Chugai Pharmaceutical (TSE:4519): Assessing Valuation as Investor Interest Grows

Reviewed by Kshitija Bhandaru

See our latest analysis for Chugai Pharmaceutical.

Chugai Pharmaceutical’s shares have seen their fair share of ups and downs, with the 1-year total shareholder return virtually flat at 0.46%, even as the company has more than doubled investors’ money over three years. Despite the choppy performance recently, momentum could be building again as the latest move hints at renewed interest and the underlying business remains on a steady growth track.

Looking for other compelling moves in healthcare? Our dedicated screener lets you discover new opportunities in the space. See the full list for free.

With shares trading at a notable discount to analyst targets, but steady growth in revenues and profits, it is worth asking whether Chugai Pharmaceutical is truly undervalued right now or if the market already anticipates further expansion.

Most Popular Narrative: 15.8% Undervalued

Chugai Pharmaceutical’s widely followed narrative pegs its fair value at ¥8,171, which represents a notable premium over the last close at ¥6,881. This perspective highlights strong future prospects and points to major drivers still unfolding.

Significant investment in advanced, environmentally friendly manufacturing capacity (e.g., the new UKX research facility) is expected to strengthen Chugai's ability to efficiently scale production of innovative therapeutics, enhancing supply chain resilience and driving better cost control, with a positive impact on future net profit margins.

Want to know what powers this valuation? The narrative is built on bold projections, including future growth, margin expansion, and a striking profit multiple. Which of these assumptions are most aggressive? Unlock the full story to see what really drives this price target.

Result: Fair Value of ¥8,171 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on just a few blockbuster drugs, along with tightening global pricing pressures, could challenge Chugai Pharmaceutical's growth narrative and future valuations.

Find out about the key risks to this Chugai Pharmaceutical narrative.

Another View: Market Valuation Signals Mixed

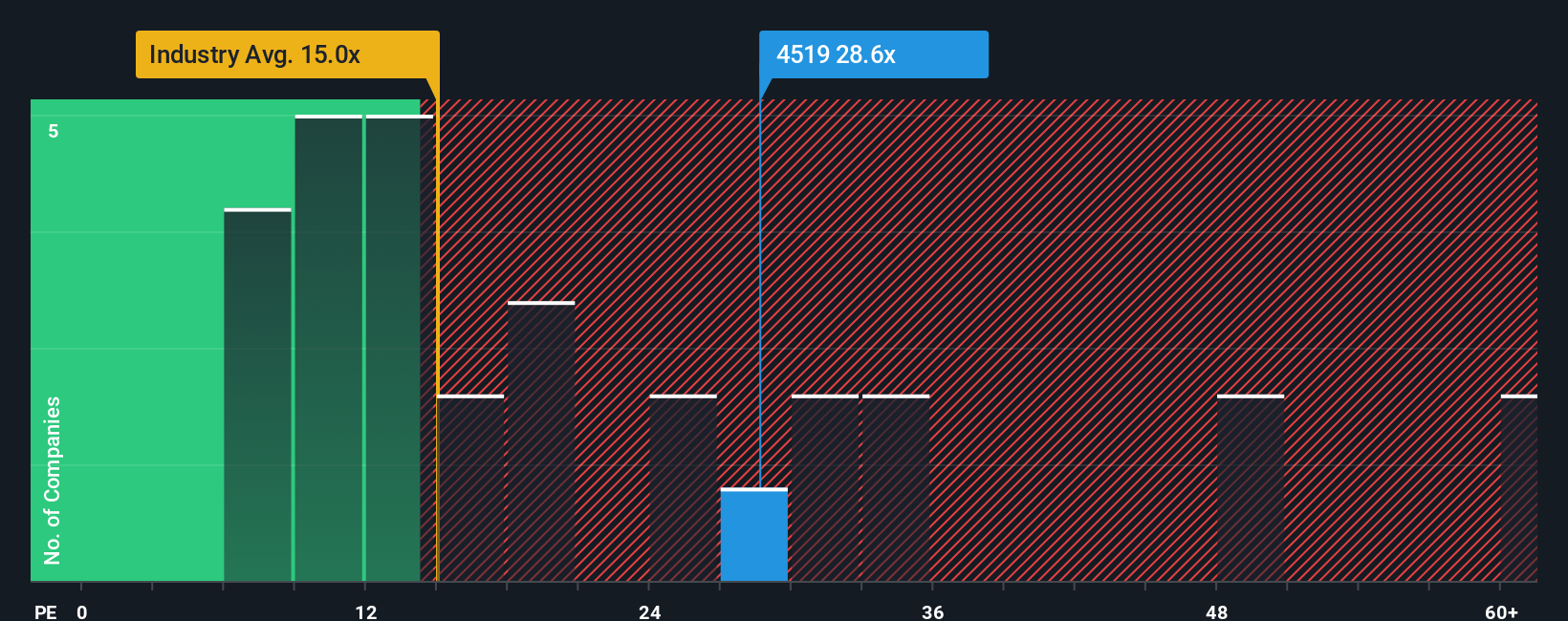

While the most popular narrative argues Chugai Pharmaceutical is undervalued, the current valuation using the price-to-earnings ratio tells a different story. At 28.6x, it is nearly double the industry average of 15x and slightly below peer averages. However, this is still under the fair ratio estimate of 34.5x, which suggests some upside if sentiment improves. Does this “expensive” status mean the market is already pricing in future growth, or is there more opportunity left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Chugai Pharmaceutical Narrative

If you think there is more to the story, or would rather dive into the data yourself, you can assemble your own view in just a few minutes. Do it your way.

A great starting point for your Chugai Pharmaceutical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next big winner slip away. Tap into curated shortlists where real growth, future trends, and reliable income come together to fuel your investment strategy.

- Start collecting steady income by checking out these 18 dividend stocks with yields > 3%, which offers healthy yields and proven financial strength for long-term portfolios.

- Catch a wave of innovation and potential with these 24 AI penny stocks as they shape the AI frontier and unlock tomorrow’s market leaders today.

- Spot hidden value now in these 878 undervalued stocks based on cash flows, which is primed for re-rating as new catalysts emerge and fundamentals accelerate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4519

Chugai Pharmaceutical

Engages in the research, development, manufacture, sale, importation, and exportation of pharmaceuticals in Japan and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives