- Japan

- /

- Life Sciences

- /

- TSE:4572

Carna Biosciences, Inc. (TSE:4572) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Carna Biosciences, Inc. (TSE:4572) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

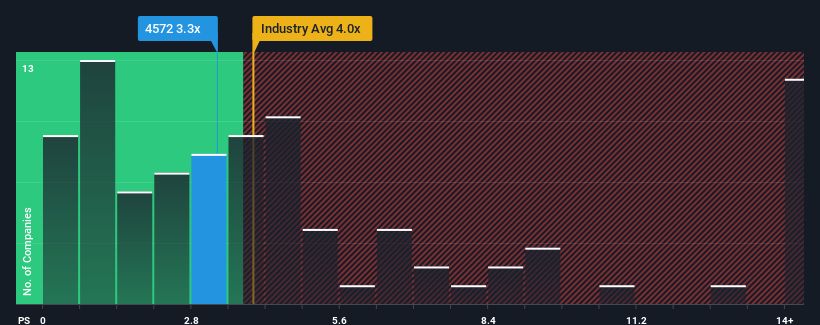

Although its price has dipped substantially, given close to half the companies operating in Japan's Life Sciences industry have price-to-sales ratios (or "P/S") below 2.7x, you may still consider Carna Biosciences as a stock to potentially avoid with its 3.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Carna Biosciences

What Does Carna Biosciences' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Carna Biosciences has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Carna Biosciences' earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Carna Biosciences would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 49% last year. The strong recent performance means it was also able to grow revenue by 53% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 19% shows it's noticeably less attractive.

With this information, we find it concerning that Carna Biosciences is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Carna Biosciences' P/S?

There's still some elevation in Carna Biosciences' P/S, even if the same can't be said for its share price recently. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Carna Biosciences currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Carna Biosciences (2 are significant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Carna Biosciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Carna Biosciences, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4572

Carna Biosciences

A clinical-stage biopharmaceutical company, discovers and develops drug therapies to treat unmet medical needs in Japan.

Flawless balance sheet low.

Market Insights

Community Narratives