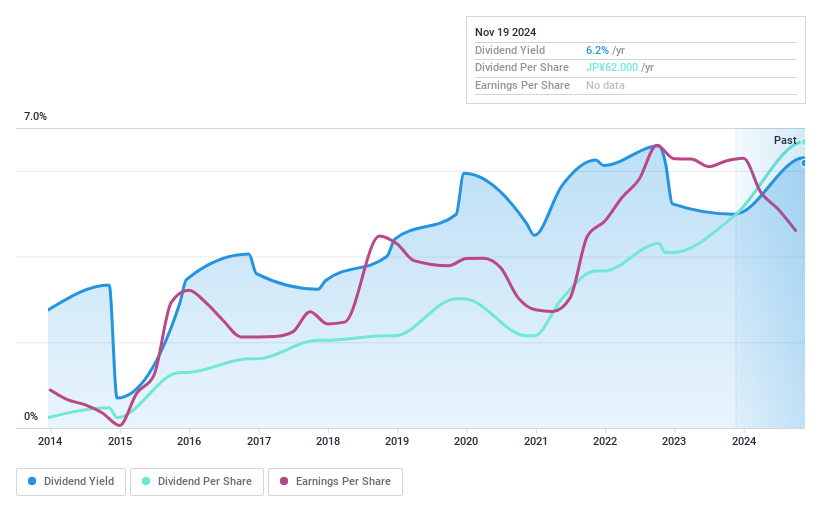

Dear LifeLtd (TSE:3245)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dear Life Co., Ltd. operates in the real estate sector in Japan and has a market capitalization of ¥43.99 billion.

Operations: Dear Life Co., Ltd.'s revenue is primarily derived from its Real Estate Business, which contributes ¥42.83 billion, and its Sales Promotion Business, which adds ¥4.06 billion.

Dividend Yield: 6.1%

Dear Life Ltd.'s dividend yield of 6.07% is among the top 25% in the Japanese market, yet it faces sustainability issues as dividends are not supported by free cash flows or earnings. Despite a low payout ratio of 48.6%, dividends have been volatile and unreliable over the past decade, with profit margins declining from last year. While dividend payments have increased over time, high non-cash earnings raise concerns about quality and stability.

- Click to explore a detailed breakdown of our findings in Dear LifeLtd's dividend report.

- Our valuation report unveils the possibility Dear LifeLtd's shares may be trading at a premium.

Taking Advantage

- Reveal the 1951 hidden gems among our Top Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3245

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives