- Japan

- /

- Medical Equipment

- /

- TSE:7817

Unveiling 3 Top Japanese Dividend Stocks With Yields Up To 4.4%

Reviewed by Simply Wall St

Amidst a backdrop of mixed weekly returns in the Japanese stock markets and ongoing speculation about monetary policy adjustments, investors are keenly observing opportunities within this nuanced landscape. In such an environment, dividend stocks can offer a compelling blend of potential income and stability, making them an attractive option for those looking to diversify their investment portfolios in Japan.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.72% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.70% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.56% | ★★★★★★ |

| Globeride (TSE:7990) | 3.80% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.60% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.51% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 3.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.18% | ★★★★★★ |

| Innotech (TSE:9880) | 4.15% | ★★★★★★ |

Click here to see the full list of 394 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

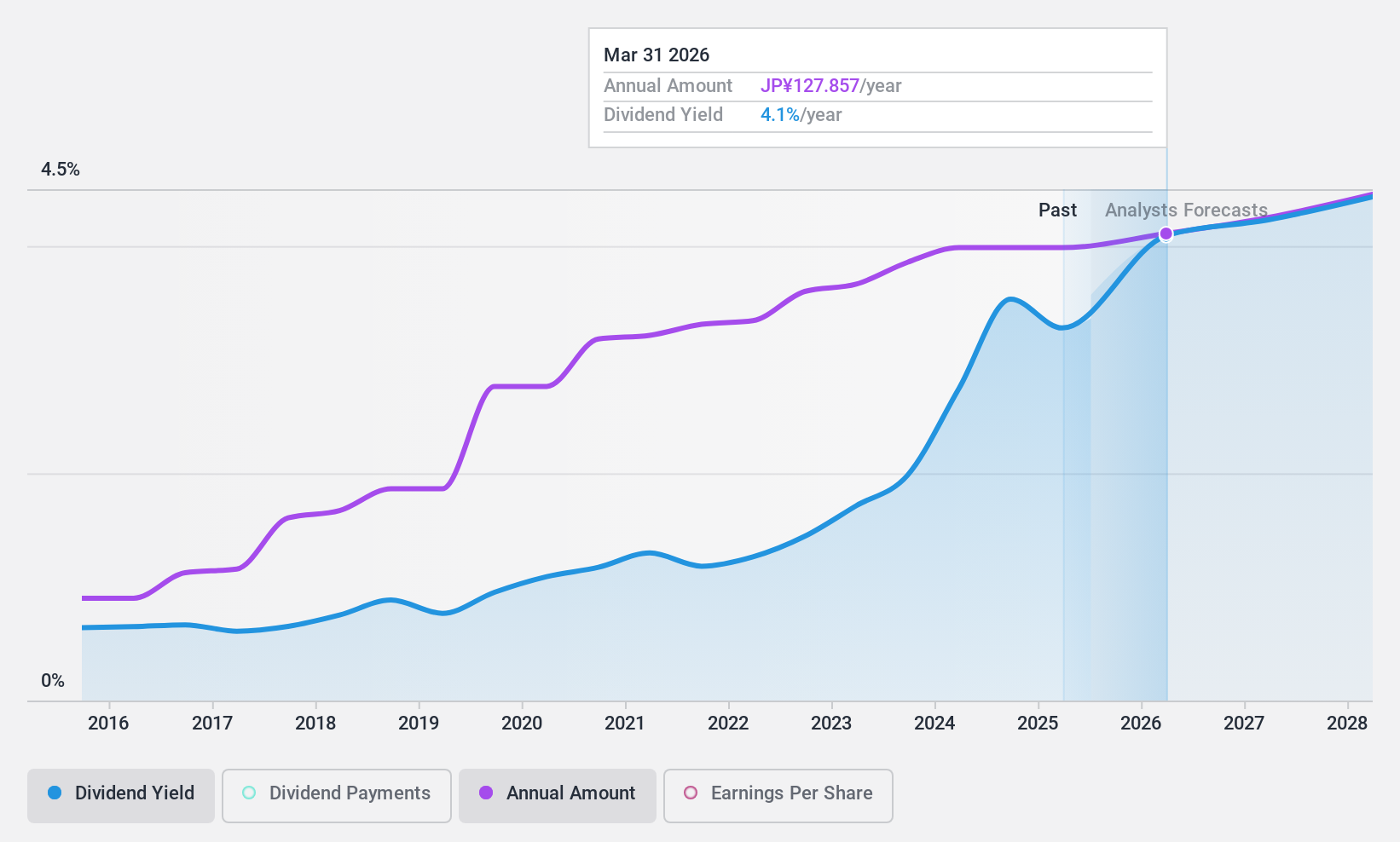

Nippon Shinyaku (TSE:4516)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Shinyaku Co., Ltd. is a company based in Japan that specializes in manufacturing and selling pharmaceuticals and foodstuffs, both domestically and internationally, with a market capitalization of approximately ¥207.65 billion.

Operations: Nippon Shinyaku Co., Ltd. generates its revenue primarily through the production and sales of pharmaceuticals and foodstuffs across various global markets.

Dividend Yield: 4%

Nippon Shinyaku offers a dividend yield of 4.02%, higher than the Japanese market average, supported by a low payout ratio of 33.2% which suggests sustainability from earnings. However, its dividends are not well covered by cash flows with a high cash payout ratio of 125.8%. Despite a forecasted earnings decline of 5% annually over the next three years, dividends have shown stability and growth over the past decade. The company's price-to-earnings ratio stands at 8x, below the market average, indicating relative value. Recent board discussions on introducing a restricted stock compensation plan highlight ongoing adjustments in governance affecting shareholder returns.

- Click here to discover the nuances of Nippon Shinyaku with our detailed analytical dividend report.

- The analysis detailed in our Nippon Shinyaku valuation report hints at an deflated share price compared to its estimated value.

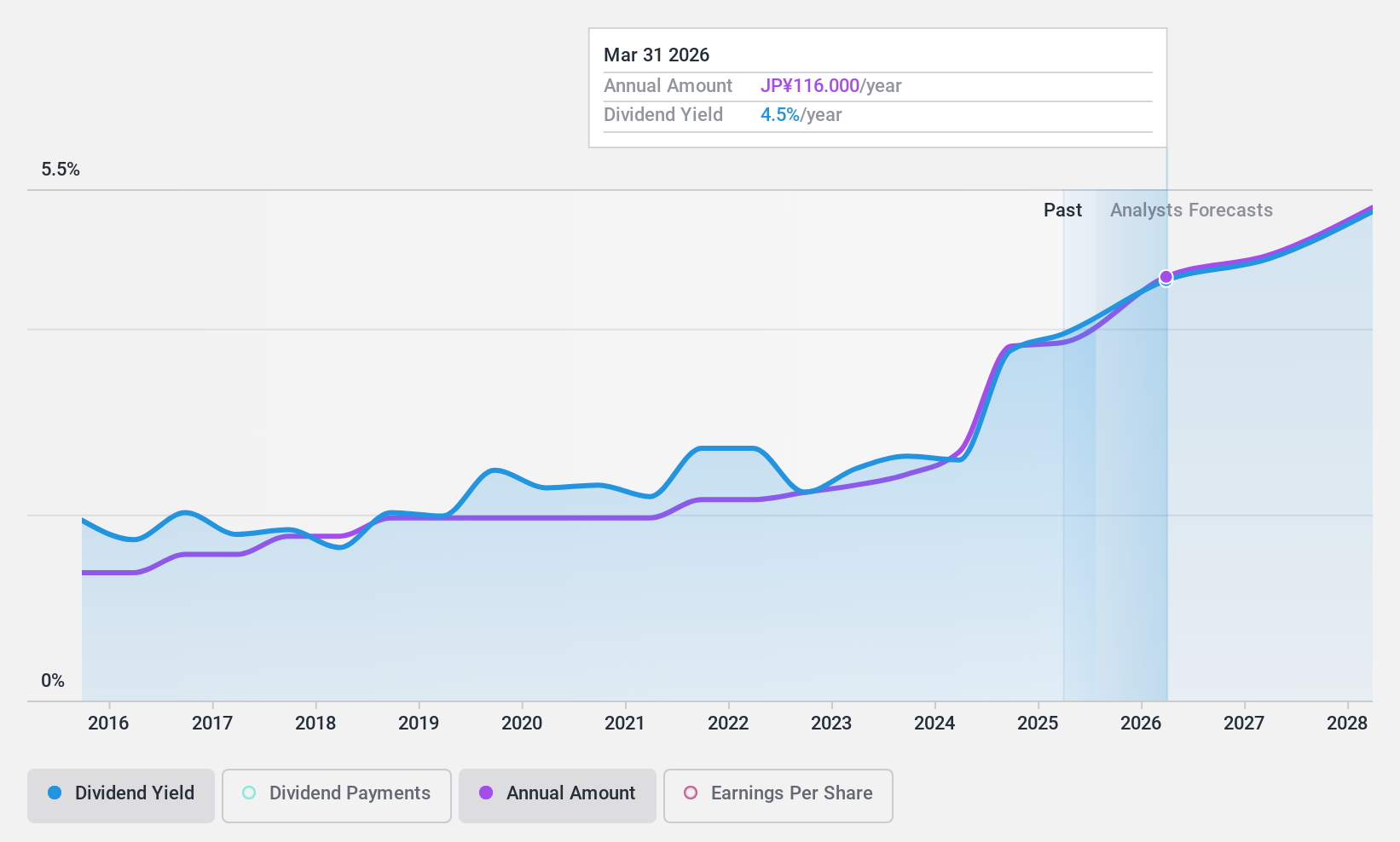

IDEC (TSE:6652)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IDEC Corporation specializes in developing human machine interfaces, industrial switches, and control devices for various applications both in Japan and globally, with a market capitalization of approximately ¥85.60 billion.

Operations: IDEC Corporation generates revenue primarily from three regions: ¥39.09 billion in Japan, ¥14.86 billion in the Americas, and ¥19.76 billion in Asia-Pacific, with an additional ¥18.54 billion from Europe, the Middle East, and Africa (EMEA).

Dividend Yield: 4.5%

IDEC's dividend yield of 4.47% ranks in the top quartile of Japanese dividend payers, yet its sustainability is questionable with a cash payout ratio of 130.4% and earnings coverage at 86.6%. Dividends have increased over the past decade but have shown volatility. Recent strategic collaboration with Wetouch Technology may bolster its market position, yet profit margins declined to 6.1% from last year's 12.1%, and earnings are predicted to grow by 18.49% annually.

- Click to explore a detailed breakdown of our findings in IDEC's dividend report.

- Insights from our recent valuation report point to the potential overvaluation of IDEC shares in the market.

Paramount Bed Holdings (TSE:7817)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Paramount Bed Holdings Co., Ltd. is a Japanese company that specializes in manufacturing and selling beds, mattresses, and medical and nursing care equipment, with a market capitalization of approximately ¥161.41 billion.

Operations: Paramount Bed Holdings Co., Ltd. generates its revenue primarily from the healthcare-related segment, which amounted to ¥10.60 billion.

Dividend Yield: 3.5%

Paramount Bed Holdings has demonstrated a 15.3% increase in earnings over the past year, with dividends growing consistently for a decade, reflecting stability and reliability. However, its dividend sustainability is under pressure as the cash payout ratio stands at 169.5%, indicating dividends are not well covered by cash flows. Despite this, its price-to-earnings ratio of 15.2x remains below the industry average, suggesting some value relative to peers. The dividend yield of 3.45% is competitive within the Japanese market.

- Get an in-depth perspective on Paramount Bed Holdings' performance by reading our dividend report here.

- The analysis detailed in our Paramount Bed Holdings valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Take a closer look at our Top Dividend Stocks list of 394 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Paramount Bed Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7817

Paramount Bed Holdings

Manufactures and sells beds, mattresses, and equipment for medical and nursing care in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives