Is New Phase 3 Data on Vimseltinib Changing the Investment Case for Ono Pharmaceutical (TSE:4528)?

Reviewed by Sasha Jovanovic

- Ono Pharmaceutical recently presented two-year efficacy and safety data from the MOTION Phase 3 study of vimseltinib in patients with tenosynovial giant cell tumor (TGCT) ineligible for surgery at the 2025 European Society for Medical Oncology Congress in Berlin.

- The long-term results underscore vimseltinib’s potential as a treatment option for individuals with limited alternatives, marking an important achievement in Ono's oncology pipeline.

- We’ll explore how these positive long-term clinical findings position vimseltinib as a highlight in Ono Pharmaceutical’s investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Ono Pharmaceutical's Investment Narrative?

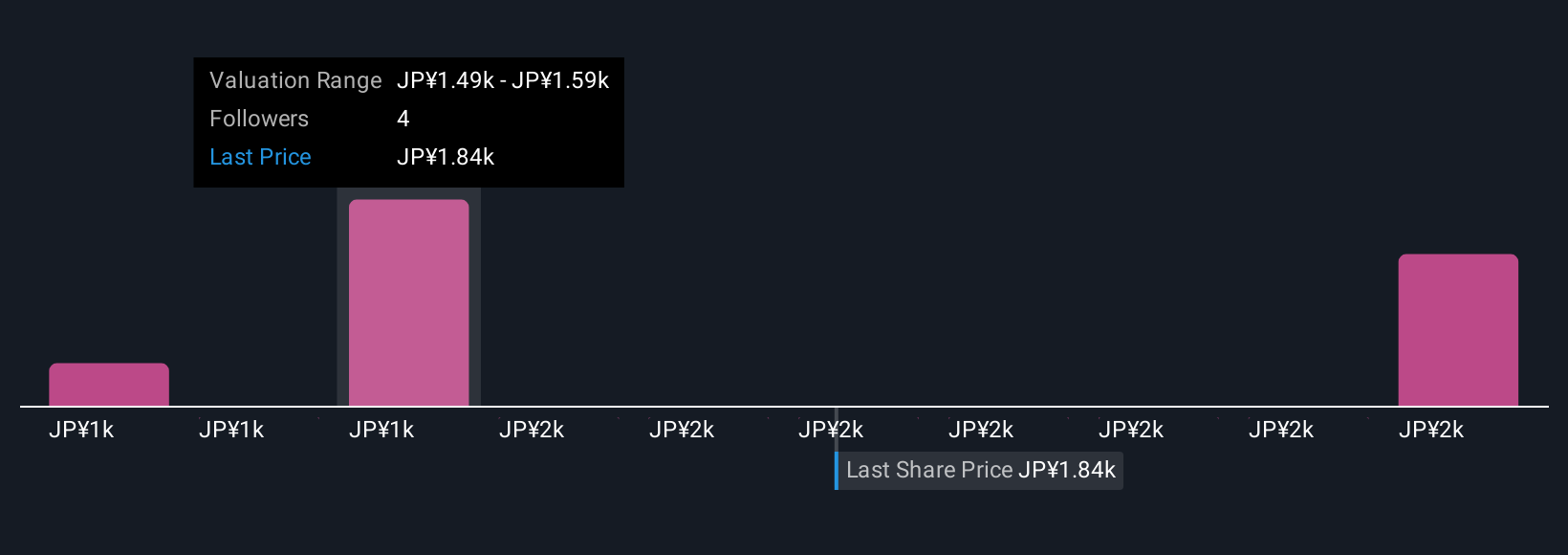

For anyone considering Ono Pharmaceutical, the investment case has always hinged on the company’s ability to bring innovative treatments to market while navigating modest growth expectations and strong competition. The newly presented two-year results from the MOTION Phase 3 study put vimseltinib in the spotlight, potentially refreshing the company’s near-term catalysts by supporting future regulatory discussions and bolstering the oncology pipeline, with clear relevance given recent European approval. That said, management has revised revenue guidance downward, and Ono still faces expected declines in revenue and tighter profit margins compared to prior years. The vimseltinib data may shift sentiment or expectations near-term, but the share price still trades below analyst consensus fair value, and risk remains if uptake or reimbursement for new medicines does not accelerate meaningfully. Looking forward, potential catalysts now include updates on vimseltinib commercialization and upcoming earnings, but the core risk continues to be lackluster top-line growth. Yet, investors should consider the ongoing challenge of declining revenues.

Ono Pharmaceutical's shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Ono Pharmaceutical - why the stock might be worth as much as 25% more than the current price!

Build Your Own Ono Pharmaceutical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ono Pharmaceutical research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Ono Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ono Pharmaceutical's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4528

Ono Pharmaceutical

Produces, purchases, and sells pharmaceuticals and diagnostic reagents worldwide.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion