As global markets grapple with heightened trade tensions and economic uncertainty, the Asian stock market has not been immune to these challenges, experiencing volatility amid new tariff announcements and shifting investor sentiment. In such an environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking resilience in their portfolios.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | 6.21% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.44% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 5.06% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 4.57% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.21% | ★★★★★★ |

| ENEOS Holdings (TSE:5020) | 4.24% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.47% | ★★★★★★ |

| Torigoe (TSE:2009) | 5.67% | ★★★★★★ |

Click here to see the full list of 1310 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

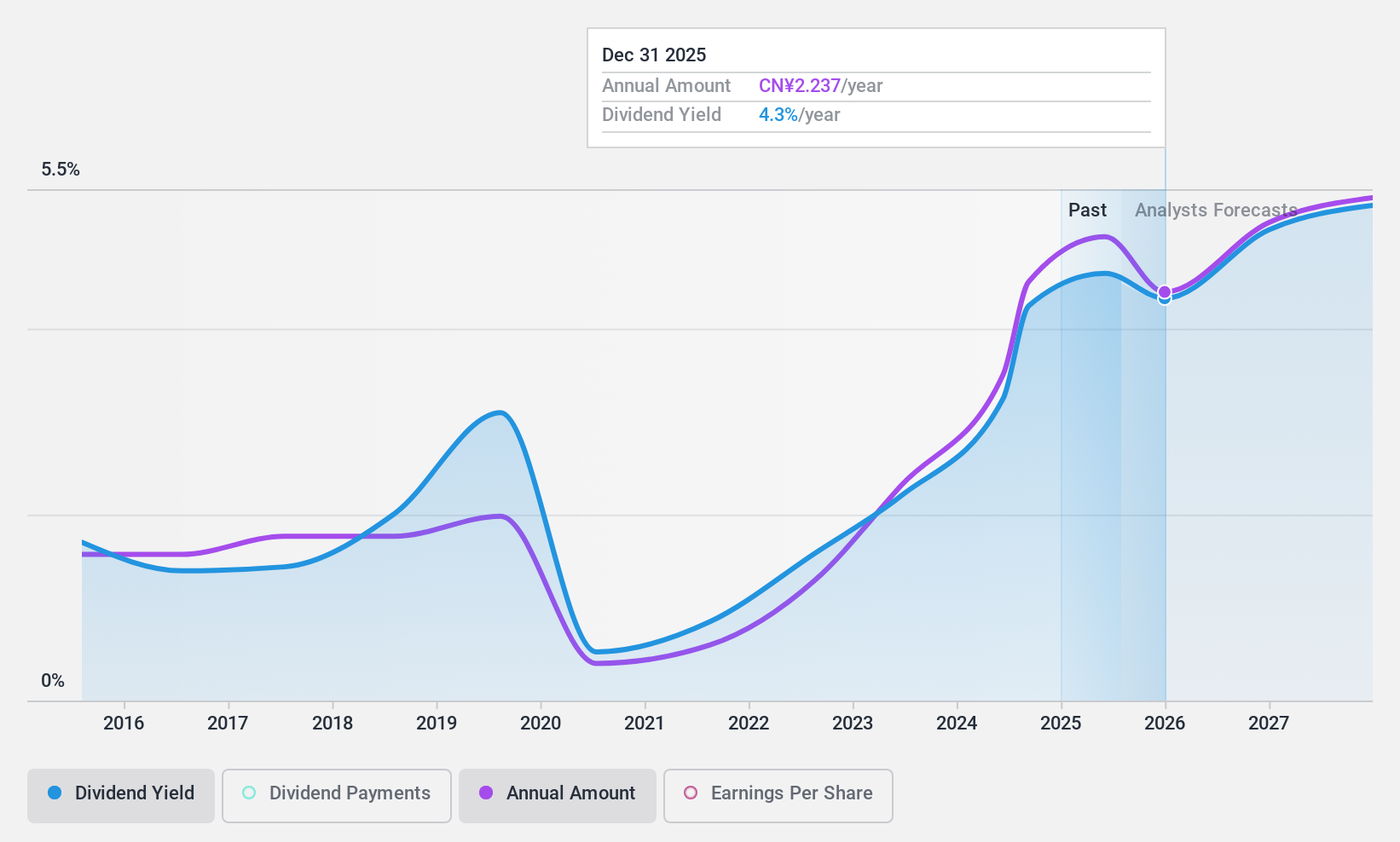

Dong-E-E-JiaoLtd (SZSE:000423)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dong-E-E-Jiao Ltd. engages in the research, development, production, and sale of Ejiao along with Chinese patent medicines and health foods, with a market cap of CN¥39.16 billion.

Operations: Dong-E-E-Jiao Ltd. generates revenue primarily from the operation of Ejiao and its related products, amounting to CN¥5.92 billion.

Dividend Yield: 4.2%

Dong-E-E-Jiao Ltd. has shown notable earnings growth, with net income rising to CNY 1.56 billion in 2024 from CNY 1.15 billion the previous year, but its dividend sustainability remains a concern due to a high payout ratio of nearly 100%. Despite being among the top dividend payers in China with a yield of 4.17%, the company's dividends have been volatile and not well covered by earnings or cash flows, impacting reliability for income-focused investors.

- Dive into the specifics of Dong-E-E-JiaoLtd here with our thorough dividend report.

- Our expertly prepared valuation report Dong-E-E-JiaoLtd implies its share price may be lower than expected.

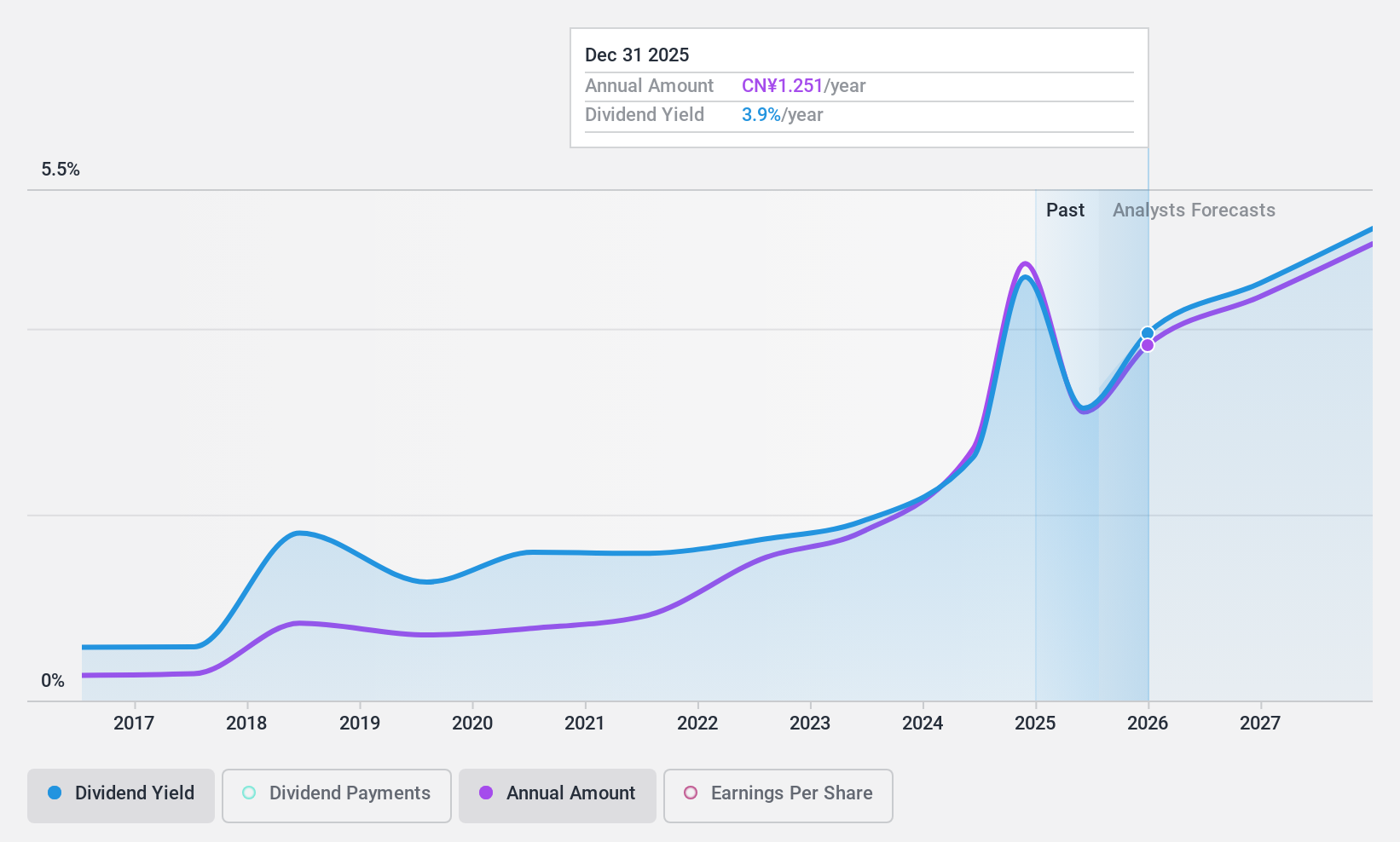

China Resources Sanjiu Medical & Pharmaceutical (SZSE:000999)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Resources Sanjiu Medical & Pharmaceutical Co., Ltd. operates in the pharmaceutical industry, focusing on the production and distribution of medical products, with a market cap of approximately CN¥55.12 billion.

Operations: China Resources Sanjiu Medical & Pharmaceutical Co., Ltd. generates revenue from its primary segments, with CN¥24.24 billion from Pharmaceuticals, CN¥0.88 billion from Printing and Packaging, and CN¥4.17 billion from the Medicines, Equipment Wholesale and Retail Industry Segment.

Dividend Yield: 3.1%

China Resources Sanjiu Medical & Pharmaceutical's dividend yield of 3.08% ranks it in the top 25% of Chinese dividend payers, supported by a cash payout ratio of 46.9%, indicating solid coverage by cash flows. However, its dividends have been volatile over the past decade, affecting reliability despite recent earnings growth to CNY 3.37 billion in 2024 from CNY 2.85 billion a year earlier and a reasonable earnings payout ratio of 50.2%.

- Get an in-depth perspective on China Resources Sanjiu Medical & Pharmaceutical's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that China Resources Sanjiu Medical & Pharmaceutical is trading behind its estimated value.

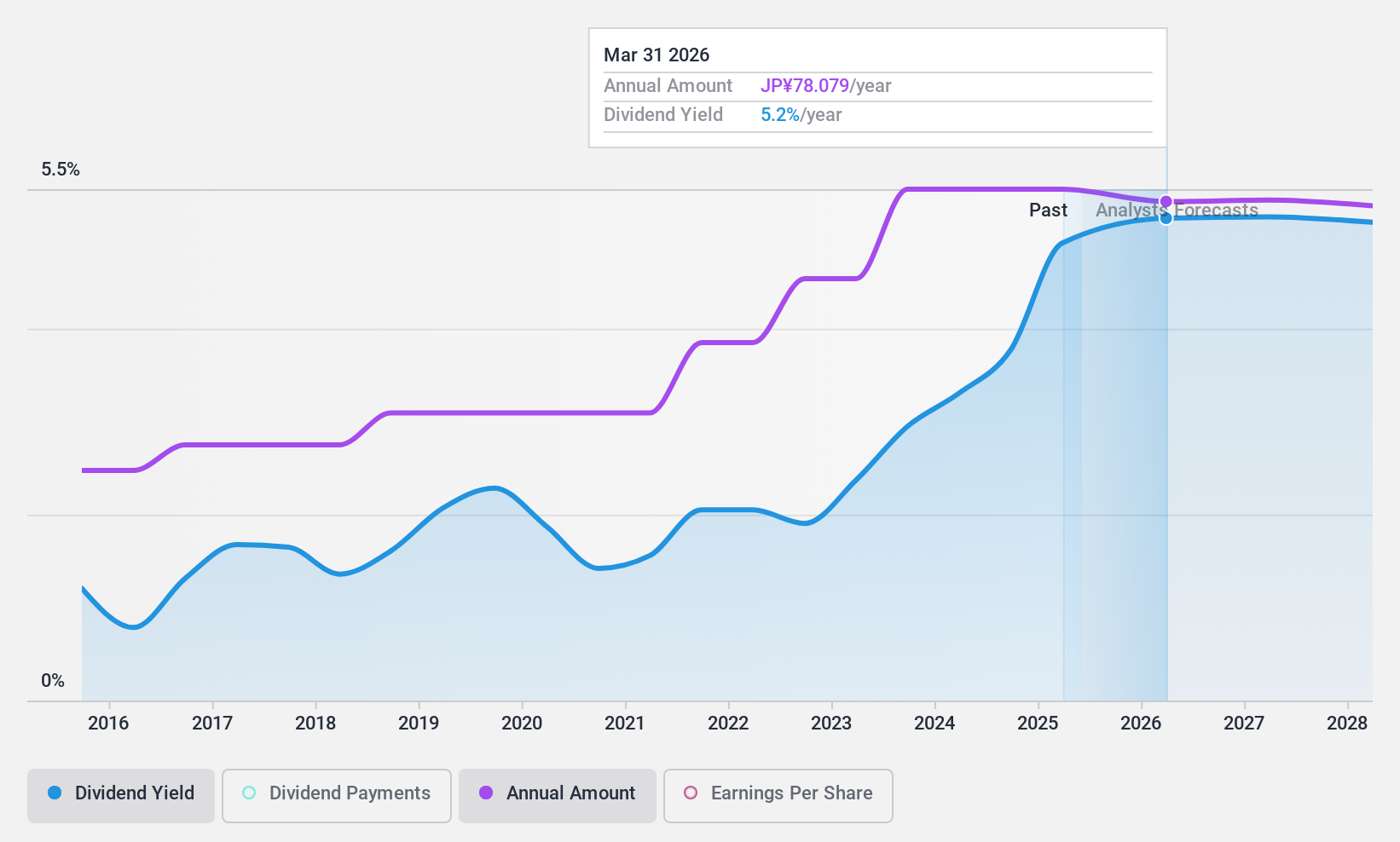

Ono Pharmaceutical (TSE:4528)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Ono Pharmaceutical Co., Ltd. and its subsidiaries engage in the production, purchase, and sale of pharmaceuticals and diagnostic reagents globally, with a market cap of ¥762.34 billion.

Operations: Ono Pharmaceutical Co., Ltd. generates revenue of ¥487.33 billion from its pharmaceutical business segment.

Dividend Yield: 4.9%

Ono Pharmaceutical offers a compelling dividend profile with a yield of 4.93%, placing it in the top quartile of Japanese dividend payers. Its dividends are well-supported by earnings and cash flows, with payout ratios of 50.8% and 49.6%, respectively, ensuring sustainability. Despite recent profit margin declines to 15.2% from last year's 25.6%, dividends have remained stable and reliable over the past decade, although earnings are projected to decrease by an average of 2.5% annually for the next three years.

- Delve into the full analysis dividend report here for a deeper understanding of Ono Pharmaceutical.

- Our valuation report unveils the possibility Ono Pharmaceutical's shares may be trading at a discount.

Make It Happen

- Access the full spectrum of 1310 Top Asian Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000423

Dong-E-E-JiaoLtd

Research and development, production, and sale of Ejiao and a series of Chinese patent medicines, health foods, and foods.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives