Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Chiome Bioscience Inc. (TSE:4583) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Chiome Bioscience

How Much Debt Does Chiome Bioscience Carry?

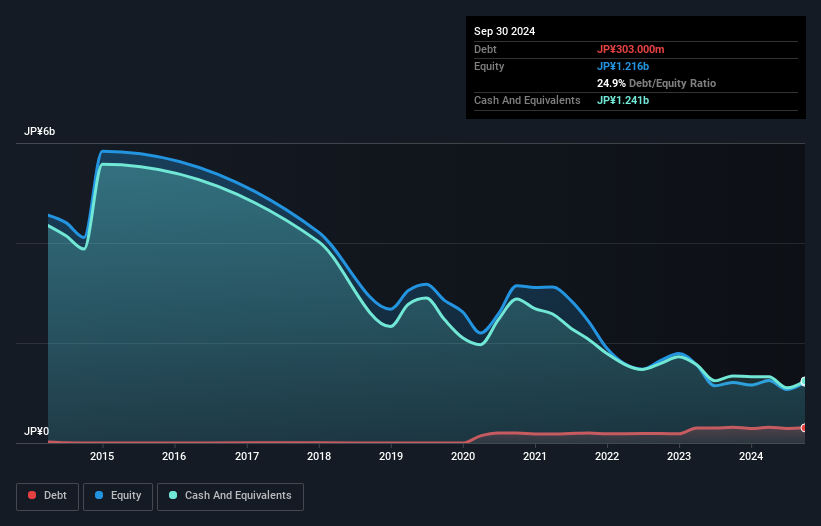

As you can see below, Chiome Bioscience had JP¥303.0m of debt at September 2024, down from JP¥316.3m a year prior. However, it does have JP¥1.24b in cash offsetting this, leading to net cash of JP¥938.3m.

How Healthy Is Chiome Bioscience's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Chiome Bioscience had liabilities of JP¥423.2m due within 12 months and liabilities of JP¥55.0m due beyond that. On the other hand, it had cash of JP¥1.24b and JP¥92.9m worth of receivables due within a year. So it actually has JP¥855.9m more liquid assets than total liabilities.

This surplus suggests that Chiome Bioscience has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Chiome Bioscience boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Chiome Bioscience will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Chiome Bioscience had a loss before interest and tax, and actually shrunk its revenue by 19%, to JP¥581m. We would much prefer see growth.

So How Risky Is Chiome Bioscience?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Chiome Bioscience lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of JP¥1.2b and booked a JP¥1.2b accounting loss. But at least it has JP¥938.3m on the balance sheet to spend on growth, near-term. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 4 warning signs with Chiome Bioscience (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4583

Chiome Bioscience

Engages in the research and development of drug discovery technology platforms worldwide.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives