PeptiDream Inc.'s (TSE:4587) 42% Price Boost Is Out Of Tune With Revenues

PeptiDream Inc. (TSE:4587) shares have continued their recent momentum with a 42% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 11% is also fairly reasonable.

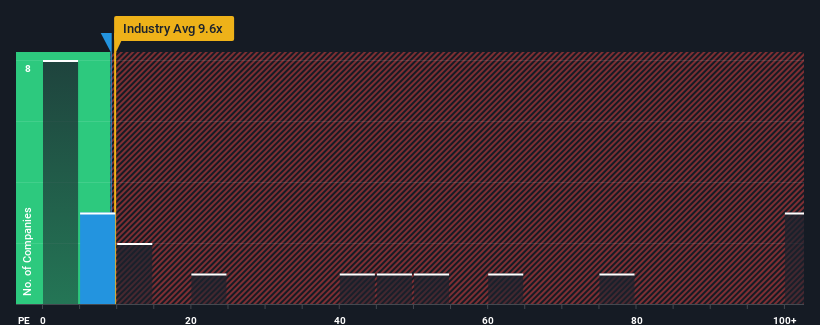

Although its price has surged higher, there still wouldn't be many who think PeptiDream's price-to-sales (or "P/S") ratio of 9.1x is worth a mention when the median P/S in Japan's Biotechs industry is similar at about 9.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for PeptiDream

What Does PeptiDream's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, PeptiDream has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think PeptiDream's future stacks up against the industry? In that case, our free report is a great place to start.How Is PeptiDream's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like PeptiDream's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 6.9%. Pleasingly, revenue has also lifted 146% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 13% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 27% each year, which is noticeably more attractive.

With this information, we find it interesting that PeptiDream is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

PeptiDream's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that PeptiDream's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Plus, you should also learn about these 2 warning signs we've spotted with PeptiDream (including 1 which is concerning).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4587

PeptiDream

A biopharmaceutical company, engages in the discovery and development of constrained peptides, small molecules, and peptide-drug conjugate therapeutics.

Outstanding track record and undervalued.