CCReB Advisors Inc. (TSE:276A) shares have continued their recent momentum with a 30% gain in the last month alone. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

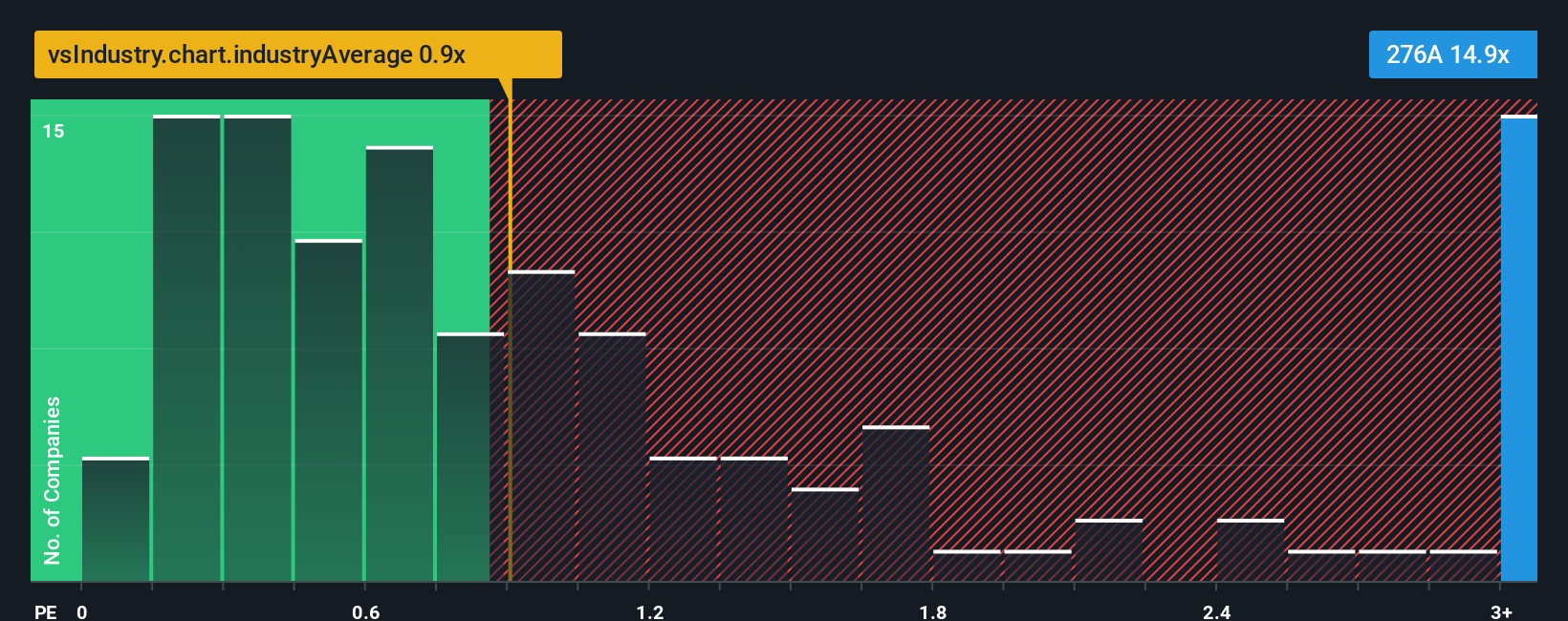

After such a large jump in price, given around half the companies in Japan's Real Estate industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider CCReB Advisors as a stock to avoid entirely with its 14.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for CCReB Advisors

What Does CCReB Advisors' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, CCReB Advisors has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on CCReB Advisors.How Is CCReB Advisors' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as CCReB Advisors' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 94% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 38% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 7.5%, which is noticeably less attractive.

With this in mind, it's not hard to understand why CCReB Advisors' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does CCReB Advisors' P/S Mean For Investors?

CCReB Advisors' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that CCReB Advisors maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Real Estate industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for CCReB Advisors that we have uncovered.

If you're unsure about the strength of CCReB Advisors' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:276A

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives