Why Chugai Pharmaceutical (TSE:4519) Is Up 14.6% After Japan’s 2025 Flu Outbreak Drives Vaccine Demand And What’s Next

Reviewed by Sasha Jovanovic

- Earlier in 2025, Japan experienced a major influenza outbreak, which led to heightened demand for flu vaccines and increased government collaboration with pharmaceutical companies.

- This surge in demand placed companies like Chugai Pharmaceutical in a central role, highlighting the importance of rapid pharmaceutical innovation and supply chain responsiveness during public health emergencies.

- We'll explore how the elevated demand from the influenza outbreak could reshape Chugai Pharmaceutical’s investment narrative and growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Chugai Pharmaceutical Investment Narrative Recap

To own shares in Chugai Pharmaceutical, you need to believe in the company's ability to translate medical innovation, particularly in biologics and personalized medicine, into reliable growth, even as competition and pricing pressures intensify. The recent influenza outbreak has put a spotlight on Chugai’s supply agility and innovation, giving a near-term boost in demand, but it does not eliminate the primary risk: dependence on a handful of blockbuster drugs facing looming patent expiries.

Among recent announcements, Chugai’s ongoing construction of the UKX research facility stands out. This project is expected to double R&D output and accelerate the transition to new drugs, which is highly relevant given both the short-term increase in demand for infectious disease therapies and the longer-term need to address the threat of patent cliffs and pipeline gaps.

Yet, in contrast to short-term demand, heavy reliance on Hemlibra and Actemra exposes Chugai to risks that every investor should watch for...

Read the full narrative on Chugai Pharmaceutical (it's free!)

Chugai Pharmaceutical's narrative projects ¥1,381.4 billion revenue and ¥516.9 billion earnings by 2028. This requires 4.9% yearly revenue growth and a ¥121.5 billion earnings increase from ¥395.4 billion today.

Uncover how Chugai Pharmaceutical's forecasts yield a ¥8082 fair value, a 12% upside to its current price.

Exploring Other Perspectives

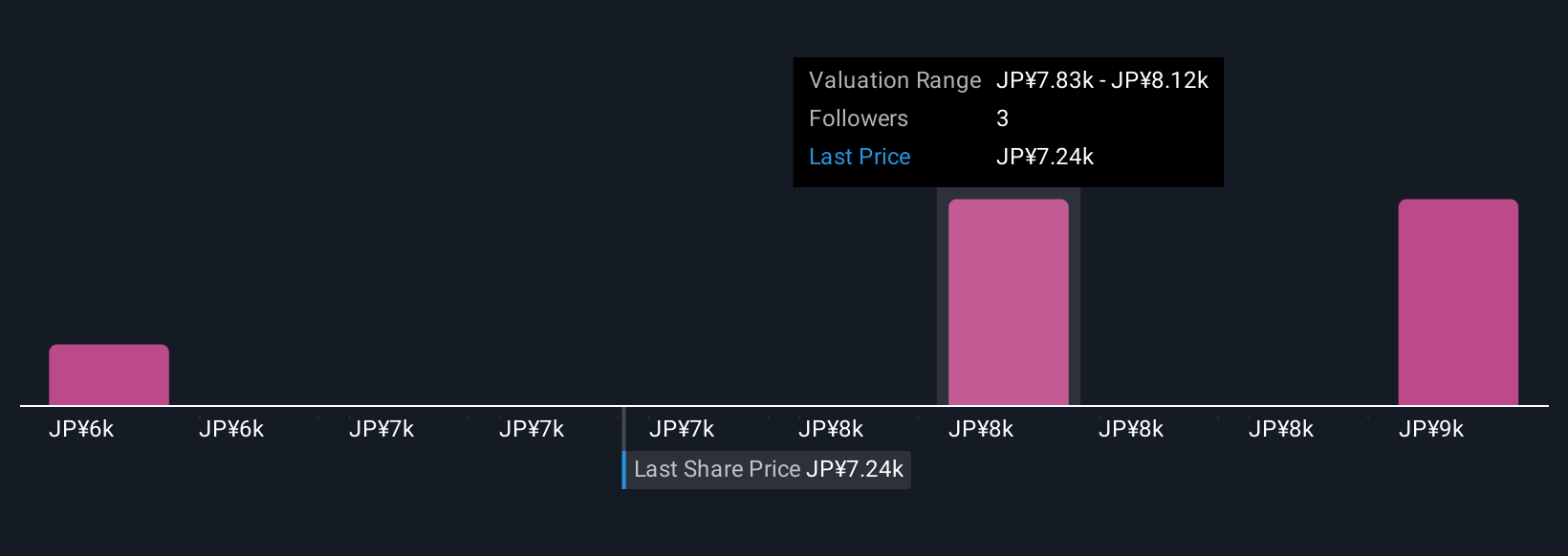

Private fair value forecasts for Chugai from the Simply Wall St Community range widely, from ¥6,100 to ¥8,985, with 3 unique analyses on record. While many are focused on Chugai’s innovative R&D pipeline, the persistent risk from upcoming patent expiries is a key factor shaping future performance. Compare several viewpoints to understand how your own expectations align.

Explore 3 other fair value estimates on Chugai Pharmaceutical - why the stock might be worth 16% less than the current price!

Build Your Own Chugai Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chugai Pharmaceutical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chugai Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chugai Pharmaceutical's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4519

Chugai Pharmaceutical

Engages in the research, development, manufacture, sale, importation, and exportation of pharmaceuticals in Japan and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives