Nippon Shinyaku (TSE:4516): Valuation Insights Following Positive Brogidirsen Clinical Results

Reviewed by Kshitija Bhandaru

Nippon Shinyaku (TSE:4516) shares are in focus after its subsidiary NS Pharma released 3.5-year clinical data on brogidirsen for Duchenne muscular dystrophy. The results highlighted stable motor function and a favorable safety overview in treated participants.

See our latest analysis for Nippon Shinyaku.

While news of brogidirsen’s progress has put a spotlight on Nippon Shinyaku, the share price has yet to show positive momentum, with a year-to-date decline of 19.6% and a one-year total shareholder return down 19.5%. Long-term performance has been underwhelming, but positive clinical developments could shift sentiment if they translate into future growth.

If you’re interested in discovering more innovative pharmaceutical companies with solid pipelines and potential, check out See the full list for free.

With the latest clinical milestone and shares trading below analyst targets, investors now face a key question: Is Nippon Shinyaku undervalued at current levels, or is the market already pricing in future upside?

Price-to-Earnings of 7.2x: Is it justified?

Nippon Shinyaku currently trades at a price-to-earnings ratio of 7.2x, which is significantly below both its industry and peer benchmarks based on the current share price of ¥3,246.

The price-to-earnings ratio represents how much investors are willing to pay today for each ¥1 of earnings generated by the company. It is a key indicator for pharmaceuticals since growth prospects and earnings quality directly impact valuations. A lower ratio can signal undervaluation, particularly if underlying growth is solid and consistent.

Compared to the JP Pharmaceuticals industry average of 15x, Nippon Shinyaku’s multiple is strikingly low. The company also trades below the Japanese market’s 14.4x and well under the peer group average of 13.6x. In addition, our analysis estimates a fair price-to-earnings ratio for the company at 12.3x, suggesting there could be substantial upside if market sentiment shifts.

Explore the SWS fair ratio for Nippon Shinyaku

Result: Price-to-Earnings of 7.2x (UNDERVALUED)

However, risks such as slowing net income growth and a lack of recent share price momentum could challenge a bullish outlook in the near term.

Find out about the key risks to this Nippon Shinyaku narrative.

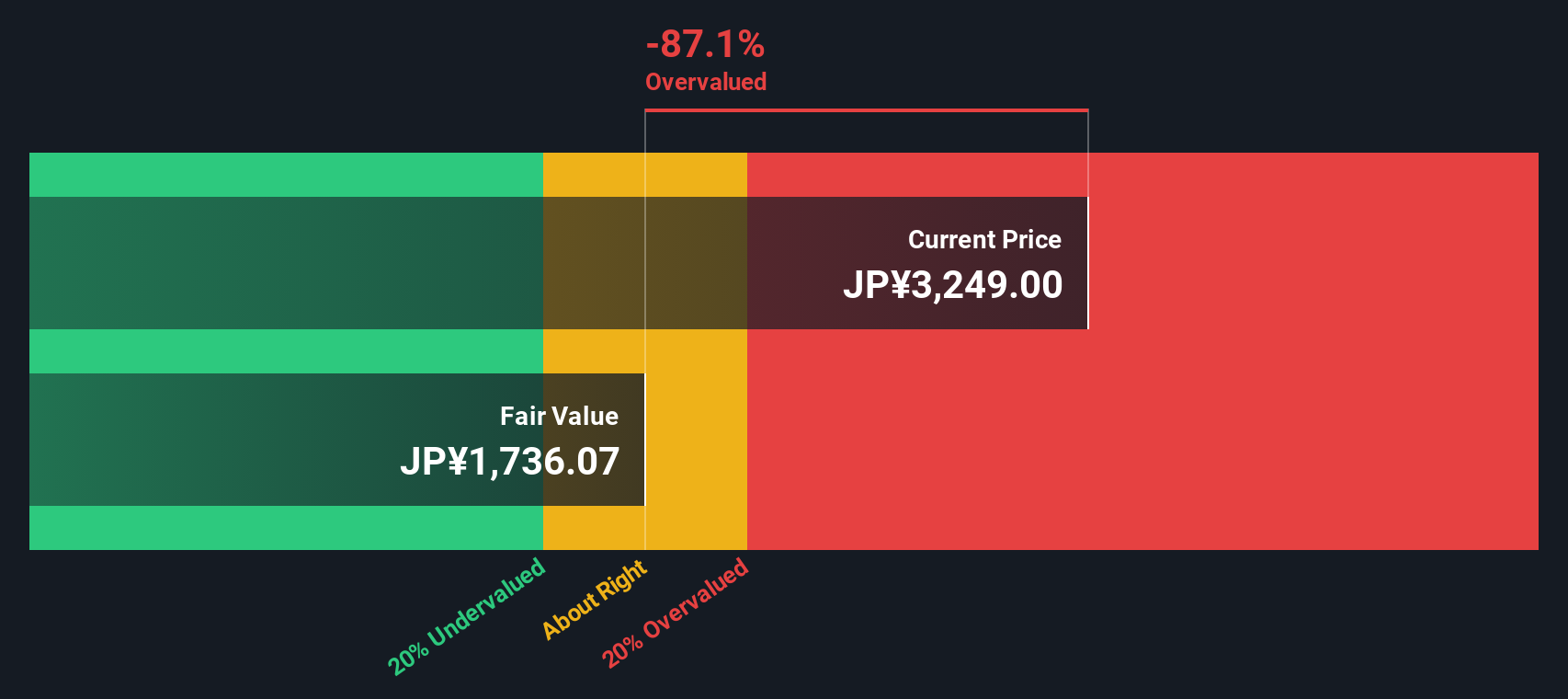

Another View: Discounted Cash Flow Paints a Different Picture

While Nippon Shinyaku looks undervalued on earnings multiples, our SWS DCF model suggests a more cautious outlook. According to the DCF approach, the stock is trading well above its estimated fair value, which could indicate the market is overly optimistic about future cash flows. Could this divergent view signal hidden downside, or is the market betting on clinical breakthroughs?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Shinyaku for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Shinyaku Narrative

If you want to draw your own conclusions or prefer hands-on investigation, it only takes a few minutes to craft your own view. Do it your way

A great starting point for your Nippon Shinyaku research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Confidently build your portfolio by tapping into compelling opportunities others might overlook. The Simply Wall Street Screener can point you toward fresh ideas before the crowd catches on.

- Take advantage of growth potential by checking out these 24 AI penny stocks, which feature innovative products and strong market demand.

- Enhance your income stream with these 20 dividend stocks with yields > 3%, a selection of companies known for consistent and reliable payouts.

- Stay ahead of financial trends by exploring these 79 cryptocurrency and blockchain stocks, highlighting leaders in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Shinyaku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4516

Nippon Shinyaku

Manufactures and sells pharmaceuticals and foodstuffs in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives