As global markets navigate a landscape marked by fluctuating interest rates and geopolitical uncertainties, investors are increasingly focused on finding stability within their portfolios. Amidst this backdrop, dividend stocks offer a compelling option for those seeking consistent income and potential resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.56% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm managing assets across sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets with a market cap of AED2.91 billion.

Operations: Al Waha Capital PJSC's revenue segment includes Private Investments (Excluding Waha Land) amounting to AED149.88 million.

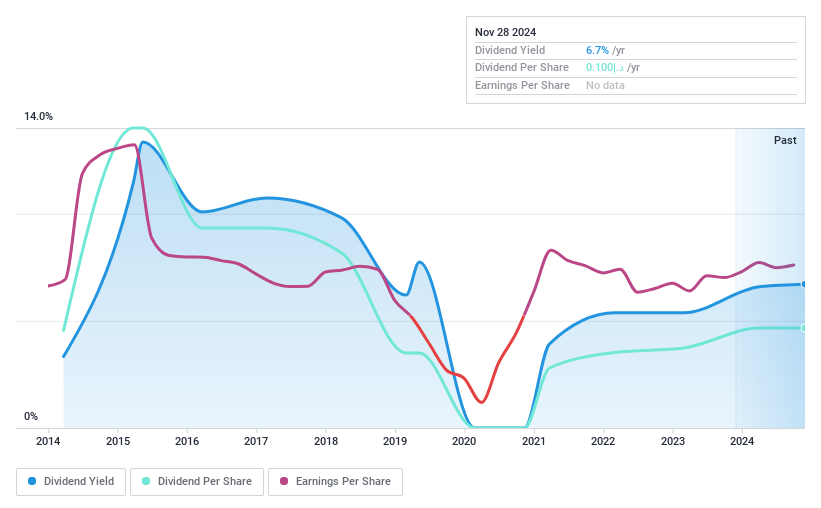

Dividend Yield: 6.4%

Al Waha Capital PJSC has shown recent earnings growth, with net income rising to AED 77.56 million in Q3 2024 from AED 53.63 million a year prior. Despite a low price-to-earnings ratio of 5.9x, suggesting good value, its dividend yield of 6.37% is not well covered by free cash flows and remains volatile and unreliable over the past decade. While dividends are covered by earnings due to a payout ratio of 37.2%, sustainability concerns persist without sufficient cash flow backing.

- Take a closer look at Al Waha Capital PJSC's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Al Waha Capital PJSC is priced higher than what may be justified by its financials.

Able Engineering Holdings (SEHK:1627)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Able Engineering Holdings Limited is an investment holding company that operates a building construction business in Hong Kong, with a market capitalization of HK$1.08 billion.

Operations: Able Engineering Holdings Limited generates revenue primarily from its construction segment, amounting to HK$6.43 billion.

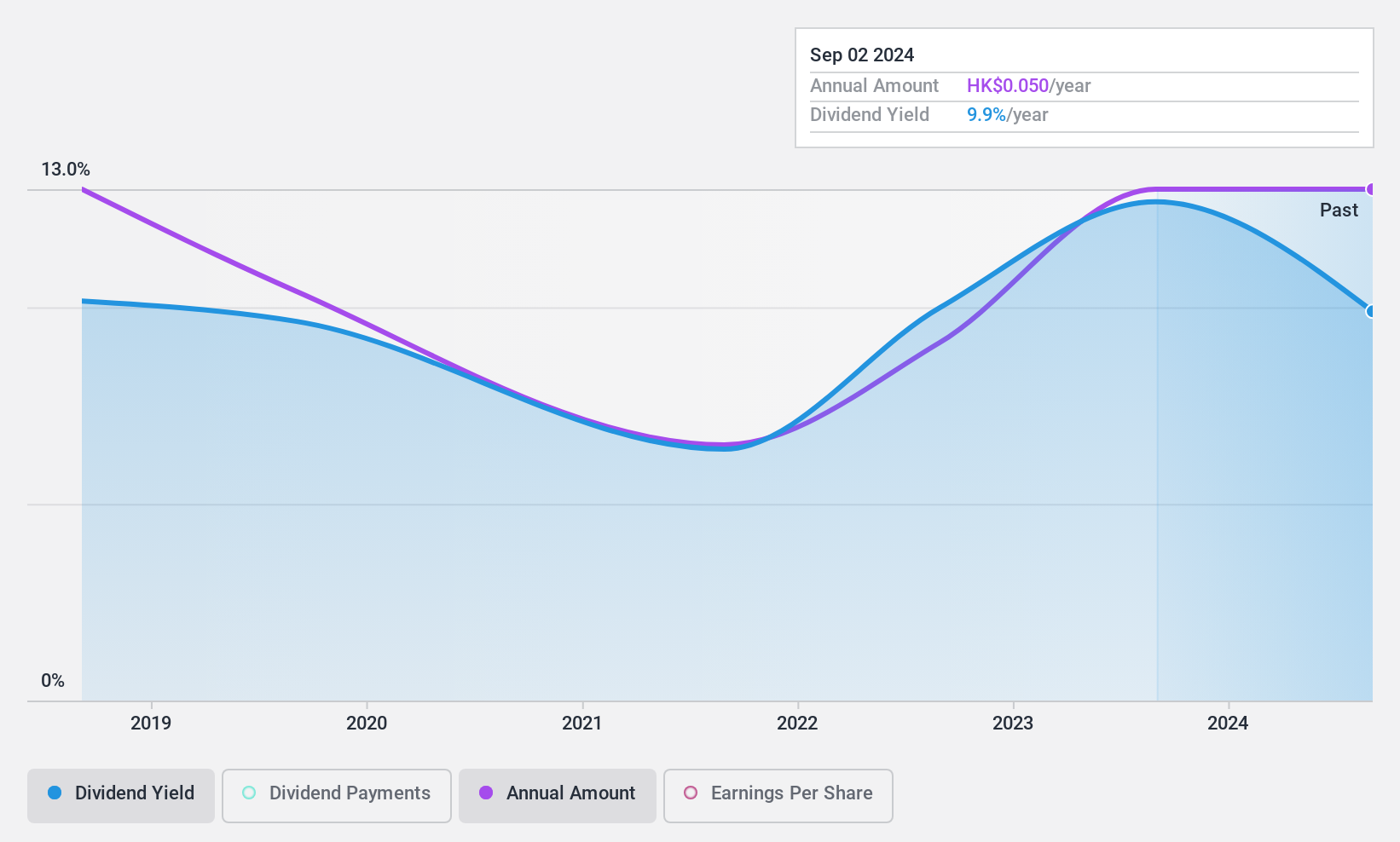

Dividend Yield: 9.4%

Able Engineering Holdings reported significant earnings growth, with net income increasing to HK$99.89 million for the half year ended September 30, 2024. Despite trading at a substantial discount to estimated fair value, its dividend history is unstable and unreliable due to volatility over the past six years. However, dividends are well-covered by both earnings and cash flows with payout ratios of 41.2% and 14.2% respectively, offering a high yield of 9.43%, ranking in Hong Kong's top quartile.

- Navigate through the intricacies of Able Engineering Holdings with our comprehensive dividend report here.

- The analysis detailed in our Able Engineering Holdings valuation report hints at an deflated share price compared to its estimated value.

Nippon Shinyaku (TSE:4516)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Shinyaku Co., Ltd. is engaged in the manufacturing and sale of pharmaceuticals and foodstuffs both in Japan and internationally, with a market cap of ¥248.56 billion.

Operations: Nippon Shinyaku Co., Ltd.'s revenue is derived from two main segments: Pharmaceuticals, generating ¥132.61 billion, and Functional Food, contributing ¥21.66 billion.

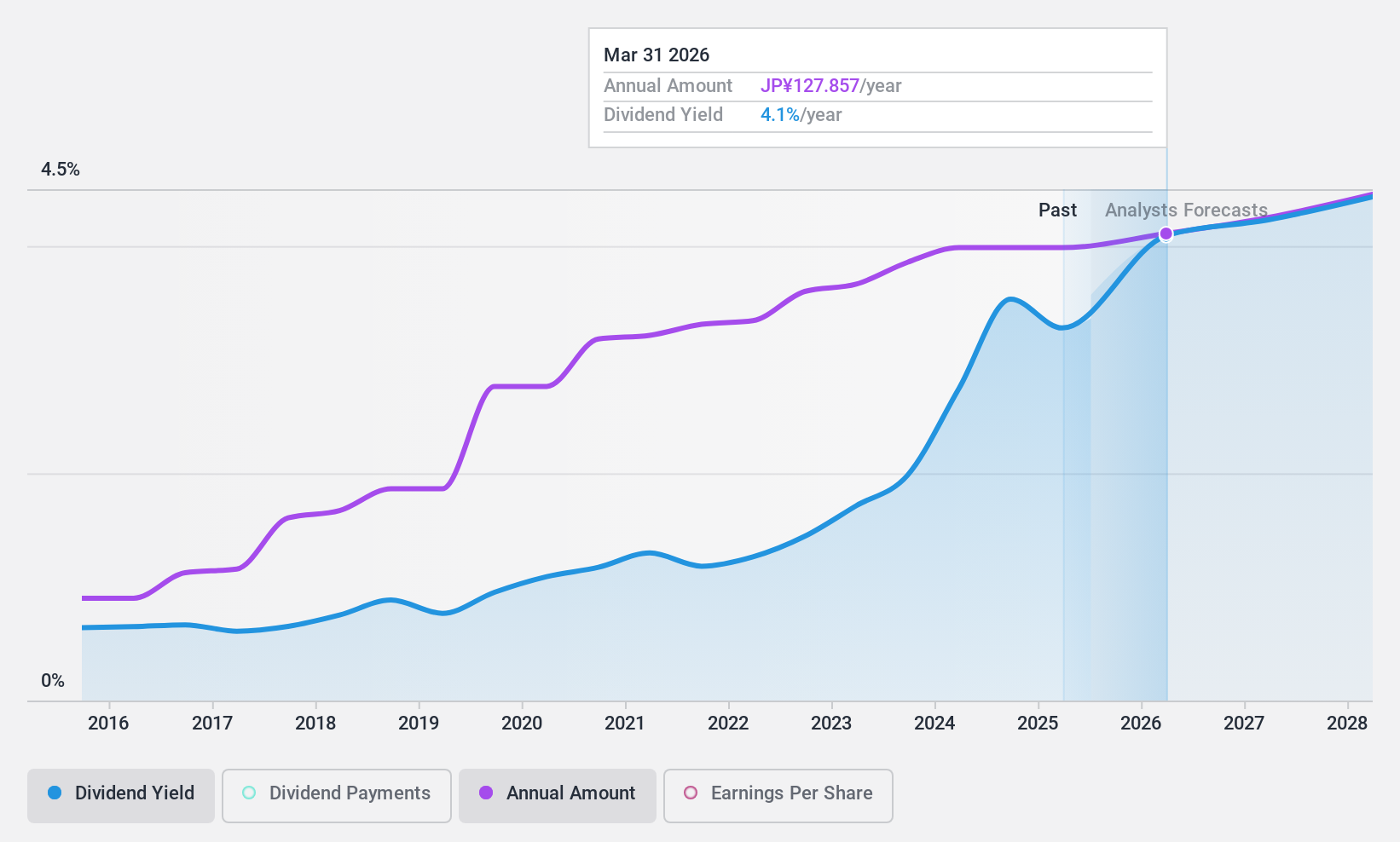

Dividend Yield: 3.3%

Nippon Shinyaku's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 32.1%. However, the cash payout ratio is high at 102.4%, indicating dividends are not well-covered by free cash flows. The stock trades at a favorable P/E ratio of 9.9x compared to the Japanese market average of 13.4x but offers a relatively lower dividend yield of 3.25%. A recent strategic partnership with REGENXBIO could impact future earnings positively if milestones are achieved, potentially influencing dividend sustainability and growth prospects in the long term.

- Click to explore a detailed breakdown of our findings in Nippon Shinyaku's dividend report.

- The valuation report we've compiled suggests that Nippon Shinyaku's current price could be quite moderate.

Make It Happen

- Explore the 1980 names from our Top Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nippon Shinyaku, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nippon Shinyaku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4516

Nippon Shinyaku

Manufactures and sells pharmaceuticals and foodstuffs in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives