Why Ono Pharmaceutical (TSE:4528) Is Up 6.4% After Positive Mid-Stage Data in Gastric Cancer and MSA

Reviewed by Sasha Jovanovic

- Ono Pharmaceutical recently announced positive findings from two Phase 2 clinical trials: ONO-4578 in combination with Opdivo and chemotherapy showed improved progression-free survival for untreated, HER2-negative unresectable advanced or recurrent gastric cancer, while interim results for ONO-2808 in multiple system atrophy indicated slowed disease progression and a manageable safety profile.

- The results point to clinical advancement in challenging areas with limited treatment options, adding momentum to the company’s late-stage development pipeline.

- We will explore how progress in novel therapies for gastric cancer and multiple system atrophy supports Ono Pharmaceutical’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ono Pharmaceutical's Investment Narrative?

To be a shareholder in Ono Pharmaceutical, I think one has to focus on the company’s ability to convert its innovative late-stage pipeline into meaningful revenue, especially in a market where current growth rates have trailed sector averages and net profit margins have compressed sharply year on year. The recent positive Phase 2 results from ONO-4578 and ONO-2808 fit squarely into this investment thesis, as they directly address the company’s need for fresh clinical catalysts and potentially open new addressable markets in areas with high unmet need. With sentiment previously challenged by modest growth forecasts and lower returns, these announcements could refresh short-term catalysts leading into the Q2 2026 results, but questions remain around how quickly these trials could translate into approvals or material revenue impact. Risks tied to slower top-line growth and sustainable dividend coverage remain prominent, even as clinical momentum improves. On the other hand, top-line growth remains under pressure and should not be overlooked.

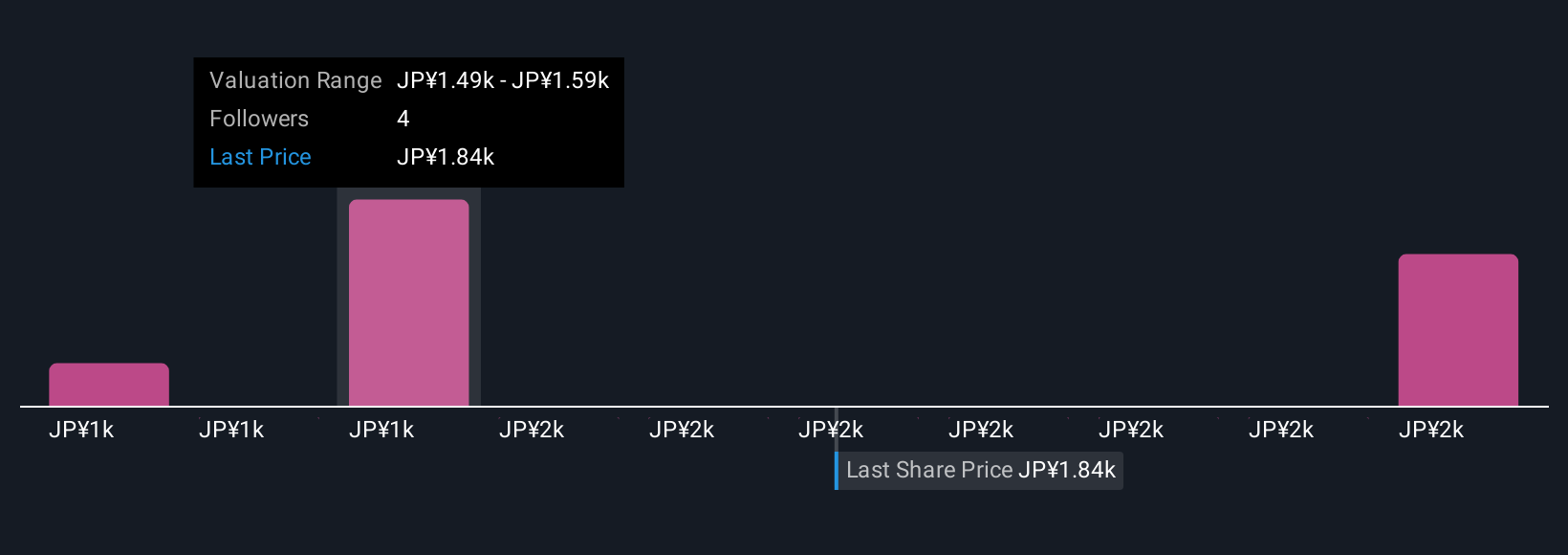

Ono Pharmaceutical's shares have been on the rise but are still potentially undervalued by 47%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Ono Pharmaceutical - why the stock might be worth as much as 90% more than the current price!

Build Your Own Ono Pharmaceutical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ono Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ono Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ono Pharmaceutical's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4528

Ono Pharmaceutical

Produces, purchases, and sells pharmaceuticals and diagnostic reagents worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives