JCR Pharmaceuticals (TSE:4552) shareholders are up 13% this past week, but still in the red over the last three years

JCR Pharmaceuticals Co., Ltd. (TSE:4552) shareholders should be happy to see the share price up 18% in the last quarter. But that is meagre solace in the face of the shocking decline over three years. Indeed, the share price is down a whopping 72% in the last three years. So it sure is nice to see a bit of an improvement. But the more important question is whether the underlying business can justify a higher price still.

On a more encouraging note the company has added JP¥10.0b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for JCR Pharmaceuticals

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

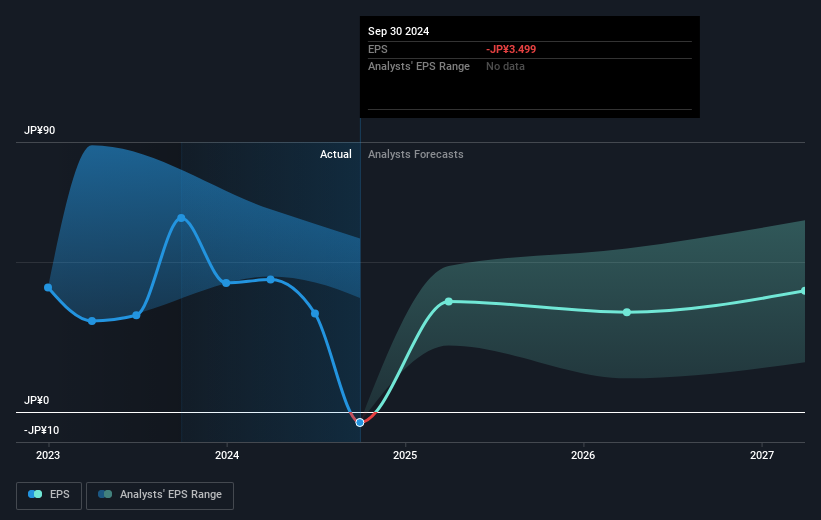

Over the three years that the share price declined, JCR Pharmaceuticals' earnings per share (EPS) dropped significantly, falling to a loss. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on JCR Pharmaceuticals' earnings, revenue and cash flow.

A Different Perspective

Investors in JCR Pharmaceuticals had a tough year, with a total loss of 43% (including dividends), against a market gain of about 13%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand JCR Pharmaceuticals better, we need to consider many other factors. Case in point: We've spotted 2 warning signs for JCR Pharmaceuticals you should be aware of, and 1 of them is concerning.

Of course JCR Pharmaceuticals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4552

JCR Pharmaceuticals

Engages in the research, development, manufacture, import and export, and sale of pharmaceutical products, regenerative medicines, and drug substances in Japan.

Moderate growth potential with mediocre balance sheet.